3 min read

European Pulp and Paper Industry Market Outlook

Marko Summanen

:

Jun 19, 2024 12:00:00 AM

Marko Summanen

:

Jun 19, 2024 12:00:00 AM

The European pulp and paper industry is currently at a pivotal point, encountering a mix of unprecedented challenges and promising opportunities. For professionals in this sector, grasping these dynamics is essential for maintaining a competitive edge. A comprehensive understanding of the market can provide actionable insights to successfully steer companies through the future.

Current Industry Challenges in Europe

Like many other regions, the European pulp and paper industry is currently facing several challenges in a rapidly evolving market. These challenges include:

- Managing Grade Turbulence: The European pulp and paper industry is currently navigating through a period of grade turbulence. While the demand for printing and writing paper is on the decline, the containerboard sector is experiencing robust growth. This shift necessitates companies to swiftly adapt to evolving market trends. Focused grade management can enable businesses to enhance production efficiency and reduce losses.

- Sustainable Fiber Availability: With the growing focus on sustainability, the availability of sustainable fiber is becoming increasingly volatile. The competitive use of wood for various applications, from construction to bioenergy, is adding pressure on pulp and paper manufacturers.

- Cost Optimization: Energy costs and CO2 emissions are critical factors in the pulp and paper industry’s operational efficiency. The European Union’s stringent regulations on carbon emissions are pushing companies to find innovative ways to reduce their carbon footprint. Investing in energy-efficient technologies and renewable energy sources can help companies optimize costs and comply with regulations.

- Retail and Brand Owners' Focus on LCA Structure of Packaging: Retailers and brand owners are increasingly scrutinizing the Life Cycle Assessment (LCA) packaging structure. High CO2 emissions are becoming a significant concern, and companies that fail to address this will face pressure from their clients. Proactively reducing emissions and enhancing the sustainability of packaging can give businesses a competitive edge.

Overview of the Current Market

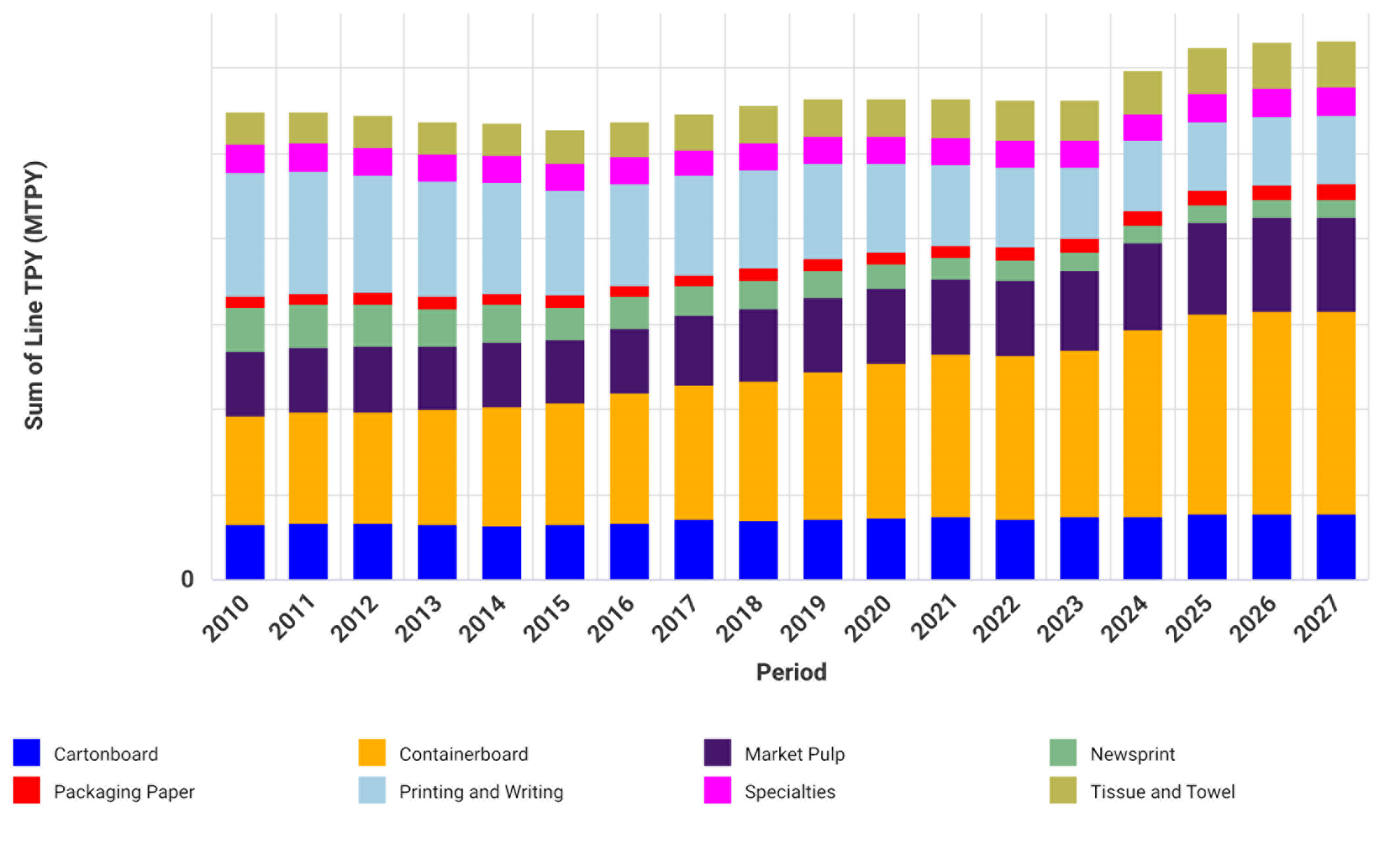

Upon analyzing the current state of the European pulp and paper market, it is evident that while overall capacity has remained steady in recent years, there have been significant shifts in the product mix.

Containerboard, cartonboard, and packaging paper have displayed a notable Compound Annual Growth Rate (CAGR) increase between 2010 and 2023. Conversely, printing and writing paper, as well as newsprint, have witnessed declines over this period.

European Pulp and Paper Capacity (Actual and Announced)

Source: FisherSolve

Looking ahead, several capacity increases have been announced for the 2024-2027 period. Turkey in particular is set to add the most significant containerboard capacity in the coming years.

However, many previously announced projects have either been delayed, canceled, or not yet started due to overcapacity and uncertain demand forecasts. Unlike Europe, the US containerboard market, with its more consolidated supply side, has not implemented similar investment plans. As Europe continues to invest, its machine base will become increasingly competitive compared to the US.

Read More: How to Navigate the Overcapacity Issue in the European Pulp and Paper Industry

These delays and cancellations highlight the market uncertainty companies are experiencing. It's now more important than ever for companies to carefully evaluate market conditions and demand forecasts before committing to new projects.

In the chart below, we can see how much executed and announced capacity Europe vs. North America has been planning. The difference is staggering, leading many to wonder what the reasons are behind this.

Containerboard Capacity Development: Europe vs North America

Source: FisherSolve

The Importance of Sustainability

When looking ahead, CO2 emissions will likely determine who will survive in the EU graphic paper market. Companies that prioritize reducing emissions and enhancing their sustainability impact will have a competitive advantage. Implementing energy-efficient technologies and adopting sustainable practices is essential for long-term success.

Mills with high CO2 emissions, high costs, and particularly non-viable assets will face some of the greatest challenges. Upgrading energy-generating assets may not be justified if other process equipment remains uncompetitive.

The European Union Deforestation Regulation (EUDR), aimed to promote a green economy, will impact imports to the EU. This will particularly affect forest commodities at risk of contributing to deforestation.

Failure to adhere to these regulations could lead to disruptions in the supply chain for companies, underscoring the critical importance of sustainability practices in the industry. This raises some important questions:

- Which forest commodities are most at risk?

- What are the top pulp and paper grades imported into Europe?

- What countries are the top importers into Europe?

- How will the EUDR affect producers who own their own plantation operations for pulp fiber?

Ensure Competitiveness with ResourceWise

ResourceWise provides companies with crucial insights to make informed decisions and address any industry questions they may have. Offering several market intelligence platforms tailored for the pulp, paper, and forest products industries, along with expert consulting services, ResourceWise empowers businesses to move with confidence.

ResourceWise equips companies with the essential insights necessary for informed decision-making. Offering several market intelligence platforms tailored for the pulp, paper, and forest products industries, along with expert consulting services, ResourceWise empowers businesses to move with confidence.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)