Optimize Your Business Strategy for Profitability.

Developed jointly by Fisher International, a legacy ResourceWise company, and STE Analytics, a highly professional modeling firm. ResourceWise-STE Forecasts are part of our collection of tools and skills used for data-driven decision-making.

Our forecasts offer:

- Exceptional capabilities for predicting market behavior.

- Impact of companies' actions on markets.

- The ability to optimize strategies for income.

ResourceWise-STE Forecasts are powered by good data, industry understanding, and System Dynamics mathematical models. Our models are unique because they simulate the key drivers of markets and how they interact, including supply, demand, price, inventories, order rates, shipments, imports, exports, and market leadership.

Our Forecasting Model

System Dynamics from the MIT Sloane School of Management.

Developed by Professor Jay W. Forrester at the MIT Sloan School of Management, systems dynamics is based on control theory. The method is used to build a model of a business, and the model is then used to predict, understand and change behavior.

Comparison

Traditional Models vs. Systems Dynamics

| Traditional Methods | System Method: The ResourceWise-STE model | |

|---|---|---|

Main Focus |

How to turn historical data into a forecast |

How are decisions made in the market? |

Process |

Data analysis and linear model(s) |

Expert interviews, data analysis, and data synthesis into dynamic model(s) |

Outcome |

A forecast based on historical data |

A forecast based on decision maker's behavior and market structure |

We predict price turning points -- not just price levels -- for pulp, paper, and energy markets.

We perform "What-If" sensitivity analysis, testing proposed strategic plans against real market dynamics.

We explain market movements in verifiable, fact-based, common-sense terms that industry professionals find useful.

Empower your business

Use ResourceWise–STE forecasts to answer these questions, and more:

- What is the optimum amount of new capacity for the market? When should it come online?

- What contract structure optimizes revenue?

- When should you invest or divest?

- When is the best time for share repurchases?

- What is the second-order impact of our decisions, e.g., pricing and imports?

- How do pricing decisions impact demand?

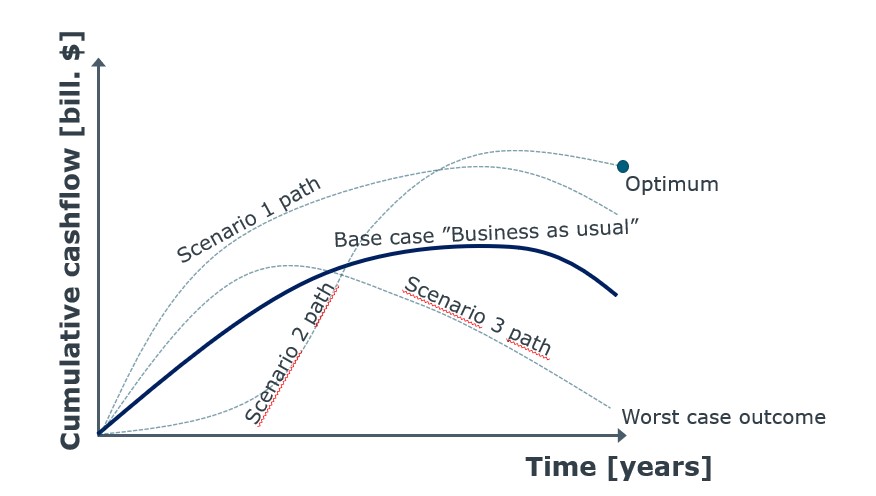

Sensitivity Analysis and Scenario Optimization

- Test the Forecast against a Range of Future Outcomes

- Test the Impacts of Your Decisions and Define Confidence in the Future(s)

Product(s)

Chemical Pulp NBSK, BHKP

Coated Woodfree papers

LWC papers

SC paper

Uncoated freesheet

Containerboard

FBB

OCC

Recycled paper

Sawn logs and lumber

Coated and uncoated recycled board

Region(s)

Globally

Europe and North America

Europe and North America

Europe

Europe and North America

North America, (Europe, China)

Europe

North America

Europe

Finland

North America

Product(s)

Electricity

Natural gas

Coal

Crude oil

Fuel oils

EUA

Region(s)

Nordpool and Europe

Western Europe

Asia and Europe

Globally

Globally

Europe

Product(s)

Titanium dioxide

Ammonia

Urea

Nitrogen fertilizers

Region(s)

Europe

Globally

Globally

Europe

Take Advantage of ResourceWise–STE Strategic Forecasting

With a 20-year forecasting track record, we are happy to share the statistics we keep on our forecast accuracy with you.

Contact us today to learn more about our methodology and accuracy. Let’s work together to enhance your performance, so you can gain a strategic advantage in the industry.