3 min read

How to Navigate the Overcapacity Issue in the European Pulp and Paper Industry

ResourceWise

:

Feb 21, 2024 12:00:00 AM

The European pulp and paper industry has been grappling with the issue of overcapacity, leading to the closure of machine lines and a significant impact on stakeholders. This blog post explores the consequences of overcapacity and its implications for the industry.

Overview of Overcapacity in the European Pulp and Paper Industry

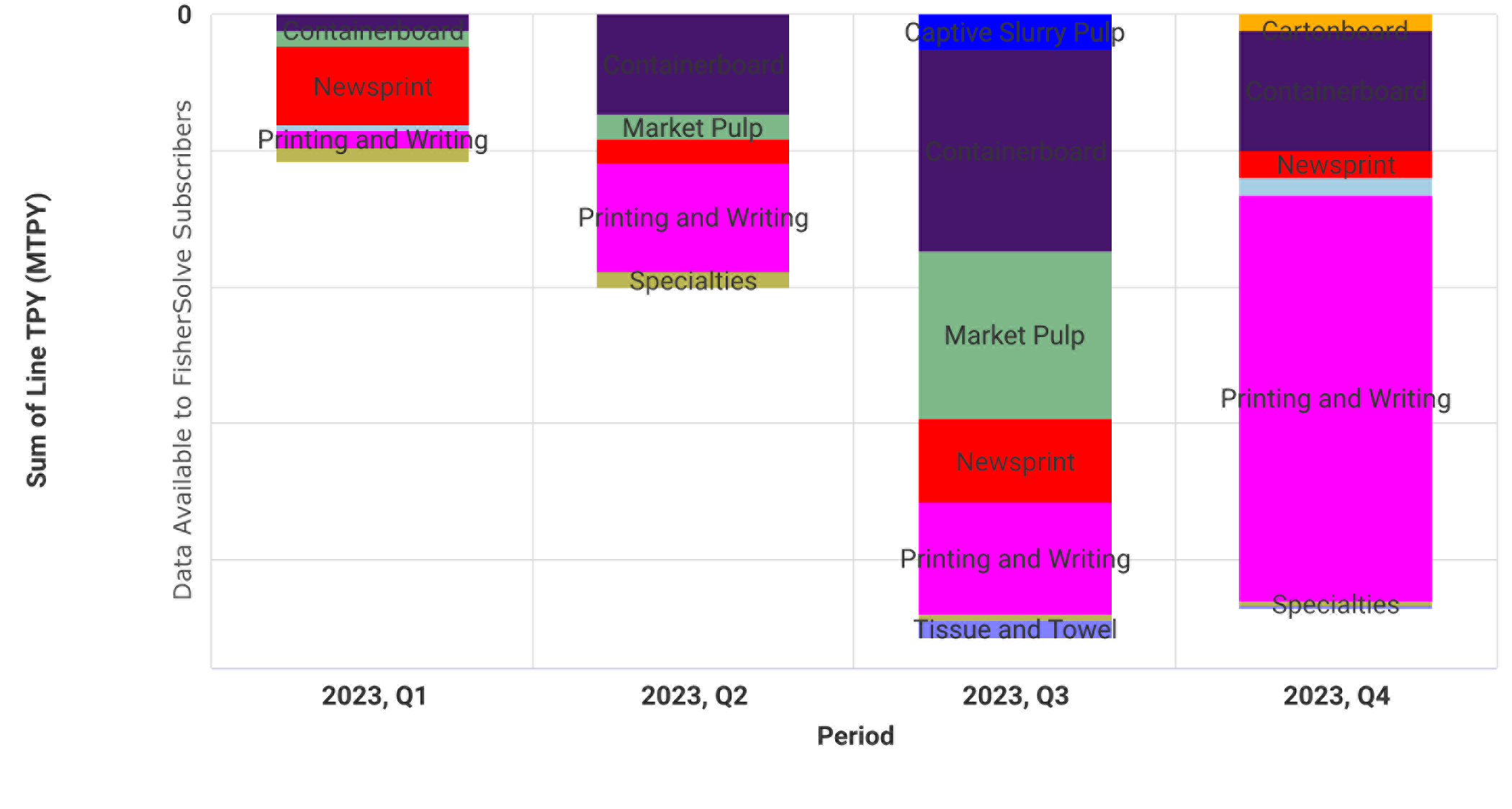

The European pulp and paper industry is facing a recent challenge regarding the issue of overcapacity. In 2023, 41 machine lines were shut down, resulting in a total closed capacity of 5.4 million tons.

Most of this capacity was in the graphic papers segment, with the highest number of lines closed occurring in Germany. This indicates a surplus of production capacity.

2023 European Line Closures

Source: FisherSolve

An example of this is Stora Enso's closure of both production lines at its De Hoop site and one of four production lines at its Ostrołęka site. This move is an attempt to improve market balance and reduce corrugated case material production capacity as a response to the overcapacity issue in the European containerboard market.

Overcapacity occurs when the production capacity of an industry exceeds the demand for its products. In the case of the European pulp and paper industry, the closure of machine lines was an attempt to address this overcapacity. However, it seems that these measures were not enough to counter the downward trajectory of demand that is expected to continue into 2024.

Factors Contributing to Overcapacity in Europe

The Confederation of European Paper Industries (CEPI) released its 2023 Preliminary Statistics report, which lends some insight into why Europe has experienced this overcapacity trend.

According to this report, paper and board consumption and production in Europe experienced a downward trajectory, influenced by unfavorable macroeconomic conditions, characterized by high inflation, interest rates, and weakened private consumption, and a prolonged destocking trend. Within Cepi member countries, there was a significant 12.8% decrease in paper and board production in 2023 compared to the previous year, primarily attributed to the substantial impact of high energy and manufacturing costs on the industry.

Another factor noted was the 6.9% decline in the use of paper for recycling by companies in 2023 in the geographic region covered by Cepi members. This decrease can be correlated with a reduction in packaging paper and board production, as European production heavily relies on recycled feedstock. Furthermore, the closure of specific graphic paper mills that utilized paper for recycling also contributed to this trend.

Why Overcapacity Is an Issue

Overcapacity poses several challenges, the first being that it can lead to inefficiencies and increased production costs. When production capacity exceeds demand, companies are unable to utilize their resources, resulting in higher operational expenses. This can harm profitability and competitiveness.

Overcapacity can also lead to price wars and downward pressure on product prices. Companies may engage in aggressive pricing strategies to maintain market share, which can erode profit margins. This not only affects the financial health of individual companies but also undermines the overall stability of the industry.

Another effect of imbalances in production is the hindrance of innovation and investment in the industry. When companies are struggling to fill their existing production capacity, they are less likely to invest in research and development or upgrade their facilities, despite the argument that companies should invest in research and development if they have access capacity. This can impede technological advancements and limit the industry's ability to adapt to changing market demands.

Challenges Faced by Stakeholders in the Industry

The overcapacity issue presents various challenges for stakeholders in the European pulp and paper industry. Some of these challenges include:

- Manufacturers: Optimizing production capacity and reducing costs to remain competitive in a challenging market. They need to find ways to streamline their operations and improve efficiency to mitigate the impact of overcapacity.

- Suppliers of raw materials: If pulp and paper manufacturers reduce their production, it may lead to a decreased demand for raw materials such as wood fiber or chemicals used in the production process. This can have a ripple effect on the entire supply chain.

- Investors and shareholders: Concern may arise about the financial performance of companies affected by overcapacity. The decline in profitability and potential decrease in share value can undermine investor confidence and lead to a loss of capital.

Strategies to Mitigate the Impact of Overcapacity

To mitigate the impact of overcapacity, companies can focus on diversifying their product offerings to tap into new markets and increase demand. By expanding their product portfolio and targeting other markets, companies can avoid the consequences of placing all their eggs in one basket and mitigate the effects of overcapacity.

Another strategy is to improve operational efficiency through process optimization and cost-reduction measures. Companies can optimize their production capacity and reduce costs by streamlining production processes, implementing lean manufacturing practices, and investing in technology.

In light of the expanding bio-economy, companies may consider exploring alternative avenues for monetization. With the increasing investment and interest in biofuels, pulp and paper companies are now turning their attention to the potential opportunities that this emerging sector holds for them.

Certain biofuels can be made using the byproducts generated during the pulp and paper production process. With the growing demand for these materials, producers can capitalize on the opportunity to sell their byproducts, enabling them to effectively utilize their existing resources and counterbalance any potential profit losses caused by overcapacity.

Harnessing ResourceWise for Successful Strategy Implementation

ResourceWise is equipped with a set of robust databases that encompass the pulp, paper, forest products, and biofuels market. Coupled with our consulting team known for their extensive experience in these industries, we can provide you with a tailored assessment to understand your competitive position and develop asset optimization strategies.

With data-driven insights, you can evaluate the long-term viability and financial health of mills within your company. This is crucial when faced with hurdles such as overcapacity, cost volatility, and many more economic factors.

For more information, check out our solutions page.