3 min read

2023 Brings More Pulp and Paper Mill Closures – Do You Have the Right Data?

Camilla Abbati

:

Jun 1, 2023 12:00:00 AM

Camilla Abbati

:

Jun 1, 2023 12:00:00 AM

Toward the end of the first quarter, Pactiv Evergreen announced that its Canton paper mill is slated to close by June 2023. This came as a surprise to the entire community as the mill has been in operation for more than 100 years and is considered integral to the economy of Canton, North Carolina.

With 1,300 jobs eliminated, President and Chief Executive Officer of Pactiv Evergreen Michael King commented on the situation, “As we continue to confront a challenging market environment for our Beverage Merchandising business, we are faced with these difficult decisions that directly impact our employees.”

Along with the Canton mill, Pactiv also plans to shutter a plant in Olmsted Falls, Ohio. Unfortunately, these closures are two of many that we’ve seen occur in the pulp and paper industry in 2023. Some other closures announced this year include:

- WestRock’s closure of its North Charleston mill. The North Charleston mill is set to close on August 31 and expected to impact about 500 employees at the facility. Reasons for the closure included high operating costs and the need for significant capital investment.

- Cascades’ progressive closure of its underperforming plants in Barnwell, South Carolina and Scappoose, Oregon. A portion of this production will be absorbed by Cascades’ other facilities and by the increase in productivity at other sites in the US.

- Sonoco’s closure of its OCC mill in Hutchinson, Kansas. The closure of the 114-year-old mill occurred due to softer economic conditions that have reduced sales for Sonoco and other paper packaging producers.

- UPM's permanent shutting down of publication paper machine in Schongau. The closure of PM6, which produces Printing & Writing and Newsprint major grades, will impact 135 employees and result in an annual reduction of 165,000 metric tons.

Why Are We Seeing an Uptick in Mill Closures?

One of the most obvious and significant factors behind the numerous mill closures seen in 2023 is the current economic climate. Unfortunately, we saw worsening market conditions accelerate in the latter part of the first quarter of 2023. In addition, the well-known decline in demand for graphic paper grades was accelerated during the pandemic years.

Those factors resulted in several downward turns within various major grades across the pulp and paper industry. These included the printing and packaging market, containerboard demand, and the consumer board segment.

Construction challenges are also still occurring, with a lower number of issued building permits and new housing starts. We expect these factors to have a temporary impact on demand within the wood products sector during the rest of the year.

Cost pressures and market uncertainties are also expected to become significantly more challenging in 2023 than 2022. As a result, this market situation will continue to weaken consumer confidence. Ultimately, the change may result in lower overall pulp and paper consumption.

Combat Uncertainty with Fisher’s Viability Module

Fisher International’s Viability Module was created to predict the long-term future of pulp lines and paper machines. Validated against several years of historical data on closures and survival, the result expertly evaluates the staying power of a given machine, mill, or company. It also serves as a powerful tool for understanding each asset’s strengths and weaknesses.

Depending on the user, our Viability Module can help you understand a number of industry aspects.

For suppliers:

- To identify which lines, mills, or companies are going to survive over the long term.

- To optimize their own customer portfolio.

For producers:

- To distinguish which competitors are at risk and why.

- To better understand which of their own lines and products are at risk and why.

The tool considers cost-of-production, size, technical age, grade risk, position in company fleet, capital required, transportation, and other factors. All of these can be assessed under various economic scenarios.

FisherSolve™ allows you to segment any data set so your Viability benchmarking analysis reflects the issues particular to your current needs.

Case Study: North American Mill Analysis

To illustrate how the tool works, let's look at a hypothetical case study.

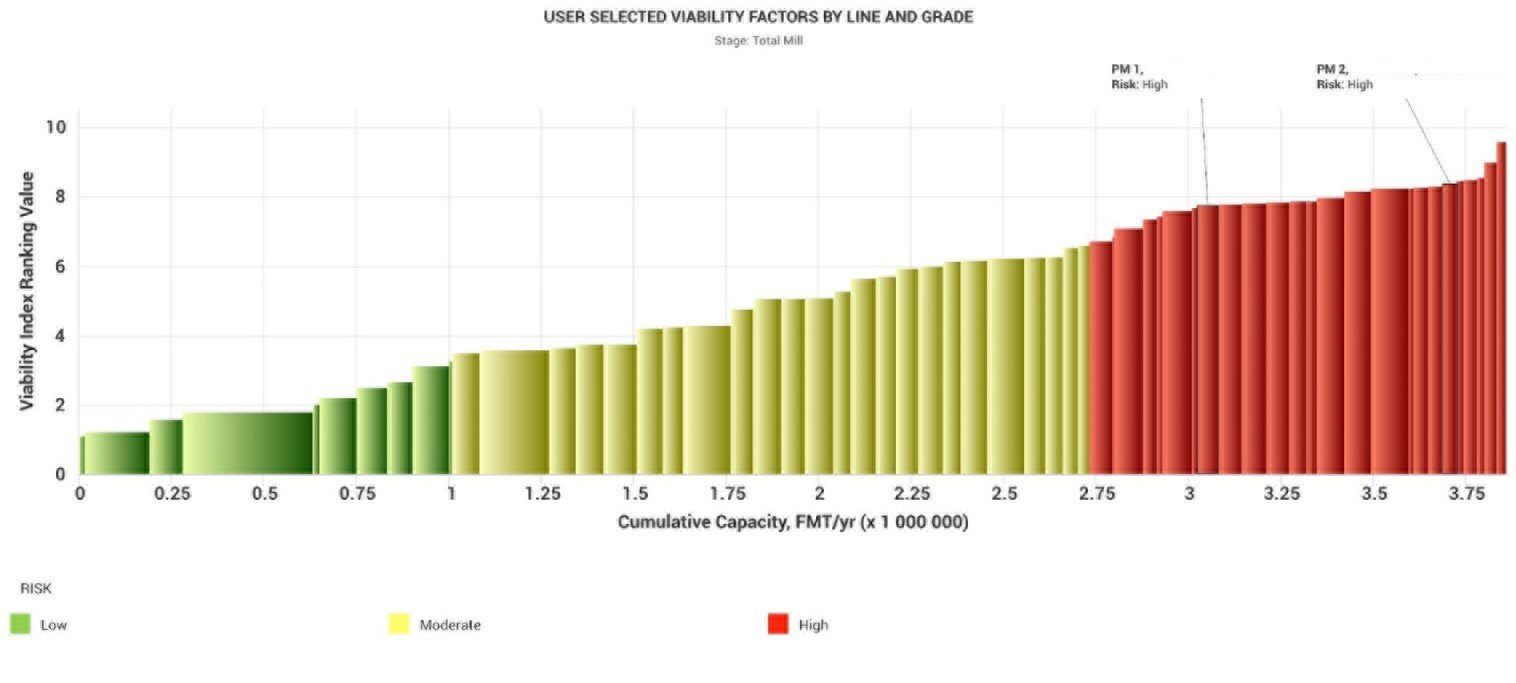

A North American mill producing uncoated recycled board wants to know the viability of two of its paper machines and what the best move would be. Using the Viability Module, we can see in the image below that both URB machines fall within high-risk territory when compared with peer machines located in North America.

Once the mill has identified where its paper machines fall within the benchmark, it can view each machine’s total profile using FisherSolve intelligence. This will help to determine what factors are causing the increased risk.

After further analysis, the company noted several factors in play:

- High production costs

- Small machine sizes

- Elevated technical age of the current machines

From there, our hypothetical mill can make a confident decision regarding the closure of these two machines. The company can also use this tool to monitor other machines within its various mills to make sure they don't venture into this high-risk category again.

Get the Help You Need Today with Fisher

Having access to such strategic data and forecasts provides pulp and paper industry players with the leverage needed to excel above and beyond competitors. This intelligence remains especially critical during a time of such economic uncertainty.

For more information on how our consulting services and data solutions can benefit your company, talk to an expert at Fisher today.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)