4 min read

Unravelling Chlor-alkali Pricing, Supply and Demand 2014 to 2024 (Part III)

ResourceWise

:

Dec 12, 2024 12:00:00 AM

In Part III of our Chemicals A to Z series exploring shifts in the price points of key chemicals over the past 10 years we turn our focus to the chlor-alkali sector.

Chlorine and caustic soda production combined amounts to over 200 million ktpa. Textile manufacturing processes and the pulp and paper sector rely heavily on caustic soda. Chlorine, meanwhile, underpins the pulp and paper sector, plus thousands of other everyday products.

The first in our series considered methanol, acetyls, and acrylates markets. In Part II, we looked at the aromatics—benzene, toluene, and xylenes or BTX chemicals, as they are widely known. The key chemical intermediate used to produce unsaturated polyester resins and phthalate plasticizers—phthalic anhydride—was also examined

Fibers, plastics, resins, maleic anhydride, and olefins will be investigated in the coming weeks.

Where's That Predicted Caustic Soda Shortage?

Back in 2022, an analysis of datasets in our chemicals business intelligence platform OrbiChem360 pointed to a looming global caustic soda shortage. In spite of a raft of new plants and facilities coming onstream, in China especially at that time, demand was predicted to be above output.

Source: OrbiChem360

What transpired in the timeframe between our chlor-alkali-focused consultant Hira Saeed, ResourceWise Chemicals making that prediction based on the global dynamics and today is a global economic downturn reminiscent of 2008. Growth in one world's biggest consumer markets, namely China, has failed to bounce back after the COVID-19 pandemic. The rest of the world therefore, is taking a hit too.

Essentially, the drop in consumer demand globally headed the predicted shortage off. What's more, there is little indication that the world economy will show much sign of recovery in 2025. Goldman Sachs Group predicts a deceleration of the nation's real GDP growth next year. The US-based multinational investment bank and financial services company said on 4 December 2024 that the drop would be almost half a percentage point.

It means that the growth in chlor-alkali capacity initiated in the relative boom years prior to COVID-19 will continue to stave off any shortage.

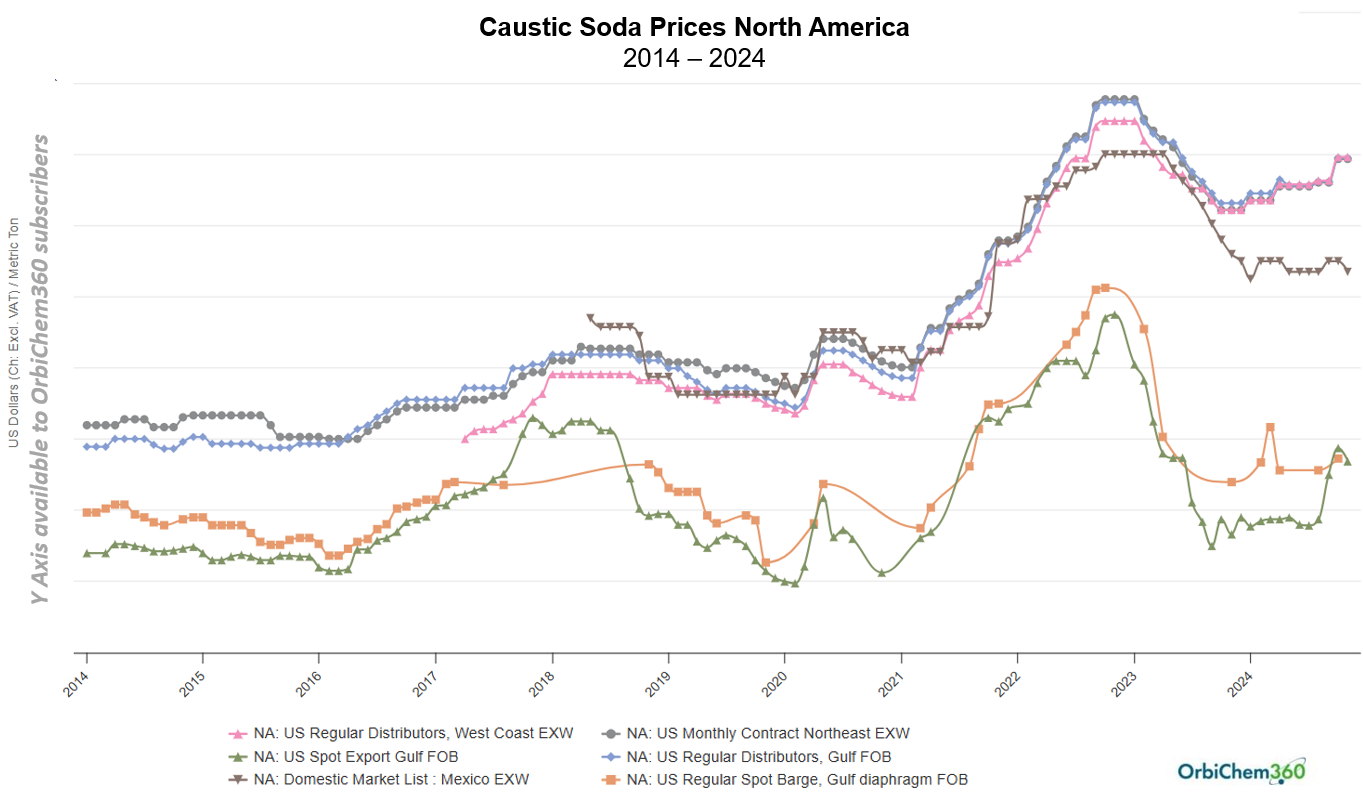

US Caustic Soda Price Nears All-time High

Despite the world's economy sitting squarely in the doldrums at present, the US price for caustic soda has increased fourfold since 2014.

A lot of the increase in the region's price was triggered by its low availability in the country due to production issues/weather related issues. In 2022, when caustic soda was stronger than chlorine derivatives, the market got tight. What happened in that scenario was prices increased. Since then, prices have just remained high, explains Saeed.

For some caustic soda produced in West Europe, there is a similar story price-wise, but for different reasons. In Europe, the high cost of energy—which is the chlor-alkali industry's biggest operating cost—drove prices higher. Saeed adds that energy costs are not such a contributing factor in the US.

Source: OrbiChem360

Earlier this year, we published a blog post exploring the Chinese government's stimulus policies: China Stimulus: View From the Sidelines. Goldman Sachs contends that while the stimulus may offset the hit to China's economy that US tariffs will bring, they will not be enough to tackle systemic issues. In short, sustained domestic demand growth and long-term structural reform is needed in China.

Another blow to the future of the caustic soda market is the recent announcement that lithium-ion battery producer Northvolt has filed for bankruptcy. The news, which broke in late November, potentially removes a promising prospect from Europe's downstream caustic soda value chain. As explored in our blog post Caustic Soda and Electric Vehicles Drive a Sustainable Future, Galp-Northvolt was once seen as one of Europe’s most advanced battery-developing joint ventures. Even after Northvolt backed out of the plan, Galp continued the quest to realize the goal, at least until last month, according to Galp's press release.

Europe's reliance on Chinese-made EV batteries is becoming more certain. Given the European Commission's imposition of up to 38% tariffs on them this summer, it is problematic.

Chlorine: A Co-product with Issues...

The chlor-alkali co-product chlorine has demonstrated devastating fundamentals in recent years. As explored in our blog post, Free Chemicals: A Bizarre Business Practice in Unpredictable Times, the price of chlorine has been negative during 2024. In fact, producers were paying to have their chlorine products offloaded, and not for the first time, as the graph below shows.

Source: OrbiChem360

The low-to-negative price point for Chinese liquid chlorine indicated in the graph is underpinned by the relationship between the two chlor-alkali products, chlorine and caustic soda. As a chlor-alkali process by-product, chlorine must also be produced to meet the demand for caustic soda. But demand for chlorine is relatively low due to its end-use industries—which include construction and infrastructure projects—are not operating at optimum in the current economic climate.

Epichlorohydrin...

Besides the chlor-alkali co-products caustic soda and chlorine, ResourceWise monitors prices for several of the latter's downstream products. Prices for epichlorohydrin—whose largest end-use market is epoxy resins—follow a similar pattern to those for chlorine. North American and European prices were highest globally in 2024 and higher than they were in 2014. Meanwhile, prices for the same product in China and the South and Southeast Asia region are lower than 10 years ago and considerably lower than in the Western world.

Source: OrbiChem360

It is clear that the world has changed a great deal since we predicted a global shortage of caustic soda in 2022. That shortage was anticipated despite China's massive growth in the sector. The only factor to change at scale is the demand side of chlorine—namely, a huge downward trend worldwide. That has pushed up the price of caustic soda since the world is still operating at a lower chlor-alkali utilization rate than it might have had the economy rebounded as it may have been expected to.

All sectors await the uptick in chlorine that signifies growth in its main end market, construction. That hoped for ray of sunshine now appears out of sight until 2025 at least.

Stay up to date by subscribing to our newsletter.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)