4 min read

Caustic Soda and Electric Vehicles: Driving A Sustainable Future

Hira Saeed

:

Sep 30, 2024 12:00:00 AM

Hira Saeed

:

Sep 30, 2024 12:00:00 AM

As the world increasingly shifts its focus toward sustainability, the growing interest in electric vehicles (EVs) is illuminating the oft-overlooked yet crucial role of caustic soda.

Though a relatively minor input across a wide range of processes, including those involved in the production of lithium-ion batteries, caustic soda is becoming indispensable in the journey to a greener future.

These batteries power electric vehicles, which in turn help reduce emissions and lessen our dependence on fossil fuels.

At first glance, it may seem counterintuitive to declare the energy-intensive chlor-alkali process as a cornerstone of a greener future. This, however, underscores the complexity of transitioning to more sustainable technologies.

Green caustic soda—produced using renewable energy—is gaining traction among manufacturers. However, widespread adoption remains an unviable option for many buyers due to its higher cost. Yet, even in its conventional form, caustic soda plays a crucial role in the broader sustainability narrative.

The Role of Caustic Soda in EV Production

Caustic soda use varies across different production processes, particularly in the evolving electric vehicle industry. While some methods rely heavily on it as a raw material, most others use it primarily for pH adjustment.

Electrode Coatings Slurry and Other Production Uses

- Uniform and stable coatings on battery electrode surfaces are key to performance. Coatings combine materials—including solvents, binders, and conductive additives—that have been mixed (usually for several hours) until homogeneous. Caustic soda solution is used to fine-tune the pH of the electrode slurry.

- Contaminants, residues, and impurities that build up around battery parts are cleaned using caustic soda solution.

- Waste streams generated during battery production—which can be acidic and/or alkaline—neutralized using a caustic soda solution.

The most conventional EV uses a lithium-ion battery. The two main raw materials used for Li-ion batteries are lithium carbonate and lithium hydroxide.

Lithium carbonate is more cost-effective and easier to handle due to its lower reactivity, while lithium hydroxide, though more reactive, offers superior performance in battery production. The choice between these two compounds influences the demand for caustic soda.

Extracting Lithium

One method extracts lithium from brine—"salars", or landlocked seas—containing water reserves with a high salt concentration. Israel's Dead Sea and the Great Salt Lake of Utah, for example, comprise up to a third of dissolved salt. They tend to have “high” lithium content at 200 – 2,000 parts per million.

The process involves pumping brine from salars into artificial lakes in the desert where open-air evaporation can raise lithium concentration by a hundred times or more when it can precipitate out as lithium carbonate.

The use of caustic soda in this process is lower than for hard rock mineral extraction. This alternative method requires desert land nearby and is mostly confined to Chile, Argentina, Bolivia, and China today.

Pegmatite-type minerals—found in granite, including feldspar, mica, and quartz—are the formations that underpin the method. Though Australia is the main source today, pegmatites are found worldwide. Extraction of lithium from the minerals, however, is mainly centered in China, where over 75 percent of world extraction happens.

According to the International Lithium Association (ILiA), hard rock extraction accounts for around 60 percent of global lithium production. In this method, ore spodumene is mined and processed to extract lithium.

The ore—comprising 0.5 - 1% of lithium—is crushed and roasted, extracting metals with sulphuric acid, before neutralization using caustic soda. Metals, including calcium, magnesium, iron, and potassium, are eliminated by progressive precipitation via pH adjustment before Li2CO3 is yielded using sodium carbonate.

Lithium Value Chain Complexity

Sourcing lithium presents significant challenges driven by environmental concerns and geopolitical factors. Most of the world’s lithium reserves are concentrated in the so-called 'lithium triangle. The triangle spans Argentina, Bolivia, and Chile, though China and Australia and are also major producers.

In fact, the demand for Chinese liquid caustic soda exports is expected to continue increasing due to Australia's rapidly developing lithium battery industry.

China plans to start up new caustic soda capacities, including capacities along the coast, which is expected to increase the supply for export. In Asia, India and South Korea are also expanding caustic soda capacities this year, which will compete with Chinese goods.

Australia’s import volume of liquid caustic soda increased by 17 percent last year compared to 2022. This, according to our China-based chlor-alkali expert Carol Li, Senior Consultant ResourceWise Chemicals, is largely driven by demand increase from aluminum producers and the energy lithium battery industry.

Lithium has been commercially produced since 1923. The surge in demand for rechargeable batteries these past decades has dramatically increased the need for this crucial resource. Its production has swelled in tandem with rising demand.

Source: ResourceWise

Realizing Refineries: The Reality

Despite concerns over sourcing, several projects have been announced across the US and Europe. Many of these initiatives, however, face possible delays or cancellations due to funding constraints, market volatility, or supply chain issues.

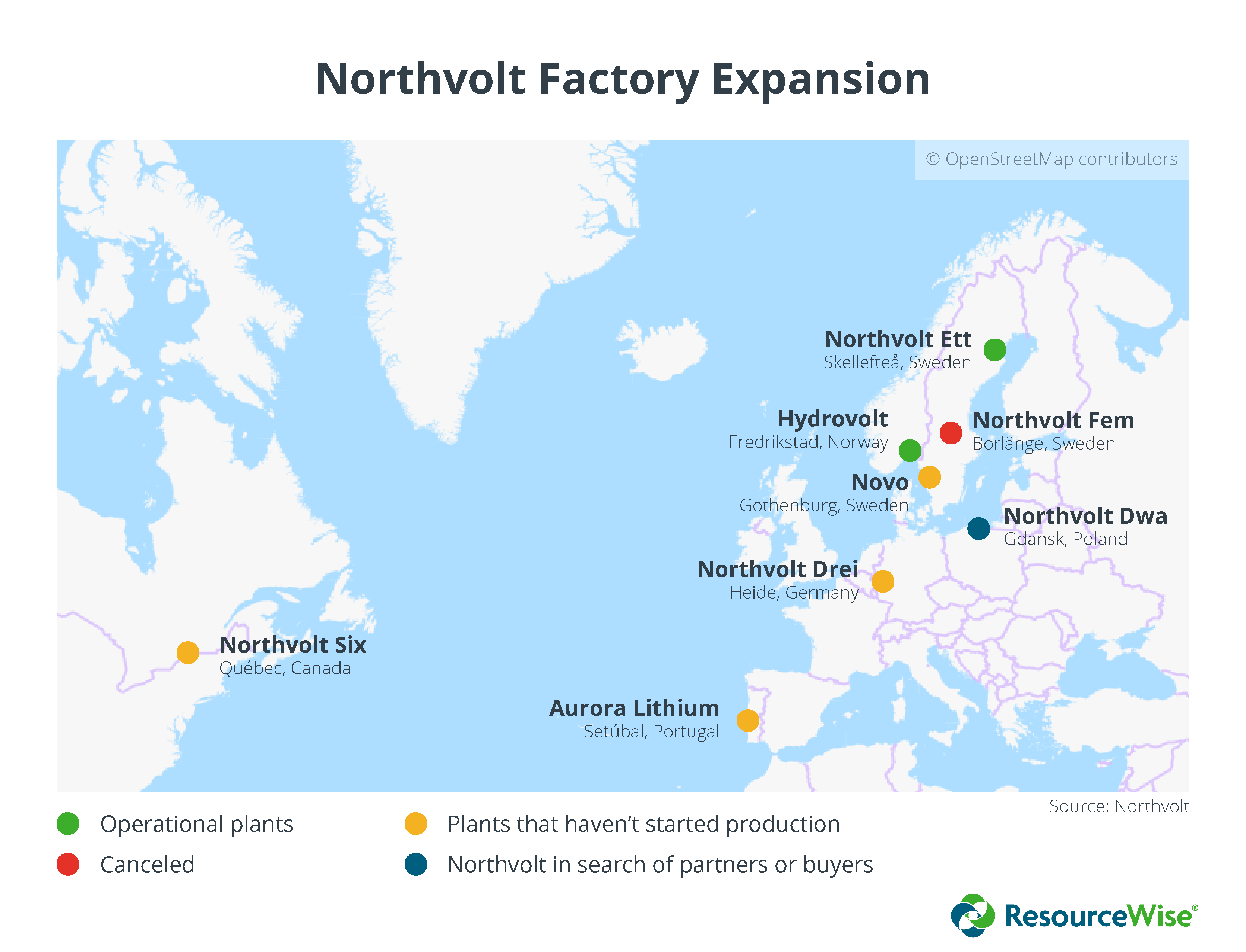

A notable example is the collaboration between Swedish battery developer Northvolt and oil and gas company Galp to establish a lithium refinery in Portugal, where Galp is based.

It was destined to be among Europe’s largest battery-grade lithium refineries by the end of 2025. However, it may be delayed. Financial uncertainty and the complexity of the undertaking are obstacles, reports Reuters. Initially, the facility was projected to produce up to 35,000 metric tons of lithium hydroxide annually.

As one of Europe’s most advanced battery developers, Galp-Northvolt’s setbacks have raised concerns about Europe’s ability to achieve self-sufficiency in battery production.

This raises the specter of continued reliance on China, which could be problematic given the 14-38% tariffs the European Commission imposed on Chinese electric vehicle batteries as of July mid-2024.

Overlooked: Demand for Aluminum in EVs

Beyond batteries, EV market growth is driving increased demand for aluminum. EVs use up to 25-27% more aluminum than traditional internal combustion engine vehicles. This is largely due to the need for lightweight components like e-drive housings, battery pack casings, and cooling plates.

Aluminum’s lighter weight compensates for the heavier lithium-ion batteries, making it essential to EV design.

Caustic soda plays a vital role in refining alumina, the precursor to aluminum. Approximately 100 kg of caustic soda is used for every ton of alumina produced. With aluminum consumption in the automotive sector expected to surge by 25%, this will significantly impact caustic soda demand. As a fast-growing end-use for caustic soda, the automotive industry’s shift toward electrification is poised to drive substantial growth in caustic soda consumption.

Source: ResourceWise

Emerging Technologies for EVs

Solid-state batteries represent a newer technology for EVs. They are potentially safer due to their lack of flammable components, but they are not yet mainstream. The lithium-ion battery uses a liquid electrolytic solution to regulate the flow of current, while a solid-state battery uses a solid electrolyte. A solid-state battery can benefit from increased energy density, faster charging, and a longer life cycle. These would still require lithium, which requires caustic soda, among many other chemicals, for extraction and processing.

Due to the wide variety of technologies and processes, quantifying the demand for caustic soda and other materials used in the production of batteries for electric vehicles is challenging, and the outlook could change very rapidly as new innovations arise.

You can read our blog post about the use of thermoplastics in high voltage applications, including EVs

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)