4 min read

Free Chemicals? A Bizarre Business Practice for Unpredictable Times

Jane Denny and Carol Li : Sep 19, 2024 12:00:00 AM

Most of us know of loss leaders. We may have seen retailers sell goods below cost to attract customers, though not in a chemical trade setting. The early 2020s, however, brewed a perfect storm of business fundamentals which took the concept to the next level.

For a few weeks in early 2024, some Chinese chemical producers subsidized buyers who offloaded a particular product. Wait, what? Surely, "waste collection" more accurately summarizes this transaction?

However, the output in question is a key raw material in several chemical industries. Recently, its price peaked at almost $US2,000 per ton in the US.

These are not credentials typical of waste streams. And anyway, the notion of negative price point “sales” for valuable commodities is unthinkable.

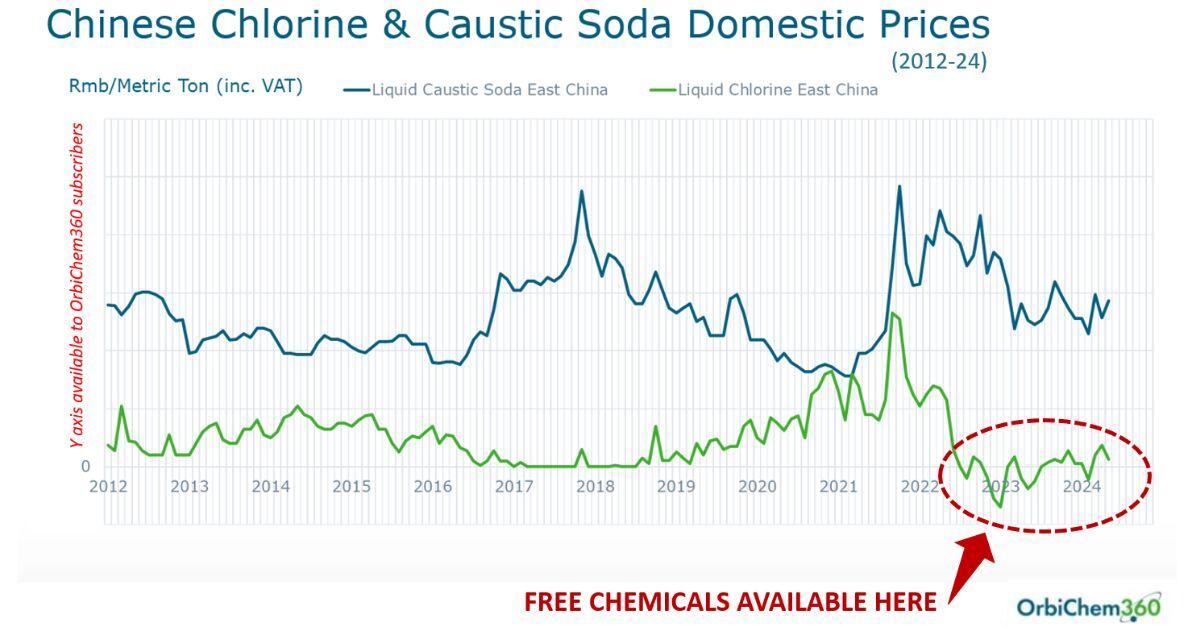

Nevertheless, they emerged in China in 2022, then returned twice for longer periods during 2023, and were seen again earlier this year.

This scenario begs the question: How can the feedstock for a derivative that had buyers scrambling amidst shortages in 2022 be worth less than nothing in 2024? And what does “worth less than nothing” really mean for goods with a five-year price index average of US$700+ per ton in North America (and $300+ per ton in Europe)?

Source: ResourceWise

Source: ResourceWise

The answer begins with an understandably bullish approach to growing output in China for the vital intermediate caustic soda this past decade.

Expanding Caustic Soda Output in China

In fact, the growth curve for chlor-alkali production in China is the third biggest of the 18 chemical subsectors ResourceWise covers. Larger capacity expansions—in terms of sheer volume—were seen only in the country’s PET and polyester sectors.

Of course, growth in China’s chemical sector dwarfed that of all other countries and regions during this past decade.

A key challenge for chlor-alkali producers is balancing offtake for the sector’s two product streams—caustic soda and chlorine. Their output ratio is close. For every ton of chlorine produced the caustic soda output is 1.1 tons. And China’s capacity to produce both is now huge. China's caustic soda capacity ten years ago was 38,000 ktpa, with chlorine at around 35,000 ktpa. In 2024, over 50,000 ktpa is achievable within China, with a chlorine capacity of almost 46,000 ktpa.

To put that in perspective, the US is the second biggest chlor-alkali market participant, with a caustic soda capacity of just over 14,000 ktpa. Chlorine output, therefore, can be over 13,000 ktpa if all plants operate at full utilization rates. Since caustic soda and chlorine have different downstream markets, their demand drivers are distinct.

Paper and pulp, soaps and detergents, textiles, pharmaceuticals, food, metal industry, and rubber industries consume caustic soda. Chlorine, meanwhile, underpins PVC and epoxy resin production, water purification and—as mentioned—it is key to chemical synthesis. Therefore, the demand curves for the chlor-alkali sector’s co-products can move in opposite directions.

Globalized Economy Growth

As China’s chlor-alkali plant expansions and new facilities came onstream in the 2010s, demand for both chlor-alkali products continued their growth trajectory. The sectors that underpin strong economies—construction, housing, automotive, and FMCG—were enjoying relative success everywhere.

Off the back of relatively stable oil and gas supplies, geopolitical calm (compared to today), and a fairly efficient shipping industry, markets mostly looked positive.

Strong caustic soda demand did trigger chlorine oversupply in 2017 and 2018, but the price index remained above zero. It meant producers were not obliged to pay "buyers" a negative value, as they have in the 2020s.

Then COVID-19 hit…

Since 2020, China has struggled to reinstate its economic success streak, as has the rest of the world. Even as established and newly completed facilities cut utilization rates, new plants are coming online. The result is that Chinese caustic soda export prices dropped last year owing to oversupply.

Conflicting Trends

On one hand, Chinese caustic soda producers ran at operating rates above 80% on average. With the startup of new capacities, China’s 2023 caustic soda output was over 41,000 ktpa. On the other hand, demand was relatively low. Caustic soda’s purchasing price was cut down by alumina producers, whose buying tactics were driven by poor production profits in their own sector.

Demand from downstream markets, including the viscose fibers, printing and dyeing industries, was also weak.

Source: ResourceWise

Liquid Caustic Soda Exports

China’s total liquid caustic soda export volume in 2023 dropped by more than a quarter compared to 2022. Demand from European buyers was weak, as was global demand.

With European buyers importing at high prices in 2022, Chinese caustic soda prices were pushed upwards. However, liquid caustic soda exports dropped again early in 2024 as economic growth slowed globally.

Australia was the largest import country from China, Indonesia and Taiwan ranked from second to third in 2023, as was the case in 2022 and 2021.

Solid Caustic Soda Exports

The total export volume of solid caustic soda decreased by 8 per cent in 2023 compared to 2022. China’s export volume for solid caustic soda fell by almost a quarter during the first four months of this year compared to 2023.

Weak demand in overseas markets—as well as container shortages, and high freight cost—were key drivers of this reduction. A notable difference in exports of solid caustic soda—compared to liquid—was that export destinations were more scattered. Over 130 countries imported solid caustic soda from China in 2023, compared to just 40 importing countries for liquid caustic soda. The top two export destinations last year were Vietnam and Indonesia.

Middle Eastern and African countries imported the greatest volumes of solid caustic soda from China last year, nearly half the country’s total export volume. South and Southeast Asia accounted for almost a quarter of the total export volume.

Australia’s import volume of liquid caustic soda increased by 17 per cent last year compared to 2022. And Indonesia’s import volume increased by around 5 per cent compared to 2022. Vietnam and Singapore saw rapid increases at around 30 per cent.

Chlor-Alkali Markets of the Future

China’s caustic soda and PVC capacities continued to grow in 2024. All in all, over two million tons of caustic soda is planned to come onstream by the end of the year. That's on top of the capacity increases seen in recent years. Similarly, additional PVC capacity was expected to come online this year, but postponement of some to 2025 is possible.

With more supply of the chlor-alkali co-product chlorine in the market than demand for it, producers face problems. In some cases, will be down to producers existing for long enough to see demand improve.

Back in 2022, when demand for Chinese-made chlor-alkali products was still high (and prices reflected that), the world was staring down at a potential shortage of caustic soda, even in spite of the growth in output.

Those fundamentals have not disappeared entirely, but for now, there seems to be much more capacity than is needed.

If only it were possible to produce caustic soda without yielding the co-product chlorine, many might think. Well, this is exactly what Evonik announced as a key area of R&D last week.

The German specialty chemicals company is investing (low) double-digit millions of euros in a new electrochemical process to recover caustic soda—with no corresponding chlorine—from salts, such as sodium sulfate.

While such a green route might alleviate the problem of chlorine oversupply, markets for its co-product sulfuric acid will be needed. Also, it won't be licensed, as Evonik wants to keep the technology inhouse.

You can read our blog post about the looming shortage of caustic soda below.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)