3 min read

Navigating Methanol Price Volatility: Impacts, Strategies, and Solutions

Suz-Anne Kinney

:

Mar 26, 2024 10:06:40 AM

Suz-Anne Kinney

:

Mar 26, 2024 10:06:40 AM

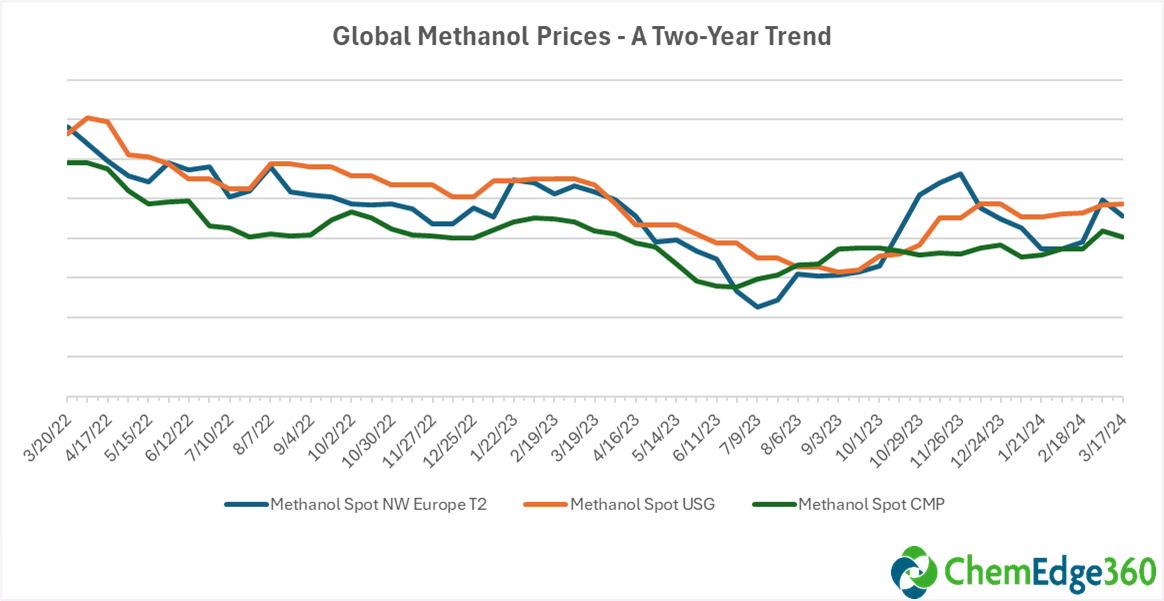

Methanol prices respond to many supply and demand factors, including supply chain disruptions, natural gas and crude oil prices, environmental regulations, and demand from new applications. The chart shows how methanol prices have reacted to these factors over the last two years.

High methanol prices can increase production costs for many downstream products, putting pressure on manufacturers' margins. This added expense requires manufacturers across these industries to demonstrate agility as they balance product pricing and profitability.

End Users Impacted by Methanol Price Volatility

- Construction and Building Materials: Methanol is used to manufacture PVC, insulation foams, and plywood. Higher methanol prices can result in increased expenses for constructing these materials. This, in turn, can lead to higher overall costs in construction projects, potentially influencing real estate pricing.

- Automotive Industry: Methanol is used in the manufacturing of vehicle components such as engine parts, fuel pumps, and exhaust systems, so changes in methanol prices can impact the production costs for both manufacturers.

- Consumer Packaging Goods: The cost of methanol significantly impacts the affordability of producing packaging materials and adhesives, which impacts the pricing of consumer goods. Fluctuations in methanol prices can directly affect the costs of items like plastic bottles, wood adhesives, and synthetic fabrics.

- Electronics and Appliances: Numerous components like circuit boards, microchips, and casings in electronic devices and appliances heavily rely on materials derived from methanol. For instance, the plastic casings of smartphones, circuit boards in computers, and microchips in smart home devices are all examples where methanol-based materials are crucial. Consequently, any price hikes in methanol can significantly raise manufacturing expenses for companies in the electronics and appliances industry.

- Textile Industry: Methanol is vital in producing synthetic fibers and textiles, making this industry susceptible to price fluctuations. Specifically, methanol is crucial in producing polyester fibers used in clothing, carpets, and upholstery. The reliance on methanol highlights how its price variations impact a broad array of everyday textile products.

- Agriculture: Methanol is used in the production of formaldehyde and acetic acid, essential components for manufacturing agricultural fertilizers like ammonium nitrate and urea. Additionally, it is a key ingredient in synthesizing pesticides such as glyphosate and organophosphates. Price increases affect both the farmer and the consumer.

- Marine Transportation: In 2023, the International Maritime Organization set a net-zero emissions target by 2050. As a result, large maritime shipping companies will require large amounts of methanol and green methanol to comply. Shipowners have been ordering more ships built to run on methanol. This new demand will likely cause prices to rise, and the shipowners will need to manage through this challenge.

Download your copy of the eBook: Guide to Understanding the Global Methanol Market

7 Strategies for Mitigating Methanol Price Volatility

In the face of methanol price volatility, industries must adopt strategic measures to ensure continuity and mitigate potential financial strain. Here are several strategies that can be instrumental:

- Diversification of Suppliers: Companies should diversify their suppliers to reduce dependency on a single source of methanol. This includes looking beyond local suppliers to global markets where methanol prices may be more favorable.

- Long-term Contracts: Negotiating long-term contracts with suppliers can help lock in lower prices, providing a buffer against short-term price fluctuations. The most effective contracts are generally linked to a reliable and accurate price benchmark, offering a structured approach to managing potential risks in the market.

- Investment in Methanol Alternatives: Exploring and investing in alternative raw materials that can substitute methanol in certain applications will reduce the industries' vulnerability to methanol price swings.

- Efficiency Improvements: Companies can lower their overall methanol consumption by enhancing process efficiency and reducing waste. Technological advancements and process optimizations are key to achieving this objective.

- Strategic Stockpiling: When prices are low, businesses can consider stockpiling methanol during periods of high price volatility. This strategy requires careful planning and analysis to avoid unnecessary financial burden due to storage costs.

- Financial Instruments: Utilizing financial instruments such as futures contracts, options, and swaps can provide some level of protection against price fluctuations. These tools allow companies to hedge against unfavorable price movements.

- Market Intelligence: Staying well-informed about the methanol market and its influencing factors allows companies to anticipate changes and adjust their strategies accordingly. This includes monitoring methanol production levels, crude oil prices, and geopolitical events that may affect supply chains.

By adopting one or more of these strategies, end users can boost their resilience against the volatility of methanol pricing, ensuring operational and financial stability.

Inform Your Strategy with ChemEdge360

Understanding the volatile nature of methanol prices is crucial for industries that depend on this essential chemical. The strategies outlined in this article demonstrate the importance of agility, foresight, and strategic decision-making in navigating these fluctuations.

ChemEdge360 stands at the forefront of providing comprehensive insights and solutions tailored to your business needs in the face of price volatility. Our platform offers timely and reliable market intelligence to help you safeguard your operations, develop sound supplier diversification strategies, and enhance your overall competitiveness.