1 min read

Toward Top Quartile: Southern Pine Sawmill Cost Increases

Bryan Beck

:

Nov 11, 2024 12:00:00 AM

Beck Group Consulting's observation of Southern pine sawmill benchmarking studies began in the mid-1990s. Until the past decade, Southern pine costs increased trailing inflation due to incremental operating efficiency improvements at most sawmills.

Inflation Trends and Manufacturing Costs

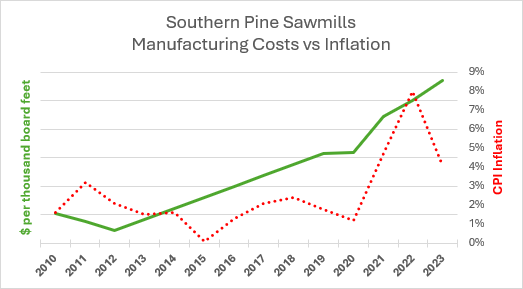

The Great Recession kept its boot on lumber prices for the period 2007-2011, which had most of the timber industry cutting and capping costs. In the nine years leading up to the global pandemic, however, costs rose by about 4% per year while U.S. inflation hovered around an annual rate of 1.6%.

Manufacturing costs (including depreciation but excluding log costs) increased by over 6% per year from 2019-2023, with a notable jump from 2020-2021 due to pandemic-related labor and supply chain issues affecting all parts of the economy. And while inflation in the overall US economy took a steep drop from 2022-2023, Southern pine mills’ manufacturing costs continued to rise.

Labor and depreciation costs are both key drivers of this increase in operating costs. During the lumber market doldrums around the time of the Great Recession, sawmill wage rates were suppressed, and capital investment was limited for several years.

This all began to change as investment poured into the Southern pine lumber industry over the past decade, with numerous new greenfield mills and major expansion at existing mills driving up depreciation costs and creating more demand for experienced sawmill workers.

Wage rates and labor considerations are addressed in more detail in our other blog post: Toward Top Quartile: Southern Pine Labor Data Insights

A related trend is that Southern pine mills’ manufacturing costs have also reversed historical norms by exceeding log costs (lumber basis). Specifically, manufacturing costs rose by more than 4.7% per year from 2012-2023, while average log costs increased by only 1.2% per year. In 2012, Southern pine log costs constituted 57% of the total cost of producing lumber; in 2023 that had fallen to just 46%.

Enhancing Competitiveness in Southern Pine Mills

How can Southern pine mill operators remain competitive in such an environment?

Combining the Beck Group's sawmill benchmarking experience and knowledge with ResourceWise's SilvaStat360 business intelligence platform, Sawmill TQ (Top Quartile) delivers historical and current sawmill benchmark data representing a large portion of the southern sawmilling industry. Complementary benchmarking services for log, lumber, pellet, and wood fiber values can also be found.

Beck Group Consulting also conducts regular timber industry workshops, including its upcoming training on Sawmill Management (December 3-4, 2024) and Business of Forest Products (January 23, 2025).

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)