2 min read

Strong Demand and Tight Supply Have Driven Wood Fiber Costs for Pulp Manufacturers Higher in 2022

Håkan Ekström

:

Aug 17, 2022 12:00:00 AM

Håkan Ekström

:

Aug 17, 2022 12:00:00 AM

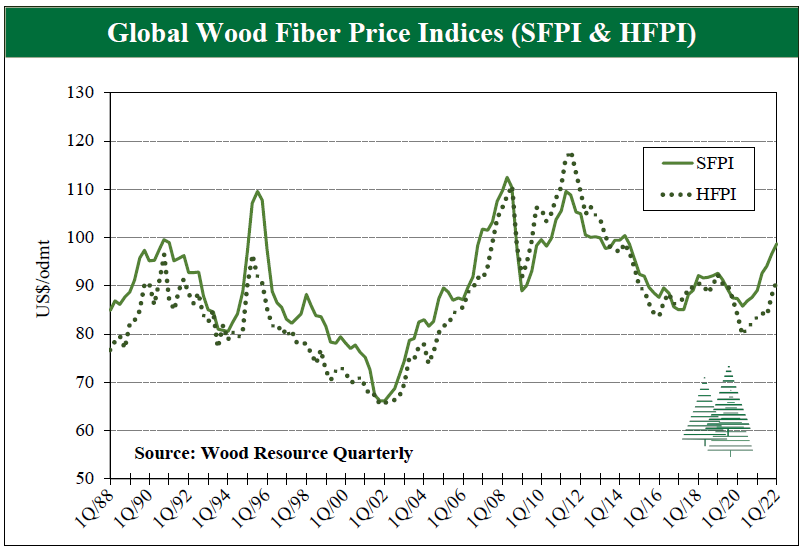

Prices for pulplogs and wood chips increased QoQ in early 2022 in all 19 regions worldwide as tracked by the Wood Resource Quarterly (WRQ). This universal increase is a highly unusual occurrence that has only happened a few times since the WRQ started tracking global wood fiber prices in 1988. Prices rose for softwood and hardwood fiber, with the most significant increases occurring in Germany, US Northwest, Chile, Australia, Western Canada, and Austria (nominally descending order).

The global wood fiber price indices (SFPI and HFPI), denominated in US dollars, were up 2.0% and 3.3% QoQ in 1Q22 for softwood and hardwood, respectively. The increase from 1Q21 was as much as ten percent for both price indices (see chart).

In North America, wood raw-material costs have increased in all major regions, not only for the continent’s pulpmills but also for the sawmills (see table). The most significant increases occurred in the US Northwest, where prices for softwood pulplogs and woodchips were up 40% from 1Q21 to 1Q22 as log supply became tighter, fuel costs increased, and shipments of wood chips to Asia trended upward.

The US South has long had low and stable log and wood chip prices. However, prices have moved upward over the past year, increasing 10-15% since early 2021. Softwood sawlog prices (in nominal terms) reached their highest level in almost 15 years, while pulpwood prices were close to their all-time highs.

Price Changes for Wood Raw-Material in North America from 1Q21 to 1Q22 (percent)

Source: Wood Resource Quarterly. Note:“N/A”- region does not produce large volumes in the open market of the product.

Source: Wood Resource Quarterly. Note:“N/A”- region does not produce large volumes in the open market of the product.

In Europe, wood fiber prices in US dollar terms were mixed in 1Q22, slightly lower YoY in the Nordic countries and substantially higher in Central Europe. Prices for softwood and hardwood pulplogs were up 10-50%, while residual prices have almost doubled in Germany in the past year. The most significant factors for the surge in prices were increased demand for wood fiber and a slowing in the production of lumber.

Close to record-high pulp prices worldwide and higher energy costs in the 2Q/22 have resulted in continued upward price pressure for pulplogs and wood chips on all continents, including North America, Europe, Latin America, and Asia. In many countries, prices reached close to their highest prices in over ten years.

Are you interested in worldwide wood products market information? The Wood Resource Quarterly (WRQ) is a 70-page report established in 1988 with subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the latest international forest product market trends, please go to www.WoodPrices.com.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)