3 min read

Plunge in Forest Product Price Index as Production Holds Steady

Forest2Market

:

Mar 17, 2023 12:00:00 AM

Forest2Market, a ResourceWise company, continually monitors the changing economic conditions impacting the forestry industry. Production seems to be holding steady as we finish out Q1. But the numbers in the forest product sector can’t match the highs they enjoyed a year ago.

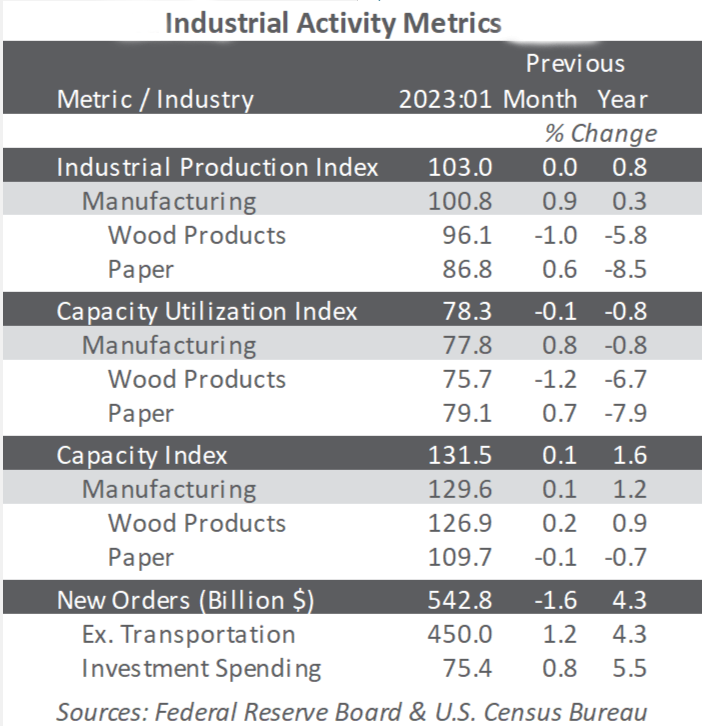

Total industrial production (IP) was unchanged in January at +0.8% year-over-year (YoY) after falling 0.6% and 1.0% in November and December, respectively. In January, manufacturing output moved up 0.9% (+0.4% expected).

Within durables manufacturing, wood products (-1.0%) and furniture posted the only losses. Paper (+0.6%) contributed to gains within nondurables.

Forest2Market is forecasting quarter-over-quarter (QoQ) changes in total IP to range between ‑4.9% and +3.7% annualized rates during the next 24 months with an overall average of -0.2%.

ISM Sentiment Shows Slowdown in Contraction

The Institute for Supply Management’s (ISM) monthly sentiment survey of U.S. manufacturers for February 2023 contracted a bit more slowly than recent months. The PMI registered 47.7%, up 0.3PP from January’s reading. 50% is the breakpoint between contraction and expansion.

As the above chart shows, the largest changes included prices paid (+6.8PP), new orders (+4.5PP), and imports (+2.1PP).

Concurrent activity in the services sector expanded at a marginally slower but still solid pace of -0.1PP to 55.1%. Business activity (‑4.1PP), employment (+4.0PP), and exports (+2.7PP) exhibited the largest changes.

Of the industries we track, manufacturers contracted while services expanded.

S&P Global Survey Consistent with ISM Data

Changes in S&P Global’s survey headline results were broadly consistent with ISM’s. Both manufacturing reports showed contraction, and both services reports exhibited expansion.

According to S&P Global’s Chris Williamson, “U.S. manufacturing remained under intense pressure in February. Although the PMI rose slightly, it continues to signal the steepest downturn outside of pandemic lockdown months since 2009. Moreover, some of the improvement in output could merely be attributed to faster supplier delivery times, which quickened to the greatest extent since 2009.”

Consumer & Producer Price Indices See Increases

Following the recalculation of seasonal adjustment factors that revised data back to 2018, the consumer price index (CPI) rose 0.5% in January. This marked a +6.4% increase YoY, the smallest 12-month increase since October 2021 after increasing 0.1% in December.

The also-revised producer price index increased 0.7%, a +6.0% increase YOY, following a 0.2% MoM decline in December 2022. A 6.2% jump in the gasoline index led the 1.2% rise in prices for final-demand goods while a 1.4% advance in the index for hospital outpatient care contributed to prices for final-demand services moving up by 0.4%.

Forest Products Mostly Drop in YoY Price Indices

In the forest products sector, price indices fared somewhat worse:

- Pulp, Paper & Allied Products: +0.5% (+7.8% YoY)

- Lumber & Wood Products: -0.6% (-12.3% YoY)

- Softwood Lumber: -5.1% (-44.1% YoY)

- Wood Fiber: -0.6% (+1.4% YoY)

Forest2Market's Forecast: Complications From Fed's Interest Rates, Inflation

As we discussed on the blog, the Federal Reserve Open Market Committee (FOMC) raised the federal funds rate (FFR) by 0.25PP on February 1 to a range between 4.5 and 4.75%. Although all Fed officials anticipate further FFR increases, the minutes reflected concern among several members about a then-ongoing easing in financial conditions that could further “necessitate a tighter stance of monetary policy.”

Also, if rates are not set high enough to slow the economy, it could halt recent progress in moderating inflation and lead to expectations becoming unmoored. This could cause inflation to remain above the Fed’s target for a longer period.

At the same time, our models call for QoQ changes in the CPI to fluctuate between +2.2% and +4.2% annualized rates for an overall average of +2.9%. The PPI will range between +2.6% and +4.2, averaging +3.2% overall.

We expect to see price inflation bubbling up repeatedly because the Fed’s tools are not well-suited for dealing with supply-side issues. Additionally, the federal government’s regulatory and tax policies will likely make energy – and therefore everything else – much more expensive.

Forest2Market’s Economic Outlook: Key Information for Better Decisions

This post is a brief excerpt from Forest2Market’s monthly Economic Outlook forecasting report.

Forest2Market, a ResourceWise company, offers subscribers key economic data in our monthly Economic Outlook (EO) forecasting report for businesses across the forest industry supply chain.

The Economic Outlook goes beyond what’s presented here by offering critical information about the forestry industry and broader economic data and indicators. This helps our subscribers to make better strategic decisions in all the following ways:

- Identifying changes and performance indicators

- Enhancing focus on market drivers

- Improving decisions with benchmarks and critical data

Learn more about the Economic Outlook by contacting ResourceWise today.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)