2 min read

Housing Starts Drop Over 20% as Interest and Recession Fears Rise

Forest2Market

:

Feb 10, 2023 12:00:00 AM

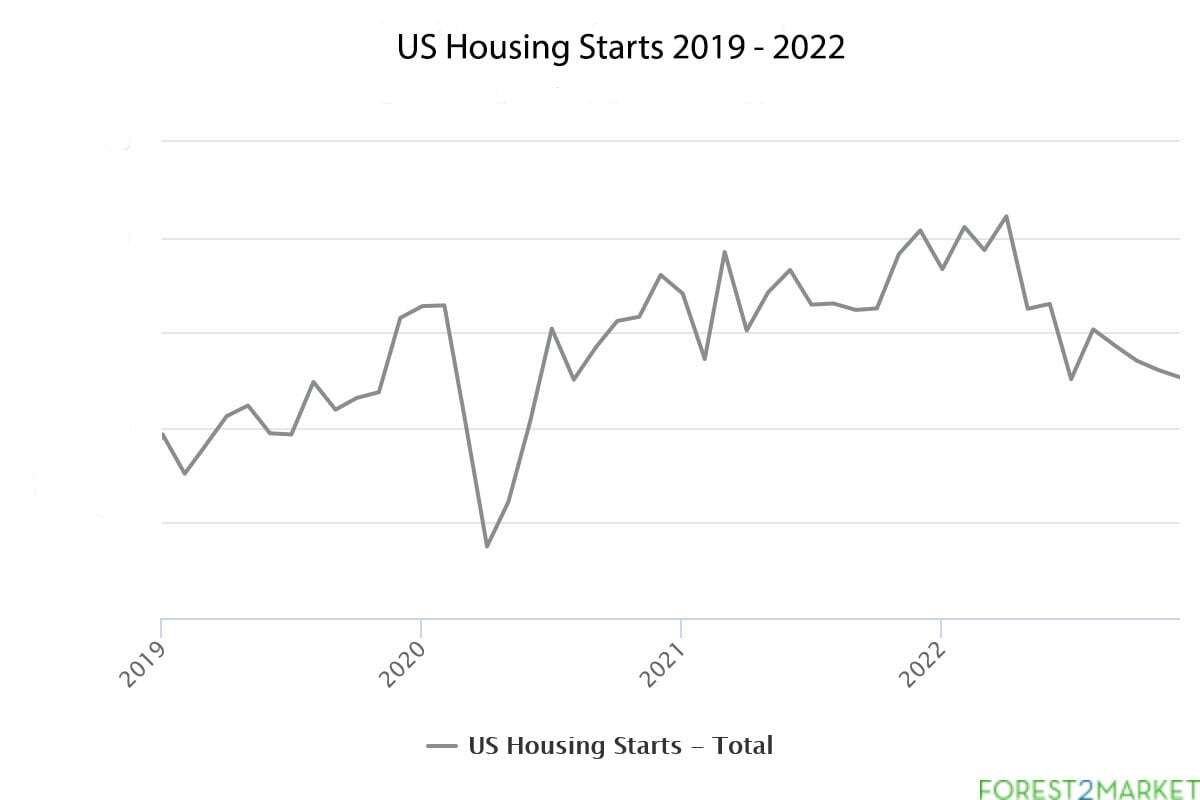

December housing starts saw a dip of over 20% from the same time last year. With interest rates rising and murmurs of a recession abound, the market continues on an unclear path in 2023.

According to Forest2Market data, housing starts at the end of 2022 were about 22% lower year-over-year (y-o-y) from 2021. The biggest drop occurred in 1 unit starts with a 25% dip YoY. Starts for 5+ units were also down 16%, while 2-4 units saw an increase from last year.

2022 experienced a somewhat erratic housing climate as the market adjusted to inflation and looming predictions of a recession. Housing starts hit their high in April, but dropped 23% by July into the lowest numbers of the year.

Total housing starts rebounded fairly quickly with a 9% increase into August. However, they continued falling to year end to just about match July’s low.

Talks on Housing Recession and Interest Slowing Homebuyers

Many economists see this dismal outlook as an obvious sign of a housing recession. Yet other forecasters dispute whether we are actually in a recession.

Splitting hairs over what “counts” as a recession doesn’t change the fact that we’ve seen multiple factors all affecting the housing market. What matters is where these conditions will take the market as 2023 continues.

The Fed raised the interest rate again at the start of February by a quarter of a percent. The increase was lower than some economists predicted. While that’s good news to some, the Fed also made it clear to expect continued hikes in the ongoing battle against inflation.

This sentiment continues to impact related parties such as REITs and mortgage bankers. Interest rates seriously affected the revenue stream for mortgage bankers. The ripple effect made its way to mortgage REITs and all related companies in the homebuilding sector.

2023 Housing Outlook Somewhat Mixed

The major question across the industry right now relates to market performance. Will we see a recovery in 2023 compared to last year? Or will the ongoing pressures of interest and inflation keep housing starts more muted?

At the consumer level, one of the biggest obstacles in any new housing venture is the price point. As demand surged in the COVID and post-COVID world, prices increased accordingly.

The prices seem to have hit their high points in many regions. Most of the forecasts acknowledge this high point and reflect what is likely to happen: what goes up must come down.

The Mortgage Bankers Association made several adjustments to their 2023 forecast with lower outlooks across the board for housing starts. This, in turn, will decrease demand for the timber driving these new construction projects.

Furthermore, current rates for new mortgages are considerably higher than even just a year ago – jumping from 3.2% to 6.3% from January 2022 to January 2023. These higher rates mean that many homeowners aren’t in a hurry to move or build a new house any time soon.

Compounding Factors in Housing from Investor Hesitance

To make matters worse, many investors in the homebuilding sector are waiting for better economic conditions to make a move. This means a delay of several months to a year or more before jumping back in.

Delays like this will inevitably lead to depressed demand for building materials. And with fewer build projects expected to start, we will likely see an even worse housing deficit for buyers.

With interest rates and costs exceeding affordability to consumers, how will the market respond?

The Value of Critical Data for Strategic Decisions

When uncertainty looms, you need precision data to provide insights that will assist you in making the best possible strategic move for your business. SilvaStat360 provides an intuitive, all-in-one source to track critical data within the forest supply chain.

SilvaStat360 delivers customizable reporting, pricing data on inventory, key macroeconomic data, and regional tracking. That way, you can develop a strategy to make the best possible decisions for your business.

Schedule a demo of SilvaStat360 today to see all the ways it can inform all your crucial business decisions.