4 min read

Is Your Carbon Position Impacting Your Mill's Viability?

Marcello Collares

:

Nov 10, 2023 12:00:00 AM

Marcello Collares

:

Nov 10, 2023 12:00:00 AM

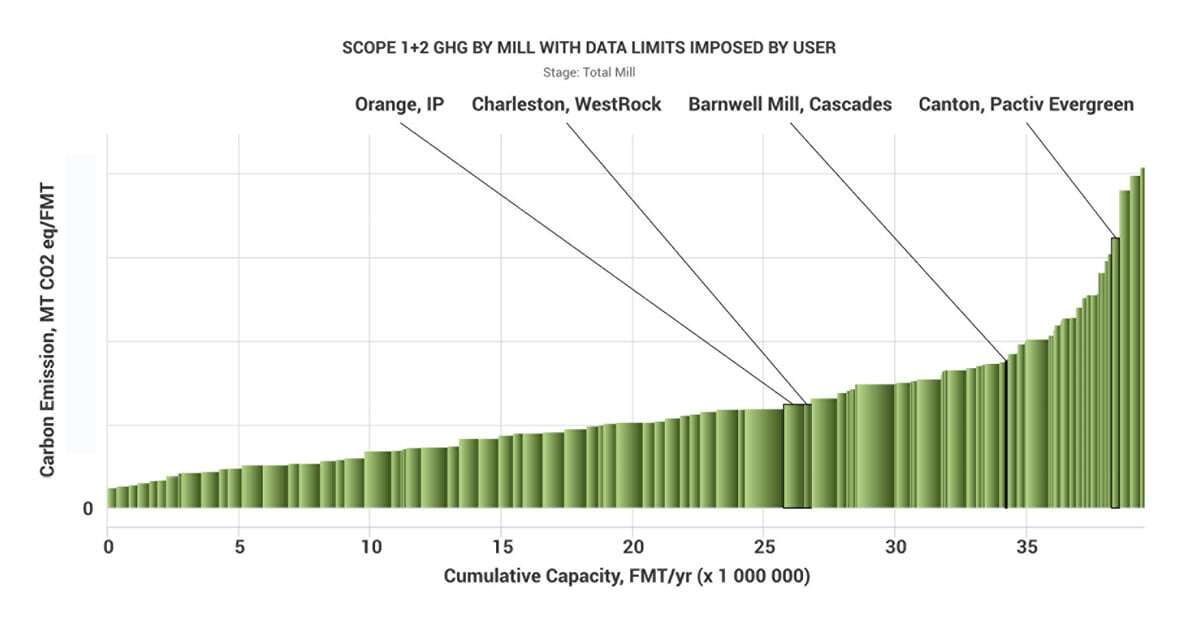

During the first half of the year, numerous announcements came out regarding the closure of various pulp and paper mills. Notable closures included Pactiv Evergreen’s Canton mill, WestRock’s North Charleston mill, Sonoco’s Hutchinson mill, and others. In a previous article, we discussed the details surrounding these closures along with the reasons why we were seeing an uptick in shutdowns in the first half of 2023. Read the article here.

A few months later, the pulp and paper industry continued to witness a series of mill closures. International Paper's recent announcement in October about the permanent closure of its Orange, Texas mill serves as a prime example. This closure of the containerboard mill will lead to a reduction in the company's capacity by 800,000 tons. It is anticipated that the mill will close by the end of this year.

Factors that Influence a Mill's Viability

The viability of a pulp or paper mill is determined by several factors. In FisherSolve, our Viability Benchmarking tool defines some of these factors by:

- Capital Required –Adequate access to capital and financial resources is crucial for investments in technology, maintenance, and expansion.

- Cost – Operating costs, including labor energy, raw materials, and overhead expenses.

- Technical Age – The number of modern machines a mill owns can oftentimes impact productivity and competitiveness.

How Big of a Role Does Carbon Play?

As we examine the greenhouse gas (GHG) emissions of the mills mentioned that have closed recently in comparison to other mills in North America, we can see in the image below that all mills fall on the upper end of the benchmark. This raises the question of whether there is a connection between a mill's GHG emissions and its long-term survival.

A mill's position in the competitive landscape is one of the more influential factors in determining its viability. And when determining how competitive a mill is, we no longer solely look to profitability as the driving answer, but also to its environmental impact.

As sustainability becomes a top priority for consumers and investors alike, it's only natural that a mill's carbon emissions can significantly influence its long-term success. Mills with high carbon emissions may face risks and struggle to attract customers who prioritize environmental performance. With an increase in customer preference for companies who have sustainability top of mind, it's no surprise that high GhG emitters are losing some of their competitive edge and therefore their viability.

In addition to consumer and investor preferences for sustainable companies, government regulations on carbon emissions also play a crucial role in determining the survival of pulp and paper mills. As part of a global initiative to combat climate change and reduce greenhouse gas emissions, governments worldwide have implemented a wide range of regulations and policies.

One major example is the European Green Deal. The primary goal of the European Green Deal is to become the first climate-neutral continent. To achieve such a lofty goal, the pressure is on individual companies to adhere to the guidelines set in place and ensure products sold on the EU market meet sustainability standards. This legislation will also impact imports and exports to and from Europe as well.

Along with the European Green Deal, we’ve seen other legislative measures establishing limits on emissions and requiring companies to invest in cleaner technologies and sustainable practices. Non-compliance with these regulations can lead to severe consequences, including fines, penalties, or even the permanent closure of mills.

How Can You Determine Where You Fall Against Your Peers?

ResourceWise products can support you in evaluating not only your carbon position and how to effectively work toward decarbonization but your mills' viability as well.

FisherSolve’s Carbon Benchmarking Module

Our Carbon Benchmarking Module within our powerful database FisherSolve empowers you to evaluate your Scope 1, Scope 2, and Scope 3 emissions from cradle to gate. By utilizing this module, you can accurately compare your mill's GhG emissions to other mills, along with identifying the main sources of your carbon.

The valuable insights gained from this benchmarking process enable you to confidently strategize and implement measures that effectively reduce your emissions. You'll be able to easily determine the threshold you need to meet to remain competitive in terms of emissions against other mills in your industry. Learn more.

Prima CarbonZero

Once you have determined your position, insights from our Prima CarbonZero platform can be utilized to gain a deeper understanding of the cost of low-carbon inputs necessary for decarbonizing your business operations.

Prima CarbonZero specializes in pricing carbon and low-carbon fuel markets, offering invaluable knowledge for grasping the green carbon value proposition of pulp and paper mills. Furthermore, the platform provides mills with a comprehensive understanding of the potential value and opportunities in their green carbon product streams. Pulp and paper companies should leverage Prima's expertise to explore how these residual streams can be transformed into future fuels and maximize returns as policies drive the demand for low-carbon fuels into high gear. Learn more.

FisherSolve’s Viability Benchmarking Module

You can also use our Viability Benchmarking Module found within FisherSolve to discover how viable your mills are. This tool was developed to predict the long-term success of pulp lines and paper machines.

Validated against historical data on closures and survival to provide statistically sound rankings, Viability Benchmarks assess the resilience of specific machines and mills. This offers valuable insights into the strengths and weaknesses of each asset. With FisherSolve's Viability Benchmarking, you can segment any dataset, so your benchmarking analysis reflects the assets and factors most relevant to your company.

The chart below illustrates FisherSolve’s viability rank in 1Q2023 for each of the closing mills we discussed earlier. As we can see, not one of these mills fell into the low-risk category (viability rank of 3.3 or lower). Learn more.

1Q2023 FisherSolve Viability Rankings

Get Ahead of the Game Before It’s Too Late

As sustainability becomes increasingly important, mills must prioritize reducing their environmental impact to remain competitive and ensure their long-term success. By embracing cleaner technologies and practices, mills can not only reduce their carbon footprint but also attract customers and investors who value sustainability. Ultimately, the ability to adapt to the changing expectations and regulations surrounding carbon emissions will be key to a mill's longevity in the industry.

For a deeper understanding of how ResourceWise can assist you in evaluating your mill's viability in this unpredictable and volatile market, contact us today.