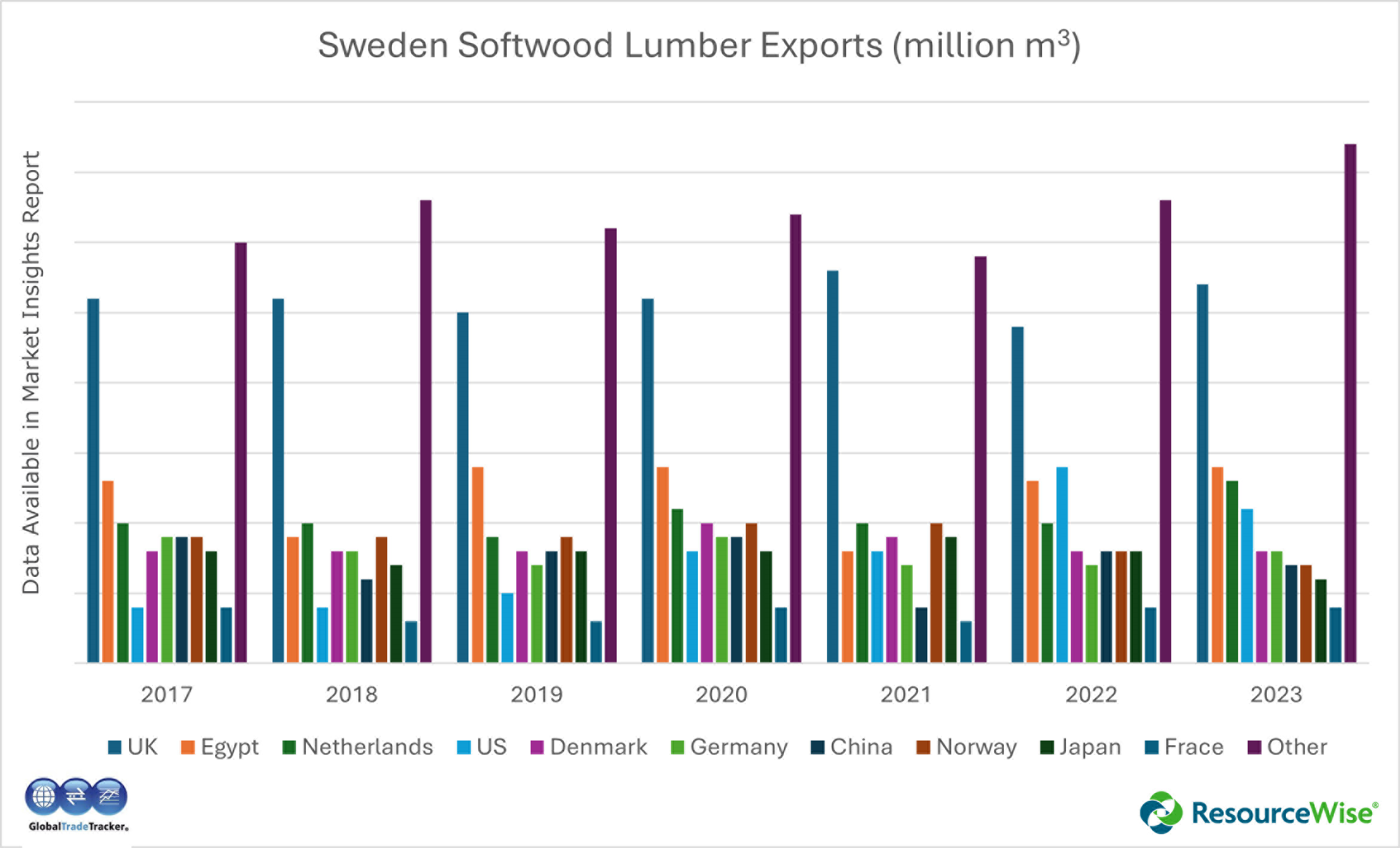

Sweden's softwood lumber export sector is a bright spot despite an economy steeped in recession. Export sawmills are optimistic that demand from the US will keep growing as Canadian supplies decrease and the US increasingly looks towards Europe for its lumber needs.

A Shaky Economy and Dwindling Lumber Production

At the EOS/ETTF International Softwood Conference in Austria last October, Christian Nielsen of Sweden Forest Industries Federation (SFIF) highlighted the economic hurdles Sweden is facing. These include soaring inflation, elevated interest rates, and a downturn in construction activities. All of these trends are predicted to persist into 2024.

When announcing its budget in September 2023, the Swedish government indicated that the nation's economic recovery from the recession is unlikely to commence before 2025.

Challenges notwithstanding, Sweden's softwood lumber export sector has remained resilient. According to SFIF's data, while Sweden's softwood lumber production was down in 2023 compared to 2022, its exports were up 4% year-over-year.

This is in part due to the decline in Canadian lumber production caused by factors such as wildfires and insect infestations. As a result, the US appears to be turning to Europe for its softwood lumber needs.

Canada's Declining Lumber Production

There have been a number of factors contributing to Canada's decline in lumber production, from an intense wildfire season in 2023 to pine beetle infestations affecting much of Canada's western provinces.

Canada experienced the worst wildfire season on record in 2023. Millions of hectares were burnt throughout the summer months and into the autumn season. This left a large amount of smoke that traveled across the eastern United States.

As a result, millions of valuable forestlands were burned, impacting both forestry and old-growth conservation. Evacuations displaced populations and uprooted daily life for thousands. The loss of trees and dangerous working conditions created ambiguity in harvest estimates and amounts.

In addition to wildfires, pest infestation has significantly contributed to the downsizing of the lumber market in British Columbia. The onset of pine beetle infestation in BC was gradual in the late 1990s but quickly escalated.

Since then, the damage has caused widespread disruption to the lumber industry. This infestation not only impacted harvesting volumes but also necessitated downsizing across sawmill operations throughout the province.

Related: Canadian Lumber Market Shrinking, Could Europe Fill Gap?

A Closer Look at Sweden's Lumber Export Market

With the decline in lumber production in Canada, Europe is poised to become a key player in supplying the US market. However, while the US may increasingly look towards Europe for lumber, it may not fully offset the impact of decreased construction activity in Sweden and Europe.

For a more in-depth analysis of Sweden's export trends over the past few years, as well as valuable insights into the future direction of its market, be sure to download our comprehensive Market Insights report. This report delves into pricing, export, and production data, providing professionals with the necessary information to stay informed on the latest developments in the industry.