As the pulp and paper industry navigated 2023, it faced a dynamic landscape marked by challenges and opportunities. There was a modest dip in consumer spending, as well as continued inventory destocking, during the year. However, new capacity announcements across diverse regions indicated a strategic response to evolving market demands and set the foundation for sustained growth.

Looking forward to 2024, the industry anticipates further transformations, and reflection on the events of 2023 becomes paramount for informed decision-making. The balance between challenges and promising developments underscores the need for a comprehensive examination of the past year's trends as a guide for future strategies.

The Slowdown in Chinese Manufacturing

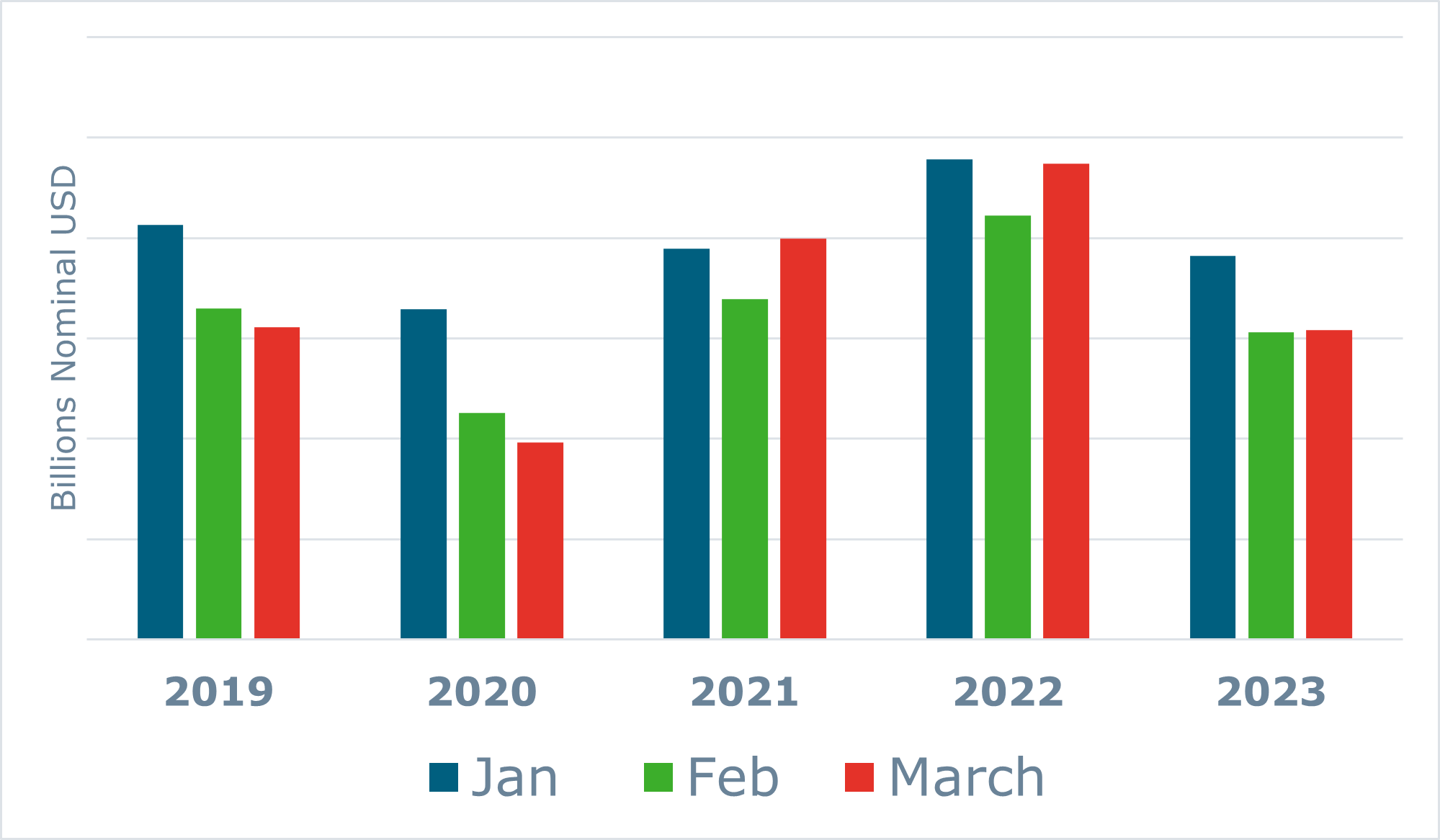

As the global economy underwent destocking, Chinese manufacturing experienced a significant deceleration. A comparison of trade data between the first quarter of 2022 and the same period in 2023 reveals a nearly 20% decline in the total value of US imports from China.

Total Value of US Imports from China During the First Quarter

Source: FisherSolve

China has long held its position as the top producer of containerboard in the industry, but recent years have seen a decline in their operating rates. Oversupply and lower demand have contributed to this downward trend, ultimately driving prices to record lows.

China's Containerboard Operating Rate by Grade

Source: FisherSolve

There was also a noticeable trend this year with numerous companies announcing their plans to scale back manufacturing operations in China. This was due to a culmination of factors, including nearly three years of strict on-off COVID-19 lockdowns and regulations, as well as protests against harsh working conditions that have caused significant disruptions in factories.

Probably the biggest company to make this announcement was tech giant Apple.

Apple faced challenges in 2022 due to various factors mentioned earlier and has since announced plans to diversify its supply chains beyond China. The company has already shifted some of its iPhone production to India and is also exploring the possibility of moving iPad manufacturing there.

During a March earnings call, Foxconn Chairman Liu Yong-way emphasized the need for expanding operations in different countries, including the US, Vietnam, India, and Mexico. This strategic move by Apple and Foxconn reflects their aim to enhance production capabilities and mitigate risks associated with overreliance on a single manufacturing hub.

This is important to the pulp and paper industry because with the transition of production to other countries, comes an increased need for iPhone boxes and packaging. Apple possesses a very high standard for its iPhone boxes, which are mainly made from virgin cartonboard. This poses questions such as:

- What companies are poised to take advantage of this change?

- How might fiber demand change?

- Can India’s paper market absorb the new demand?

Southeast Asia appears to have already benefitted in 2023 as a new record of added capacity was reached between the companies of Laos, Malaysia, Myanmar, Philippines, Thailand, and Vietnam. However, the number of paper machines and technology in Southeast Asia is hard to compete with those installed in China.

New Greenfield Pulp Projects in Latin America

Latin America has established itself as a dominant player in the global pulp market, with several countries in the region taking on a crucial role. This region has a strong focus on market pulp, with the primary grade accounting for more than 50% of the pulp and paper capacity in the region.

Latin America's Pulp and Paper Capacity by Major Grade

Source: FisherSolve

In 2023, there was a surge of exciting new projects announced in Latin America, which have the potential to significantly impact the global pulp market. These projects present exciting opportunities for growth and development in the region. Some notable projects include:

- Suzano’s Cerrado Project: This new pulp plant project in Mato Grasso do Sul state will be the world’s largest single-line pulp plant. It’s expected to produce 2.55 million tons of eucalyptus pulp a year, expanding Suzano’s current production capacity by over 20%

- Paracel’s Large-Scale Pulp Mill: Paracel plans to produce 1.5 to 1.8 million tons/year of pulp through its new project in Concepción, Paraguay. The roughly $4 billion project is expected to open by 2027. This will be Paraguay’s first large-scale pulp mill.

- ARAUCO’s $3 Billion Pulp Mill Investment: Last year, ARAUCO announced its plan to build a new pulp mill in the State of Mato Grosso do Sul in Brazil. The plant is expected to produce 2.5 million tons of hardwood pulp. The plant is scheduled to start operating in early 2028.

The Latin American pulp market experienced remarkable success in 2023, achieving unprecedented levels of capacity. Looking ahead to 2024, even greater achievements are anticipated, with projections indicating the addition of approximately 9.5 million tons of new capacity compared to 2020 figures. This upcoming surge in capacity promises to set new records and further solidify Latin America's position as a key player in the global pulp industry.

Read more about the future impacts of Latin America's surge of greenfield pulp projects: An Overview of Latin America's Wave of Greenfield Pulp Projects

Decrease in Global Pulp and Paper Prices

Prices for nearly every major pulp and paper grade took a hit in 2023, with some experiencing significant declines. Tissue and towel products saw the sharpest downward trend, with global prices dropping by nearly $350 USD/FMT from the start of the year to the end.

Global Average of Price by Major Grade (USD/FMT)

.png?width=600&height=377&name=Price%20by%20Major%20Grade%20(1).png)

Source: FisherSolve

Market pulp followed suit with a decrease of over $240 USD/FMT, while packaging paper declined by roughly $230 USD/FMT. Recovered paper and cartonboard experienced the smallest decreases of approximately $19 USD/FMT and $87 USD/FMT, respectively.

The decline in prices can be attributed to the decrease in demand witnessed by the industry in 2023. A multitude of factors, including the financial crisis, soaring inflation rates, and the repercussions of political events, have all played a role in this downward spiral of demand.

Divestitures, Acquisitions and Mergers

Europe

- Smurfit Kappa merges with WestRock. Irish firm Smurfit Kappa announced in early September that it was in active negotiations to merge with US-based WestRock. Smurfit Kappa serves as Europe’s biggest producer of paper and packaging products, whereas WestRock is the second biggest packaging firm in the US.

- Essity completes divestment of its operations in Russia. The leading hygiene and health company successfully sold off its operations in Russia to New Technologies, with Igor Shilov as the principal owner. Considering Russia's ongoing conflict with Ukraine, Essity has been committed to exiting the Russian market.

- Mondi announces acquisition of Hinton pulp mill from West Fraser Timber with plans to invest in kraft paper production. This strategic move will not only strengthen Mondi's presence in the Americas but also pave the way for a significant expansion of the mill.

North America

- Paper Excellence closed its acquisition of Resolute Forest Products. At the beginning of the year, Canada’s Competition Bureau approved Paper Excellence’s acquisition of Resolute Forest Products. The company is now exuding confidence in further improving its business in Canada.

- Resolute Forest Products’ divestment of its Thunder Bay Mill to Atlas Holdings. In the same vein as the aforementioned news, Resolute entered into an agreement to sell its Thunder Bay pulp and paper mill to an affiliate of Atlas Holdings. The sale of the mill is necessitated under the consent agreement between Domtar and the Canadian Commissioner of Competition and registered with the Canadian Competition Tribunal in connection with its review of Domtar's recent acquisition of Resolute.

- Rayonier Advanced Materials explores the potential sale of its paperboard and high-yield pulp assets located at its Temiscaming site. The Temiscaming mill, located in Quebec, Canada, produces high-purity cellulose, high-yield pulp, and coated paperboard.

Latin America

- Brazilian anti-trust authority approves Kimberly-Clark’s proposal to sell its tissue business to Suzano. The $1.3 billion deal will consolidate Suzano’s position as the largest tissue paper producer in Brazil. The company is already the world’s largest producer of eucalyptus pulp, a key raw material for tissue paper, and the acquisition of Kimberly-Clark’s assets will strengthen its position in the tissue market.

- ARAUCO sells its timberland assets in Parana State to Klabin. This $1.2 billion deal will allow ARAUCO to increase its investments near its new mill at Mato Grosso do Sul State, while allowing Klabin to speed up its timber independence.

Despite the challenges and uncertainties that have characterized the year 2023, it has also opened up new doors of opportunity for various industry sectors moving forward. While we anticipate some level of ongoing volatility in the near future, we remain optimistic regarding the accomplishments the pulp and paper industry is poised to achieve in 2024.

To stay updated on all the latest discussions and insights on the global pulp and paper industry, don't forget to subscribe to ResourceWise's weekly forest products blog updates.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)