3 min read

An Overview of Latin America’s Wave of Greenfield Pulp Projects

Marcello Collares

:

Oct 24, 2023 12:00:00 AM

Marcello Collares

:

Oct 24, 2023 12:00:00 AM

Latin America has established itself as a prominent force in the global pulp market, with multiple countries in the region playing a pivotal role. This thriving pulp industry has brought about remarkable economic growth for this region, paving the way for job creation, increased export earnings, and substantial investments in supporting infrastructure.

In the near future, we can expect a wave of innovative greenfield projects that are poised to create a rippling effect across its market. What kind of impact can we expect from these exciting developments?

Let’s take a closer look at an overview of Latin America’s market pulp sector.

An Overview of Latin America’s Market Pulp Sector

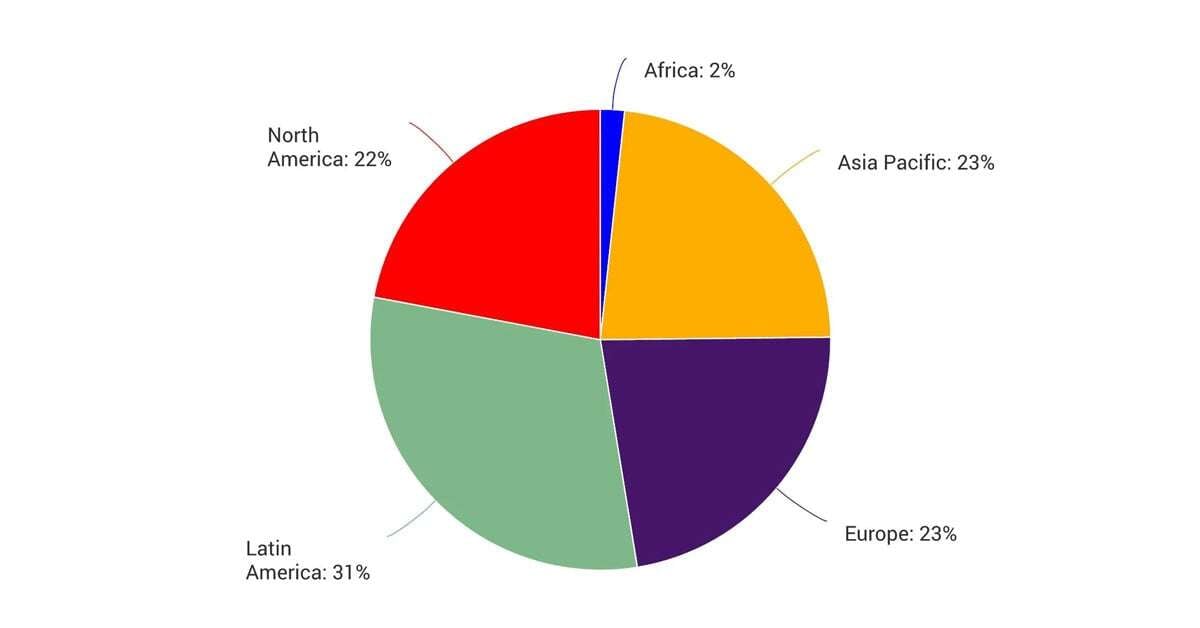

Latin America dominates the market kraft pulp production, accounting for approximately 31% of the global output. This makes sense as roughly half of all related production in Latin America is dedicated to market pulp. Among the countries in the region, Brazil, Chile, and Uruguay emerge as the frontrunners in this sector. However, Brazil surpasses the others, contributing a staggering 73% of the market pulp produced in Latin America.

Market Pulp Capacity by Region

.jpg?width=538&height=288&name=Untitled%20Graph4%20(1).jpg)

Source: FisherSolve

Why Is Latin America the Leading Producer in Market Pulp?

Latin America’s advantageous climate conditions foster the rapid growth of trees which make it an environment conducive to efficient pulpwood production. Ample sunshine and rainfall, coupled with fertile soil, allow trees in this region to thrive. Additionally, Latin America is situated in close proximity to an abundant water supply with several prominent rivers nearby. These factors help establish the region as a highly desirable location for pulp production.

Furthermore, Latin America’s vast and abundant land resources play a role in its ability to engage in large-scale pulp production. The expansive landscapes provide ample space for cultivating vast plantations of pulpwood trees, ensuring a steady supply of raw materials for the industry. This abundance of land also allows the establishment of pulp mills on a grand scale for maximum production efficiency.

What Projects Does This New Wave Entail?

Across Latin America, a wave of exciting new projects has been announced. They bring with them the potential for significant impacts in the region and to the global pulp market. Among these projects, three major ones stand out.

- Suzano’s Cerrado Project (Source) – This new pulp plant project in Mato Grosso do Sul state will be the world’s largest single-line pulp plant. It’s expected to produce 2.55 million tons of eucalyptus pulp a year, expanding Suzano’s current production capacity by over 20%.

- Paracel’s Large-Scale Pulp Mill (Source) - Paracel plans to produce 1.5 to 1.8 million tons/year of pulp through its new project in Concepción, Paraguay. The roughly $4 billion project is expected to open by 2027. This will be Paraguay’s first large-scale pulp mill.

- ARAUCO’s $3 billion Pulp Mill Investment (Source) - Last year, AURAUCO announced its plan to build a new pulp mill in the State of Mato Grosso do Sul in Brazil. The plant is expected to produce 2.5 million tons of hardwood pulp. The plant is scheduled to start operating in early 2028.

What Impacts Could This Have?

The emergence of new greenfield pulp projects brings with it the potential for significant impacts on the global pulp market. One of these potential outcomes is the increased fluctuations in pulp prices. As the market absorbs additional capacity from these new projects, it is only natural that the pricing dynamics will shift. With more players entering the market and increasing competition, there may be periods of oversupply or undersupply, leading to price volatility.

Furthermore, these new mills in Latin America will operate as lower-cost establishments. The region's advantageous climate conditions and abundant land resources provide the perfect conditions for efficient and cost-effective pulpwood production. This means that Latin American producers will have a competitive edge in terms of cost, potentially putting pressure on higher-cost producers elsewhere.

The question then arises, what will happen to the viability of these higher-cost producers? With the addition of 20% more pulp capacity at the lowest cost possible, we anticipate a change in the curve cost. This change will likely drive a certain number of mills out of the game eventually. However, this change of the curve could potentially reduce the average selling price of the commodity.

Ultimately, the impact of these new greenfield pulp projects on these producers will depend on various factors, including their ability to adapt and differentiate themselves in the market. It is likely that some producers may struggle and face pressure to reduce costs or find new markets. Others may find new or innovative ways to remain competitive and continue to thrive.