4 min read

Aromatics, Acrylonitrile and Phthalic Anhydride Ten Years to Q4 2024 (Part II)

ResourceWise

:

Nov 29, 2024 12:00:00 AM

The global chemicals industry looks very different today than it did a decade ago.

In Part II of our series exploring just how much this vital sector has changed, we look at the aromatics—benzene, toluene, and xylenes, otherwise known as BTX. We also consider phthalic anhydride—a key chemical intermediate used to produce unsaturated polyester resins and phthalate plasticizers.

The engineering thermoplastic polymer acrylonitrile—produced from the ammoxidation of propylene—is the last chemical we investigate in this second part of the series.

Our chlor-alkali, fibers, plastics, resins, maleic anhydride and olefins-focused blog posts are in progress and will be published in the coming weeks.

Benzene

A key chemical intermediate, benzene is one of the aromatic compounds. It is used to make styrene monomer, maleic anhydride and phenol, for producing epoxy resins. Raw material sources include reformate, pyrolysis gasoline, and toluene-based production techniques.

Back in 2014, the cost of a ton of benzene was well over US$1000/ton globally. Today it is considerably under that benchmark in every region. Benzene has exhibited significantly outlying price points twice this past decade. The first time this occurred was in the months after supply chains readjusted to COVID-19 and lockdowns in 2021. At that time, its price rose several hundred dollars above its highest peak in the prior five years. Then, in the months after Russia invaded Ukraine, its price began rising exponentially again. Reaching its 2020s peak thus far, it was well over ten times higher than its Western region's low price points.

Source: OrbiChem360

Toluene and Xylenes

Most toluene is produced via catalytic reforming of naphtha in the process of gasoline manufacturing. A major use for toluene however, is as a feedstock for benzene and xylenes.

Solvents targeting paint, adhesive, and varnish markets and toluene diisocyanate—a key flexible foam precursor for the polyurethanes (PU) sector—are among toluene's downstream markets.

Source: OrbiChem360

The "Gasoline Effect"

A key outlet for toluene today, however, is the gasoline market. Like its fellow aromatic compound paraxylene (PX), toluene is used as an octane booster. In fact, dwindling chemical markets have made the gasoline market the key price driver for this product. We explore these dynamics in greater depth in our free-to-download eBook, Paraxylene Chemforesight 2024.

Since the US's 2024 driving season ended in September, toluene prices have dropped in the North American region. As the graph (above) from our chemicals business intelligence platform OrbiChem360 shows, prices dropped there recently.

The graph below—from our ChemEdge360 platform, which focuses on solvents, glycol, and methanol markets—presents a more comprehensive picture of North American markets. It mirrors the insights provided by OrbiChem360 at its lowest point since the end of 2022.

Source: ChemEdge360

PX, for example, has demonstrated price gaps in markets regionally for some time. In this respect, the US was hit harder than any other region. The phenomenon has come to be known as the "gasoline effect". It is due to gasoline requiring octane (a standard measure of a fuel's ability to withstand compression). One of the sources for that is the gasoline blend stock reformate.

It has long been known that companies buying mixed xylenes to make PX must pay a price point determined by the gasoline price. That driver pushed the spot price for PX in the US to be about 50% higher than its South and Southeast Asia counterparts in 2023. It is causing a similar trickle-down effect on the toluene markets now.

Orthoxylene

In line with many chemicals, the price of orthoxylene has also dropped considerably since 2014. In some cases there has been as much as a one quarter reduction compared to 10 years ago. Our analysts are predicting little change going forward with prices looking at best, fairly flat in comparison with Q4 2024..

Orthoxylene is used to produce over 70% of the phthalic anhydride produced globally, with the remainder using naphthalene feedstock.

Phthalic Anhydride

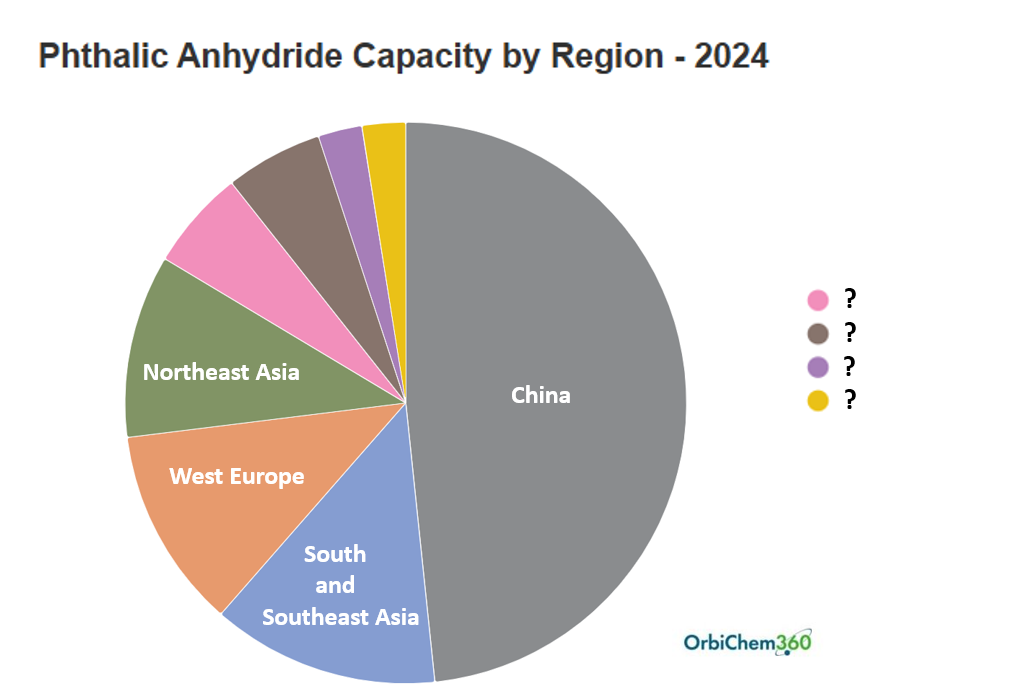

As of 2024, worldwide capacity to produce phthalic anhydride is almost 7,000 ktpa. That represents an increase of more than 500 ktpa since 2022. Almost half of that total production capacity is based in China. The South and Southeast Asia region is the second largest producer, and Western Europe is third, followed by Northeast Asia. Producers in North America and Eastern Europe are capable of similar volumes of output, while the Middle East (and African and South American regions both produce the least amount.

Phthalate plasticizers are the most important and largest end-use for phthalic anhydride. The other main uses are in unsaturated polyester resins, alkyd resins, and various other applications.

In all, OrbiChem360's price series for phthalic anhydride features seven separate price benchmarks covering China, West Europe, North America, and South and Southeast Asia. The swing between North America's 2014 price and the region's 2024 prices is 15 percent for Contract Flake DDP and Contract Molten FOB. The price drop for China's orthoxylene-based EXW (ex-works exc VAT) price in percentage terms is in excess of 40%. From this analysis, we can see that China's market for the product is currently suffering more than that of Western Europe, at least in regard to this product.

Acrylonitrile

On a global basis, acrylonitrile prices are significantly lower in Q4 2024 than they were in 2014. That reflects how deep the current downturn is and how depressed feedstock markets are right now.

Source: OrbiChem360

As the graph above shows, prices for acrylonitrile are trending lower than they were in 2014. The product's 2014 high was topped only in the months after Russia invaded Ukraine. The product shares this commonality with many commodity products. Many chemical prices were subject to sudden surges due to high energy costs in the wake of the war.

Forecasting

So, are prices for acrylonitrile set to rise or fall in the coming years? The indications of ResourceWise's proprietary chemicals industry forecasting service ChemForesight is that, in the United States at least, today marks a relative high in terms of price and that a downward trend is inevitable. That said, our analysis shows that the very lowest US price point for acrylonitrile will not be lower than that seen in mid-2023.

Source: OrbiChem360

Source: OrbiChem360

Interpreting Chemical Trends

It is worth remembering that the price of oil—the upstream material for all of the chemicals and intermediates we have focused our attention on here—was very high in 2014 compared to now.

In some ways, perhaps this can account for the drop in the price of so many products. But, since inflation is the way of the world's economy, even a three percent inflation rate spread over 10 years should have balanced the gap.

Our special investigative examines pricing structures across the full range of chemicals in our portfolio, beginning with acetyls and acrylates in Part I. We saw that the majority of our 14 methanol-focused price series are higher now than in 2014. All methanol prices in our series have migrated upwards since mid-2024, with most consistently increasing since 2023.

Part III will be dedicated to caustic soda, chlorine, and its derivatives.

Part IV will explore plastics and resins, including fibers, feedstocks, and additives vital to output worth at least a trillion dollars per annum and with an output of hundreds of millions of tons every year.

Part V will focus on maleic anhydride, olefins and polyurethanes. The final part will critically examine the findings of the prior five to provide insight into where markets might go next.

Stay up to date by subscribing to our newsletter.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)