The beginning of 2024 witnessed a series of unexpected developments within the pulp and paper industry, creating rippling impacts across the sector. From labor and major industrial accidents at pivotal mills to a noticeable decline in production and a jump in market prices, the landscape experienced a whirlwind of change.

This recap will explore crucial factors affecting the pulp and paper industry in the first quarter of 2024.

Disruptions in Finland

The Finnish pulp and paper sector faced a familiar challenge in the early months of the year. Commencing on March 11, a series of labor strikes significantly disrupted operations, affecting major industry players such as Stora Enso, UPM, and Metsä Group. These strikes, lasting two weeks, resulted in production stoppages and logistics disarray. The disruptions caused a standstill in both raw material supplies and finished product deliveries.

This halt impacted the paper industry's supply chain on both a domestic and international level. However, as quarter-end approached, Finnish trade unions tentatively halted their strike actions to facilitate a path forward. The move hints at possible resolutions and a return to normalcy. This pause does come with its own set of uncertainties, leaving the recovery trajectory of the sector in a delicate balance.

Adding to these challenges was the unfortunate incident at the Kemi bioproduct mill – an explosion that significantly halted Finland’s pulp production activities. With the supply of NBSK pulp constrained, the industry must find other avenues to make up for this loss.

Shifts in Production and Pricing

The rocky state of the global economy is nothing new. However, it is still creating market shifts in various areas of the industry, such as the availability of raw materials and changes in consumer behavior.

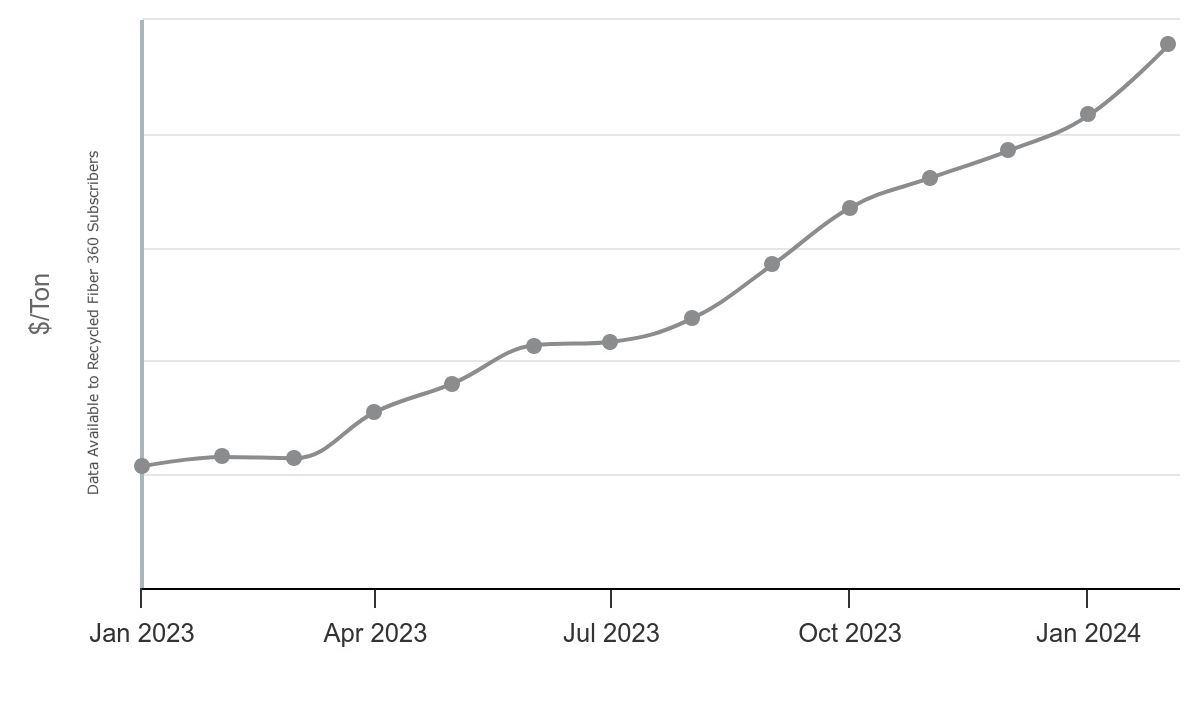

ResourceWise's Recycled Fiber 360 platform indicated that US market fiber prices experienced a significant increase during the first quarter of 2024 compared to 2023 with prices doubling.

US Market Fiber Prices

Source: Recycled Fiber 360

Additionally, the American Forest & Paper Association (AF&PA) reported that the total number of US printing-writing paper shipments decreased by 9% in January 2024 compared to January 2023. Total printing-writing paper inventory levels decreased by 1% compared to December 2023. Individually, US shipments in all three major printing-writing categories of uncoated free sheet, coated free sheet, and mechanical decreased in January 2024 compared to a year ago.

AF&PA also reported US packaging papers and specialty packaging shipments in January 2024 decreased by 4% compared to January 2023. Shipments of the bag and sack subgrade in unbleached packaging papers were 92,900 short tons for January 2024, down 1.1% from a year ago.

Mergers, Acquisitions, and Divestments

- Both International Paper and Mondi Make Offers to Acquire DS Smith – In a whirlwind of competitive offers, Mondi initially set the stage with an all-share proposal of £5.14 billion to acquire DS Smith in early March. However, International Paper countered with a higher all-equity bid of £5.8 billion towards the month's end. The latest development reveals that DS Smith has ultimately chosen to seal the deal with International Paper, marking a pivotal moment in the industry's landscape.

- Graphic Packaging Holding to Divest Augusta Bleached Paperboard Manufacturing Site to Clearwater Paper – Graphic Packaging Holding has signed a definitive agreement with Clearwater Paper to sell its Augusta bleached paperboard manufacturing site in Georgia. The transaction value of the deal is US$700 million and is expected to close in the second quarter of 2024, subject to regulatory approvals.

- Brazilian Authority Cancels Proposed Acquisition of Eldorado Brasil Celulose by Paper Excellence - INCRA declared the Eldorado Brasil Celulose acquisition by Paper Excellence invalid due to lack of authorization from the National Congress, violating Brazilian land ownership laws for foreigners. The deal, involving 400,000 hectares of eucalyptus-producing land, must be revoked as per INCRA, AGU, and MPF.

- Canfor Sells Taylor Mill for CAD 7 Million - Canfor Pulp Products announced the sale of its Taylor pulp mill, located in northeastern British Columbia, for CAD 7 million to an unnamed buyer. The buyer plans to repurpose the bleached chemi-thermo mechanical pulp mill site and develop a long-term plan for the community, according to Canfor Pulp President and CEO Kevin Edgson. The sale is expected to close in the first quarter of 2024, offering a potential boost to the local economy.

- Billerud to Divest Idled Portions of Wisconsin Rapids Mill – Billerud sells idled portions of Wisconsin Rapids mill to Capital Recovery Group, reaffirms commitment to operating vital converting plant. The plant converts paper rolls from Michigan mills into various sheets and cartonboard from European mills.

- Mondi Completes Hinton Mill Acquisition - Mondi has completed the Hinton pulp mill acquisition as announced in February 2024. The company intends to expand the mill with a new kraft paper machine with a capacity of 200,000 TPY. This will fully integrate Mondi's Paper Bags operations in the Americas.

Stay Up to Date with ResourceWise

As we navigate through the aftermath of the first quarter, we are faced with both challenges and opportunities within the pulp and paper industry. The strategic decisions taken in response to these recent challenges will not only shape the industry's trajectory but also influence its market dynamics for years to come.

It is vital to remain updated on the latest occurrences and advancements in the pulp and paper industry. Staying informed is key to being prepared to navigate and excel in this constantly changing environment. Don't miss out on any stories - subscribe to our weekly blog newsletter today.