3 min read

North American Softwood Lumber Production Down 5% as Demand Drops

ResourceWise

:

Jan 10, 2024 12:00:00 AM

As 2024 gets started, let’s take a few moments to reflect on how the North American lumber market moved in 2023. Across the board, we saw several noteworthy declines in production. This comes on the heels of major economic and environmental events like recession fears, mill closures and extreme wildfires.

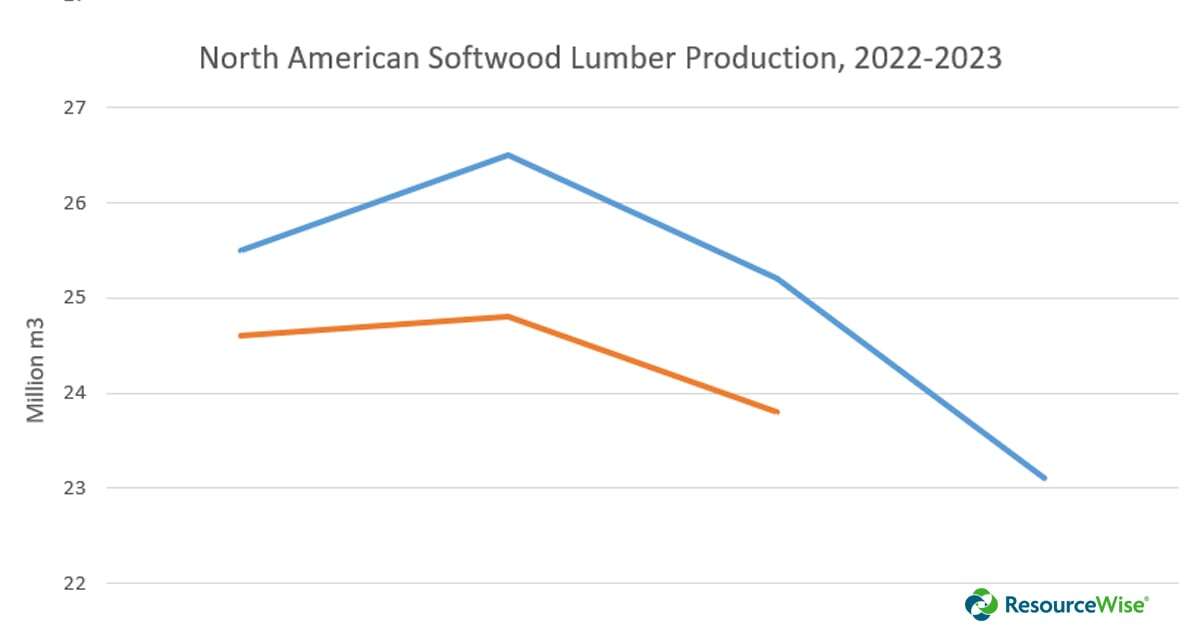

According to ResourceWise data, total softwood lumber production in Canada and the US was at 73 million m3, down about 5% year-over-year from 2022's 77 million m3. The chart below highlights the quarter-by-quarter drops between 2022 and 2023.

(Data Source: Western Wood Products Association; Q4 2023 Data Currently Unavailable)

The major drops occurred primarily in British Columbia and the US South at -15% and -9% year-over-year, respectively.

Broader Economic Slump Connects to Decrease in Lumber Demand

Many of the declines we’re seeing in the forestry industry reflect a broader economic downturn in North America. This is particularly true in the US, which has teetered on the brink of a recession for much of 2023.

In fact, many experts saw the early signs of a recession happening about midway through last year (ResourceWise included).

Related: The Verdict’s Out: We’re in the Starting Phase of a Recession

Key economic indicators such as housing starts remained depressed due to high interest rates and catapulting home prices. As 2023 closed out, these trends look to be slowing, but not quite stopping.

It remains to be seen exactly what the US Fed will do in terms of interest rates. Most economists predict a halting of rate hikes, and there are signs of life in other economic indicators. But the exact timeframe of how this will impact lumber demand is not yet written in stone.

Canada Feeling the Pinch Across the Continent in British Columbia, Quebec

Canada remains the top importer of lumber to the US. America can’t meet its own lumber demand despite a production increase that has trended upward in recent years.

However, Canada has faced an ongoing set of environmental challenges impacting its production capacity, mill operations and general investor confidence.

For starters, in the Pacific Northwest, British Columbia has experienced a gradual falling out of a once healthier forestry economy. Between 2017 and 2022, production in BC went down by 23%. These numbers reveal a stark contrast to BC’s heyday 20 years ago when mills were producing 40% more lumber than they are today.

The British Columbian exodus comes due to a few factors. Pine beetle infestations wreaked havoc on lumber production in the last decade or so, significantly reducing total harvest volumes. This led to mills restructuring, lowering capacity, laying off staff and even mill closures.

Additionally, uncertain economic conditions have led many former Canadian or Pacific Northwestern companies to relocate—mostly to the US South. The region offers a lucrative option to many investors and mill companies as a cost-effective and highly productive area compared to the pricier, more restrictive PNW regions.

In the last five years, we’ve seen a 23% production drop from 48 million m3 of lumber in 2017 to 37 million m3 in 2022. In fact, 2022 sawmill output was down around 40% from its peak production of almost 60 million m3 20+ years ago.

To balance out the market gap in decreased Canadian production, many European producers are stepping in. For instance, Germany and Sweden now cover about 10% of the US lumber import market.

Related: Canadian Lumber Market Shrinking, Could Europe Fill the Gap?

On the other side of the continent, Quebec’s lumber market has also endured a challenging 2023. The 2023 Canadian wildfires—the worst the country has seen in modern history—yielded profound effects on the region’s wood markets.

In fact, on November 30 of last year, the Quebec Forest Industry Council (QFIC) warned provincial officials that wildfire response will have at least a C$13.5 billion impact on Quebec's sawmilling industry alone. These effects will first be felt at these regional sawmill operations. But they will inevitably reverberate across the wood value chain into Quebec, Canada, and global wood markets.

We won’t be able to understand the exact impact of such a wide-scoped economic problem until we start seeing it play out. Needless to say, the market will feel these effects for a long time to come. And the effects could multiply as climate change amplifies the risk of catastrophic wildfire events like this one in major forestry regions.

Related: What Can We Learn from a Record-Setting 2023 Canadian Wildfire Season?

Download Market Insights Report to Learn More

Would you like to learn more about North American lumber markets? Download our Market Insights report from Audrey Dixon, Managing Editor and Writer, ResourceWise.