2 min read

Navigating Disruptions in the Pulp and Paper Industry

ResourceWise

:

May 7, 2024 12:00:00 AM

The pulp and paper industry has long faced disruptions, and 2024 has been no exception.

So far, the industry has been notably shaped by a series of events. At the very beginning of the year, companies had to face chaotic supply chains due to the attacks on ships in the Red Sea. Instead of taking the shorter route through the Suez Canal, container ships had to reroute around southern Africa.

Not long thereafter, Finland was hit by labor strikes on March 11. The strikes significantly impacted the nation's export and import sectors, especially affecting freight and rail transportation. Weeks later, on March 21, a gas explosion at Metsä Group's Kemi bioproduct mill halted production.

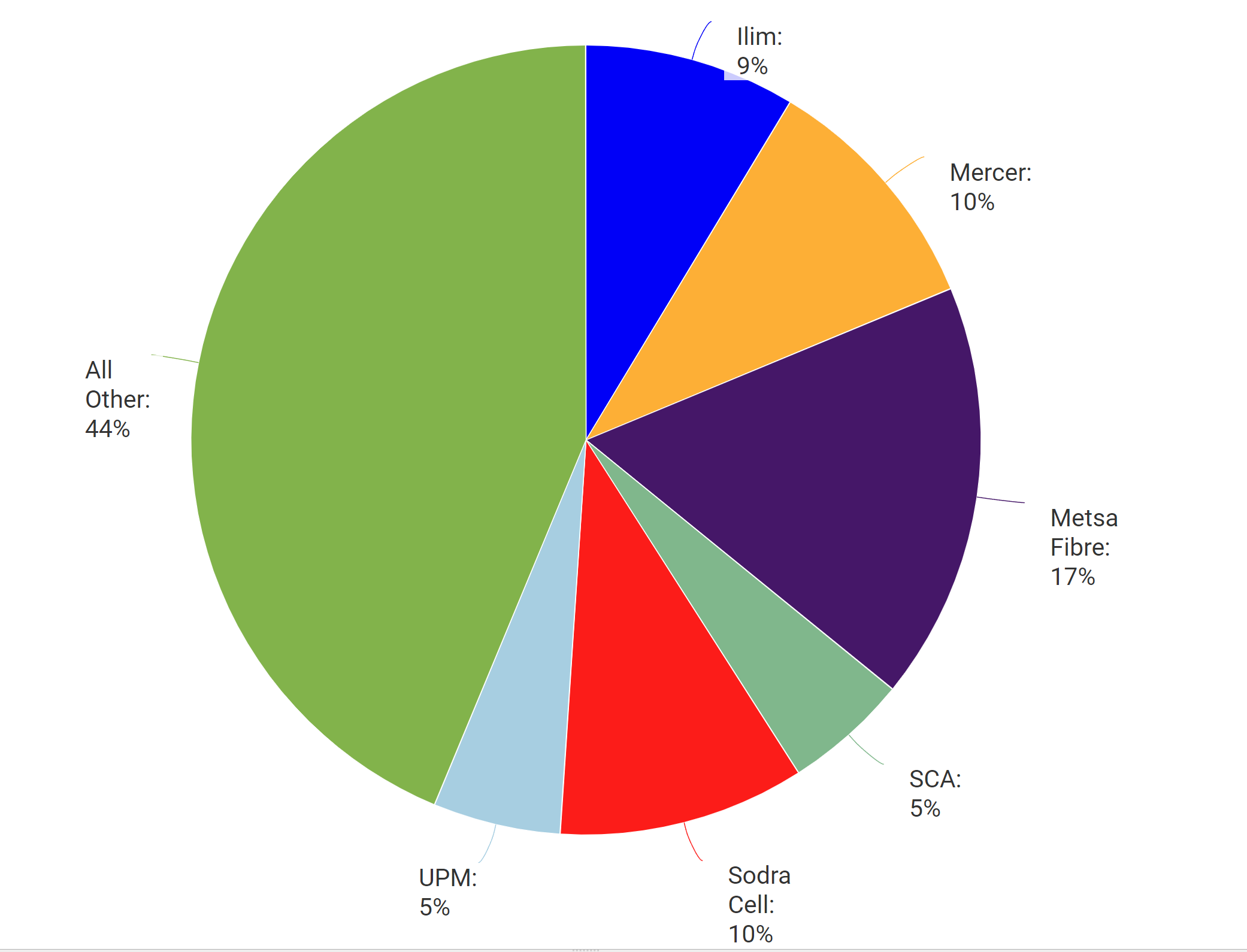

The significance of Metsä's Kemi bioproduct mill goes beyond just being a facility. It holds a substantial share in the Northern Bleached Softwood Kraft (NBSK) market pulp, producing an estimated 1.5 million tons annually of softwood and hardwood pulp. With the unexpected shutdown of this pivotal mill, the industry faces a critical blow at a time already strained by previous disruptions.

NBSK Pulp Capacity by Company

Utilizing Market Intelligence to Navigate Disruptions in the Pulp and Paper Industry

These occurrences emphasize the need to be well-prepared to tackle and navigate through such disruptions. Market intelligence serves as the tool to do just that.

In an industry where margins are often slim and efficiency is key, having access to accurate and timely data can make all the difference. You need all the following and more to stay competitive in today's market:

- Access to dependable historical data

- Reliable predictions of raw material costs derived from transactions

- Industry knowledge and insights

These elements are essential for successfully navigating through periods of uncertainty and making well-informed decisions. By delving into these valuable insights, companies can thrive in unpredictable circumstances and uphold a competitive advantage.

Even minor changes within the supply chain can trigger significant ripple effects. This underscores the critical need for access to reliable local, national, and global intelligence. Armed with these invaluable insights, you can proactively strategize, paving the way for optimal outcomes even amidst challenging market dynamics.

Market Intelligence in Use

For example, using ResourceWise-STE Forecasts, scenarios can be created to assess the impact of both the strike in Finland and the Kemi closure on NBSK and Bleached Hardwood Kraft Pulp (BHKP) prices in Western Europe. The following assumptions were used to generate the chart below:

- Due to the strike, 1.1Mt/year of NBSK capacity and 310 Kt/year of BHKP capacity were down, closing from March 20-25 and restarting on April 8.

- Due to the mill exposition, 1 Mt/year of NBSK capacity and 320 Kt/year of BHKP capacity were down starting March 21, lasting for 11 weeks.

- Due to the strike, 17% of NBSK and 4% of BHKP shipments were delayed on average by two weeks.

This graph illustrates the difference in price ($/ton) between the market in which these scenarios do occur and one in which they don't. It's important to note that prices don't start to deviate until May and June because the supply/demand balance in the pulp market in spring is/was tight enough to drive up prices even without the strike and closure.

Navigating Uncertainty with ResourceWise

With access to data-driven platforms, you can harness the power of system dynamic modeling to discover valuable market opportunities and evaluate potential risks with each disruption. This helps pave the way for strategic decision-making, guiding professionals through uncertain times with precision and insight.

A great example of this is ResourceWise-STE Forecasts, developed jointly by Fisher International, a legacy ResourceWise company, and STE Analytics, a professional data modeling firm. Fueled by robust data, deep industry insights, and System Dynamics mathematical models, ResourceWise-STE Forecasts intricately simulate the fundamental forces shaping markets and their intricate interplay. This encompasses factors such as supply, demand, pricing dynamics, and more.

Learn more about how ResourceWise's range of data platforms can assist you in navigating these challenges and other related issues.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)