2 min read

Economic Conditions Remain Unchanged, How Does This Impact the Forest Products Industry?

ResourceWise

:

Dec 27, 2023 12:00:00 AM

With economic conditions showing little variation, the forest products industry finds itself at a crucial juncture due to global conflicts and ongoing inflation. How does this industry navigate through these challenging factors?

Total Industrial Production Witnesses Decline in October

After revisions reducing September’s +0.4% to +0.2%, total industrial production (IP) declined 0.6% in October, a -0.7% decrease year-over-year (YoY). Manufacturing output also fell 0.7%, the eighth straight month of declines.

Much of October’s retreat was due to a 10% drop in the output of motor vehicles and parts resulting from strikes at several major vehicle manufacturers. Excluding motor vehicles and parts, the index for manufacturing edged up 0.1%.

The index for utilities decreased 1.6%, and the output of mines increased 0.4%. New factory orders fell 3.6%, led by durable goods (-5.4%)— especially commercial planes, which tumbled 50% after soaring 91% in September.

Nondurable goods orders decreased (-1.9%) and business investment spending tiptoed lower (-0.3% MoM).

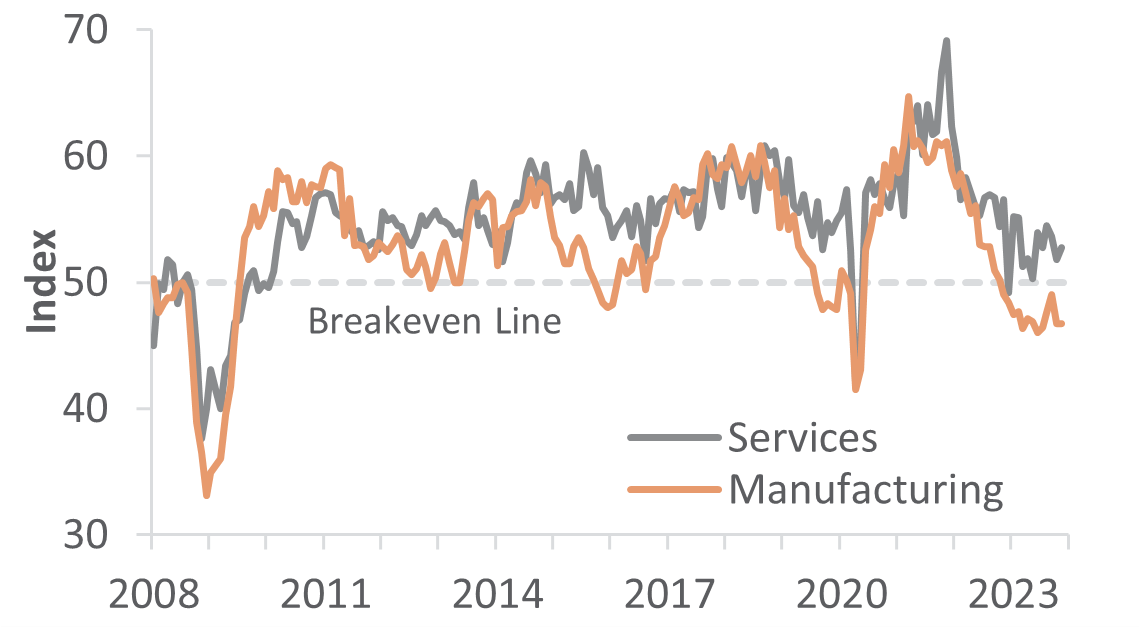

Manufacturing Survey Indicates Minimal Change to Rate of Contraction

The Institute for Supply Management’s (ISM) monthly sentiment survey of US manufacturers reflected no change to the rate of contraction in the sector during November.

The PMI registered 46.7%, representing the 13th month in contraction (50% is the breakpoint between contraction and expansion). Only the customer-inventories index remained above 50.

Paper products led the list of industries reporting a downturn. Concurrent activity in the services sector accelerated (+0.9PP to 52.7%). ISM’s estimates of current GDP range from -0.7% (manufacturing) to +1.0% (services).

Consumer Price Index Remains Essentially Unchanged

After increasing 0.4% in September, the consumer price index (CPI) was essentially unchanged in October (+3.2% YoY) because a continued rise in the shelter index offset a retreat in the gasoline index. The energy index fell 2.5% MoM as a 5.0% decline in the gasoline index more than offset increases in other energy component indexes. The food index increased 0.3% in October after rising 0.2% in September.

Meanwhile, the producer price index (PPI) fell 0.5% (+0.1% expected) after advancing 0.4% in September. October’s MoM decline was the largest decrease since April 2020’s -1.2%.

On a YoY basis, October’s final demand index rose 1.3%. The index for final demand goods fell 1.4% MoM, primarily attributable to a 15.3% drop in prices for gasoline. Prices for final-demand services were unchanged on the net.

Forest Products Sector Index Data Only

In the forest products sector, price indexes were at the following numbers:

- Pulp, Paper & Allied products: -0.2% (-0.1% YoY)

- Lumber & Wood Products: -0.3% (-6.5% YoY)

- Softwood Lumber: -3.2% (-16.3% YoY)

- Wood Fiber: +0.1% (-2.5% YoY)

Stay up-to-date with the most recent economic developments that are influencing the forest products industry.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)