1 min read

A Closer Look into the Fall of European Wood Pellet Imports After Decade-Long Increases

ResourceWise

:

Feb 12, '24

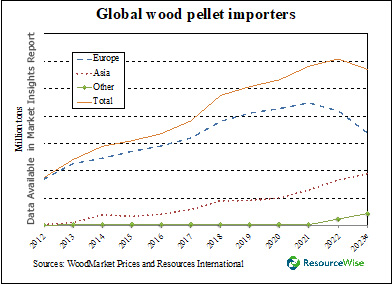

Since wood pellets were first traded overseas to Europe, shipments have always increased year-over-year. Over the past decade, the average annual increase in trade is 13%. Global shipments reached an all-time high of over 30 million tons in 2022.

However, in 2023, the more than decade-long uninterrupted global wood pellet trade increase halted as European imports fell for the second consecutive year.

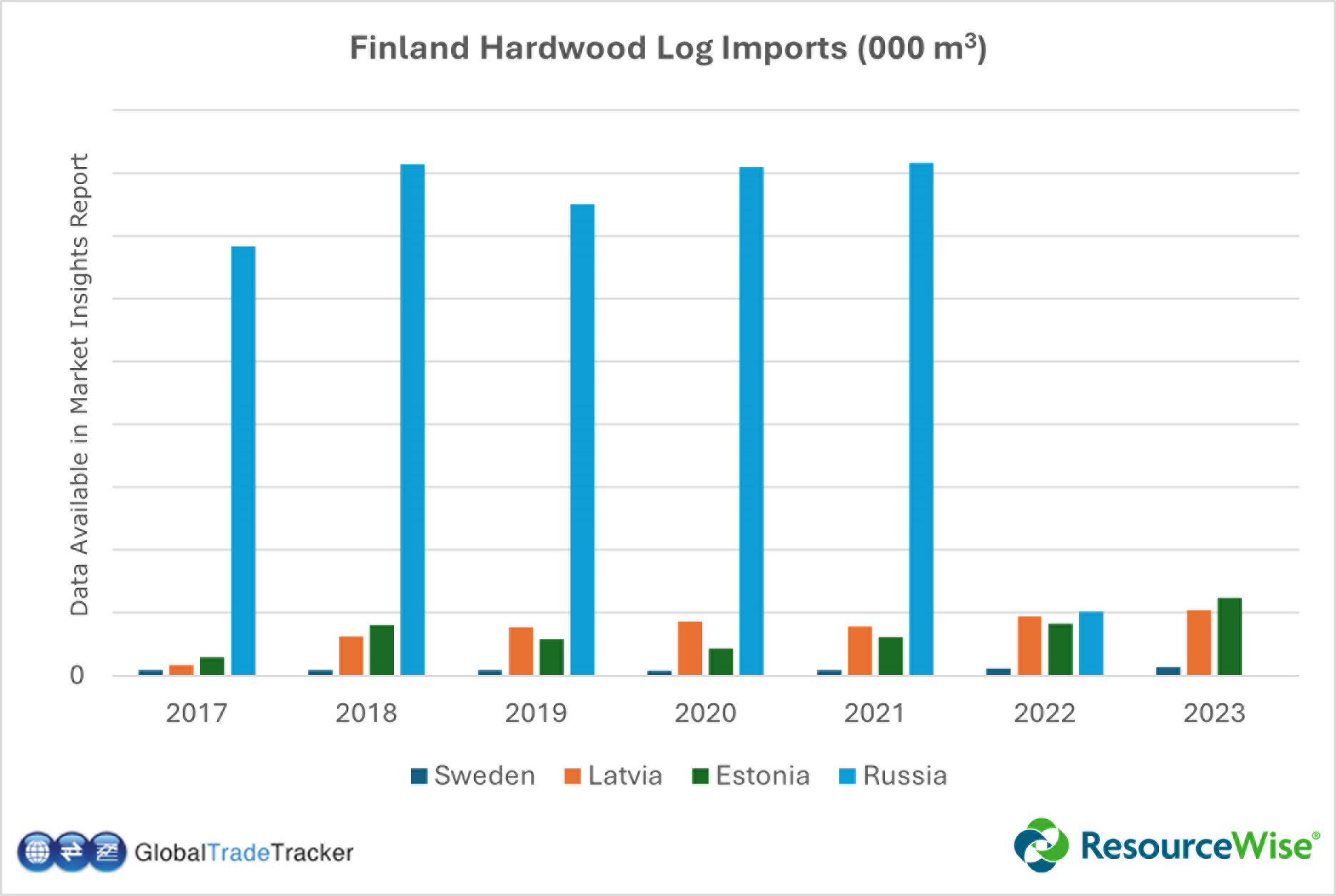

Historically, Europe imported about one-third of its consumption from North America and Russia to meet its increasing demand for wood pellets. However, with imports from Russia to Europe having stopped because of the country’s invasion of Ukraine, and North America increasing shipments to Japan and South Korea, it has become more challenging to source wood pellets at competitive prices. Markets that have been affected include the United Kingdom, Italy, Belgium, Denmark, Austria, and the Netherlands.

How Global Trade Impacts the Wood Pellet Market

The health of global trade is paramount when it comes to shaping the dynamics of the global wood pellet market. The interconnectedness of economies across the world means that any fluctuations in trade can create impacts on market growth, supply and demand dynamics, and even market prices.

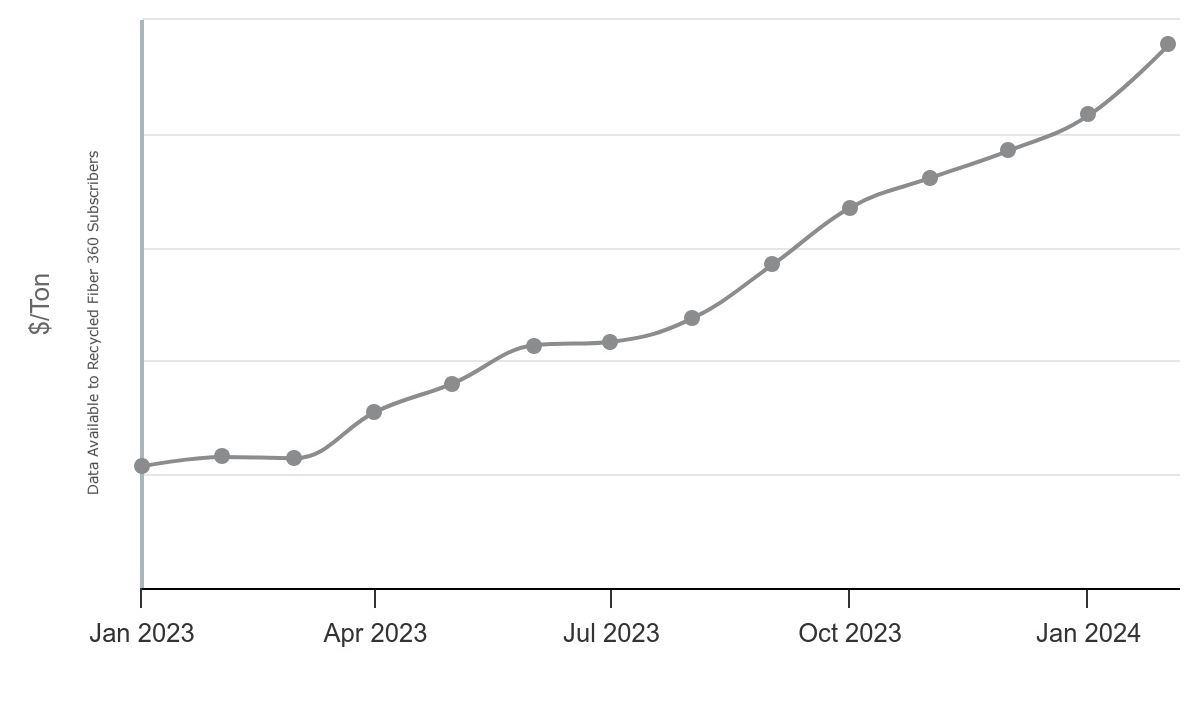

For example, the disruptions that have unfolded in the Suez Canal, an essential trade passage for goods and fossil fuels moving between Asia and Europe, have already triggered price hikes and cargo setbacks across various industries. Due to the attacks by Houthi militants in Yemen on commercial vessels within the Red Sea, numerous companies have chosen to steer clear of this route.

These assaults, occurring on a vital trade route connecting the East and West, have instigated a significant alteration in shipping paths. Instead of opting for the shorter journey via the Suez Canal, more than 100 container ships have rerouted around the southern tip of Africa. This detour adds approximately 6,000 nautical miles to the typical voyage from Asia to Europe, resulting in potential delivery delays of three to four weeks.

Understanding how the interplay of various factors can impact global trade and subsequently, the wood pellet market is crucial. By staying informed and adaptable, businesses can navigate the ever-changing dynamics of the wood pellet market and seize opportunities for growth.

Gain Further Insights into Traded Wood Pellets with Market Insights

Learn more about the unusual changes within European wood pellet imports with our Market Insights report from Håkan Ekström, Special Advisor, Global Forest Products, ResourceWise. Download the report below.