Heavy sanctions continue to cripple trade between Russia and the Western world as a growing number of companies cease operations in Russia.

But Russia’s invasion of Ukraine is also impacting all commodity markets, although each differently depending on the existing trade and other factors. Rises in crude oil and main feedstocks are adding cost pressure to all petrochemicals and chemicals globally.

Europe has been particularly affected by increasing natural gas prices – the main source of energy for the industry – compared to cheaper energy values in North America and more diversified and cheaper energy sources in Asia (coal and fuel oil).

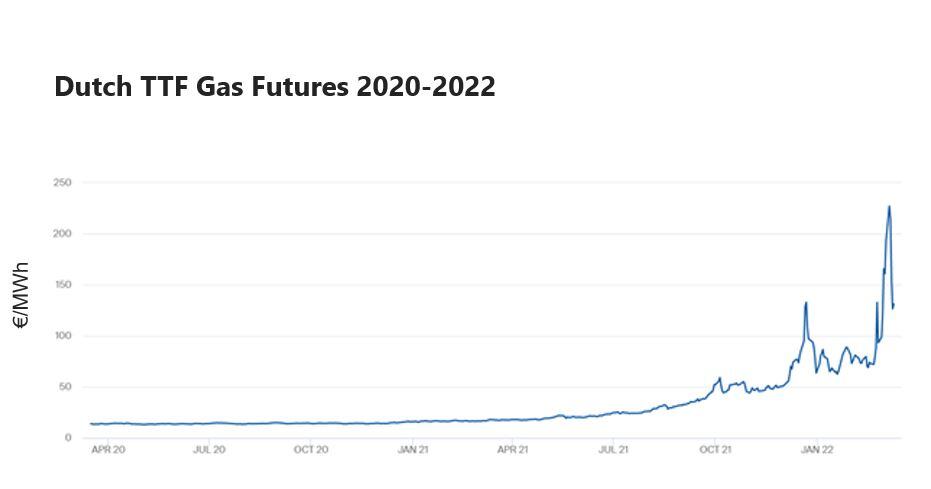

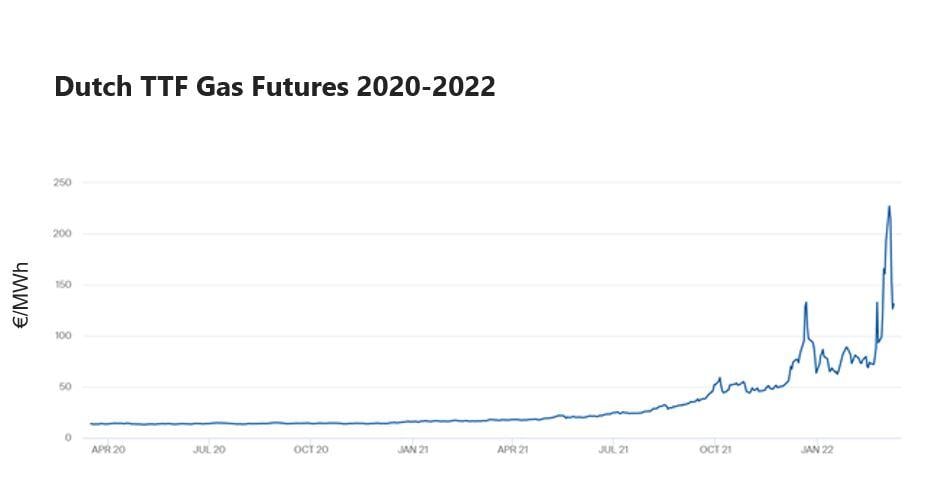

Dutch TTF Gas Futures can be taken as a representative reference of energy prices for the petrochemical industry in Europe. The chart below shows the evolution of the MWh prices in recent years. The upward trend of TTF values in Q4 2021 has accelerated since mid-February, adding higher costs and huge uncertainty on the cost structure of all companies.

Source: Dutch TTF Gas Futures

High energy values are impacting petrochemical companies in many different ways. Energy-intensive chemical companies must pass through the cost and/or adjust operating rates, maintaining or increasing previous supply disruptions.

The unusual volatility prompted the need to review the mechanism by which contracts for main feedstocks, chemicals and polymers are settled in Europe. Negotiations that did not include energy clauses for 2022 are being forced to implement energy surcharges or price increases to cope with the high cost.

This is happening at the same time that high energy prices threaten the already weak growth of the European economy, impeding or questioning the future demand for products in the different chains. Products in the nylon 6 chain can be used as an example. Caprolactam and polymers producers that have announced price increases of between €1000-1300/ton for deliveries in April represent increases above 35% on the current price. The pressure is therefore transferred to downstream industries, with more difficulties in passing on the higher cost.

Maleic Industry Maintains Watchful Eye

Kaiyin Hu, Consultant Maleic Anhydride, Oleochemicals, Bio-Materials & Intermediates, says rising crude oil and gas prices are already impacting maleic anhydride markets.

In the US, maleic prices are under upward pressure from higher n-butane prices. However, market participants are not concerned about n-butane availability because there is plenty of supply in the US.

Europe is highly dependent on Russian oil and gas and the growing threat to Europe’s gas and oil supply and volatile feedstock prices have become the top concerns for European maleic producers and buyers.

Hu said stakeholders are monitoring the potential for a shortfall of n-butane in the European market closely. Depending on raw material sourcing strategies, some maleic producers could be more susceptible than others. As of 11 March, there was no confirmation that n-butane supply to major European maleic industry participants was directly affected as a result of the war.

Those maleic producers highly dependent on Russian n-butane are expected to experience the impact first. ‘Trying to reduce dependency on Russia and move to another contract supplier may not be straightforward,’ said Hu. ‘One contact pointed out that sourcing n-butane from European contract suppliers usually requires long-term relationships.

"Buyers may have to turn to the spot market to cover the volumes they need, but these are likely to be at much higher prices. In the short term, it is possible that the market could see some reduction in output or even force majeures if the situation does not improve," Hu adds.

In Asia, Hu's analysis shows that the uncertainty and feedstock price volatility has put market participants ‘on edge’. "Buyers are hesitant to make decisions," Hu concludes.

Methanol

With Russia a key supplier of imported methanol for several years, market participants in Western Europe had been watching developments in Ukraine with growing concern for several weeks.

In 2021, the European Union (EU 27) imported some 1.33 million tons of methanol from Russia, down from 1.49 million tons in 2020 and 1.64 million tons in 2019. However, the 2021 total was higher than the totals seen in 2018 (1.29 million tons) and 2017 (1.21 million tons). Russia accounts for around 20% of the EU's total methanol imports on an annual basis. Replacing that volume will be difficult as methanol is a highly contracted market globally.

There are several methanol plants currently idled at various locations in the world which, if restarted, could provide some relief in the medium-term, but just how quickly operators could get those plants re-started and operating at stable rates also depends on access to natural gas feedstock supplies and the high costs for that natural gas in the current environment. Methanol buyers in Europe will also find themselves in competition with consumers in other regions for any additional volumes.

Butyl Acrylate Spot Market Tightens

Rachel Uctas, Senior Consultant of Acrylic Acid and Acrylate Esters, expects contract price increases in Q2 due to the huge surge in natural gas prices and the bullish crude oil market exacerbated by the war. Arkema already introduced natural gas-related surcharges on all butyl acrylate (BA) and 2-EHA contracts back in October, but up to now, no other producers have followed suit. This could change in Q2.

She says that Russia’s two producers of glacial acrylic acid (GAA) and BA – Gazprom and Sibur – have a combined total capacity of around 105 ktpa of acrylic acid and 120 ktpa of butyl acrylate. The two producers have been active in marketing butyl acrylate in several regions including Europe, Turkey, the Middle East, and South America. Uctas says they formed a joint venture in 2019 to increase their presence in export markets.

Traders and distributors are increasingly discussing a reduced exposure to Russian-origin products and are reportedly seeking alternative sources of BA due to ethical concerns. And physical flows of material between Russia and Europe have deteriorated since the invasion. Sources report that the Russian supply of spot BA is drying up, leaving Turkey, for example, with a tighter supply situation, and the prospect of rising spot prices. The European BA spot market has also firmed during March.

PET and PTA Markets

The market for PTA and PET already had good demand, limited imports, and a high dependency on European sources, which increased the profitability of the industries in 2022. Trade flows between Russia and Europe are not significant, such that the current situation will not trigger a substantial change in the European supply/demand dynamics. It has, however, focused on the need to assure product supply amid increasing uncertainty and logistical constraints, especially in Eastern European countries.

Although the short-medium term looks positive, the main concern in the medium-long term for Europe continues to be the stable or soft end-demand for virgin PET and the consensus that logistic constraints are the main reason for the good performance. Companies in the polyester chain, in cooperation with downstream users, new technology providers, and others are focused on how to address the unstoppable trend to address new Environmental, Social, and Governance standards. It seems feasible that the use of PET will continue to grow but with reduced fossil-based raw materials. The change will modify the cost structure, and alter existing supply chains, operations, and other factors.

Epoxy Resins

The European epoxy resins market was in disarray in early March as the Russian-Ukrainian conflict left participants unsure how to react to the surge in natural gas and crude oil prices. Manufacturers say they need to pass on the spike in production costs, but by 15 March they were still assessing what increases would be accepted by the market.

Phenol/acetone producers have approached their customers with proposals to increase Q2 adders by a minimum of 40%. However, suppliers acknowledge that if they push too hard, it could stymie demand in what should be a seasonally strong period.

On 14 March, epoxy resins producer Olin announced that it was temporarily curtailing production at its Stade plant in Germany. The company said that during Q1 2022 it has experienced, "Weaker epoxy resin demand in Europe than anticipated, which has been exacerbated by the uncertainty following the Russian invasion of Ukraine." Olin went to on say it is, "Unwilling to sell incremental volume into a poor-quality market and operating the epoxy resin facility at less than 50% operating rates is impractical."

"As a result of these factors, the record high natural gas and electrical power costs in Europe, and facility maintenance, Olin has decided to suspend Stade epoxy resin production," its press release said.

According to market sources, epoxy resins producer Huntsman has introduced a €300/ton energy surcharge on all accounts. Westlake Epoxy (formerly Hexion) has not yet made a formal announcement, but buyers are bracing themselves for hefty increases for April. Market sources say European suppliers have had to introduce sales allocation due to increased inquiries following Olin’s announcement.

Polyamides

The European polyamide market has come under renewed pressure in the first half of March due to the escalation in natural gas and electricity costs since the Russian invasion of Ukraine. Prices for ammonia, a key precursor for both PA 6 and PA 66 intermediates, increased from around $200/ton in March 2021 to almost $1,500/ton in early March 2022 in reaction to higher natural gas prices.

Ukraine is a major producer of ammonia, and plants in the country have been shut. Other ammonia production facilities in Europe are struggling to cope with high feedstock prices and polyamide market participants are worried that other facilities may also shut down under the strain of increased production costs. "Polyamide 66 production just can't happen without ammonia," one European market participant said.

Polyamide producers have responded to higher production costs with a series of massive price increases, with some amounts topping €1,000/ton depending on material and timing. Downstream consumption of polyamide products slowed in early March after several major automobile manufacturers in western and central Europe announced temporary closures due to the disruption in supplies from parts makers in Ukraine. Market participants are worried that polymer producers and compounders may reduce operating rates, or even shutdown lines, depending on the duration of the war in Ukraine.

Chlor-Alkali Industry Impact

As far as caustic soda is concerned, many sectors will be impacted. Ukraine’s Karpatnaftochim – with 199 ktpa caustic soda, 181 ktpa chlorine, and 300 ktpa PVC capacities at its Kalush site – shut down production on 24 February as martial law was imposed on Ukraine.

The company wrote, "The whole equipment and communications of process divisions are drained from products, filled with inert gas (nitrogen), and put on conservation mode. The equipment is in proper technical condition. Fire protection systems, emergency protection, early detection and warning systems, and energy supply systems are in good working order."

Ukraine was exporting increased volumes of PVC to Europe in January and early February. This will not be seen in March, or for the foreseeable future, as production has been completely shut down. Karpatnaftochim is the only producer of PVC in Ukraine.

There will also be an effect on caustic soda as this production is reduced from Ukraine, but this is unlikely to be noticeable as Rusal has stopped production at its Ukraine alumina refinery which will partially offset the reduced production.

European chlor-alkali production is currently reduced due to planned and unplanned output reductions. The high energy costs are putting a lot of pressure on European producers and spot product is pretty much non-existent at the moment.

Supply is unlikely to improve in the short term while the demand situation could potentially be negatively affected, particularly in the pulp & paper industry where many major European companies are announcing they will either stop production at Russian plants or halt trade with Russia.

Alumina

Another major sector that is already showing some direct impact from the conflict is the alumina sector. Rio Tinto announced it is cutting ties with Russian businesses. "Rio Tinto is in the process of terminating all commercial relationships it has with any Russian business," Reuters reported on 10 March.

This move has cast uncertainty on the future of Rio Tinto’s joint venture with Rusal. Rio Tinto owns 80% of Queensland Alumina Limited in Gladstone, Australia which is thought to have a capacity of 3954 ktpa alumina. Rio Tinto is reportedly also planning on stopping the supply of bauxite and sourcing alumina from Aughinish Alumina in Ireland, which is wholly owned by the United Company of Rusal.

Additionally, on 10 March, the UK imposed sanctions on Oleg Deripaska, the founder of Rusal and majority stakeholder in the aluminum company EN+. It is not yet clear what the impact of the sanctions will be on the alumina industry or Rusal operations, but they are not thought to impact Aughinish Alumina.

In 2018, Oleg Deripaska was sanctioned by the US government which resulted in raised alumina prices and shortages. Eventually, in early 2019, the US Treasury lifted sanctions on Rusal and its parent En+ after Oleg Deripaska’s stakes in the companies were reduced.

Subscribe to our blog to get the latest chemical industry insights delivered right to your inbox.