6 min read

Polyamide Plastics: Opportunity and Trade Options in 2024

Jane Denny

:

Jan 3, 2024 12:00:00 AM

Jane Denny

:

Jan 3, 2024 12:00:00 AM

The world has changed a great deal since ladies’ stockings introduced the new engineered thermoplastic Nylon at the New York World's Fair in 1939.

Since then, polyamide’s versatility has underpinned its use in a range of diverse applications, including bullet proof vests. The latter application perhaps rising concurrent to the former's lapse due to changes in working lifestyles and fashions versus growing geopolitical catastrophe.

The material has disrupted established sectors including steel due to its capacity to deliver durable products for automotive and aerospace applications. It has proven vital to the 3D print revolution, and continues to underpin innovation in R&D labs to this day.

Is there such a thing as too much polyamide in the market though?

Engineering Thermoplastics Availability

In 2023, global capacity to produce polyamide 66 (PA 66) was low at just 3.7 million tons per year. Global output is also unusual in that—unlike many key manufacturing materials—China’s capacity to produce doesn't dwarf that of other nations... yet.

In fact, as of 2023 North America was the world largest producer of PA 66. China was at second place, with its annual output only around 160 kilotons more than Europe’s. Compared to its polyamide 6 (PA 6) output, China's capacity to produce PA 66 is significantly low.

The overall capacity of the world's biggest producer—US-headquartered Invista—is now more than 710 kilotons per annum (ktpa). In 2023, more than 220 ktpa of Invista's production capacity was in China. In fact, Invista was then the Asian country's biggest PA 66 producer. And, according to Tecnon OrbiChem sources, Invista Shanghai will add 280 ktpa capacity this year. Ascend Performance Materials, the world's second biggest producer has a capacity output of 701 ktpa as 2024.

The largest Chinese PA 66 producer within China—though with an output capacity lower than Invista—is China Shenma Group Company. The firm had plans to increase its Henan and Shanghai outputs by 60 ktpa by the close of 2023, with a further addition of 180 ktpa capacity earmarked for its Henan location post-2024.

Many smaller producers of PA 66 in China, catalogued visually by name and nameplate capacity within OrbiChem360, contribute to the country's PA 66 output. Beyond the extra output buyers can expect from Shenma and Invista in 2024, more than 4 million tons per annum extra capacity is expected in the coming years. Essentially, this will more than double its availability.

Among the largest producers adding to this upcoming PA 66 glut is China's Ko Yo Chem, adding 800 ktpa capacity in Sichuan post-2024. Gulei Petrochemical is due to add 400 ktpa capacity in Fujian post-2024 and Eversun Jinfei will bring 600 ktpa online in the province before the close of 2026.

Consumption of PA 66 in fibre and engineering resin polymer applications isn't expected to exceed 3.2 million tpa by 2026. So just where this new capacity will be used is a source of much conjecture.

William Bann, Tecnon OrbiChem lead business manager

"These and other proposed new PA 66 plants could have a major impact on PA 66 regional balances, should all those plans reach fruition,’ said Tecnon OrbiChem business manager William Bann.

‘Consumption of PA 66 polymers—for usage in both fiber and engineering polymer resin applications—is expected to be around 3.0-3.2 million tpa by 2026, so just where this new capacity will be used is a source of much conjecture.

"It will be important to monitor the progress of these projects in the coming months to identify which are feasible," Bann adds.

Polyamide 6 Capacities Globally

When it comes to PA 6, China’s reputation as the world’s workshop is well-supported. As of 2023, global capacity was 11.6 million tons per year, with China accounting for over half. Unlike PA 66 capacity’s foreign producer footprint, several Chinese company’s capacity to produce PA 6 dwarf that of the first western company to appear on the list—namely BASF with 100 ktpa output capacity in the country from 2008.

What Are the Margins for Producing PA 6?

According to the Margins Dashboard within our chemical business intelligence platform OrbiChem360, there is little incentive for Northeast Asian producers to operate PA 6 virgin resin lines at optimum output.

2023 margins (to November) averaged just $122. Back in 2014 that figure averaged over $250 throughout the year. As of today, capacity utilization within the PA 6 sector globally is under 65%. Such was the state of the chemical industry as 2023 ended.

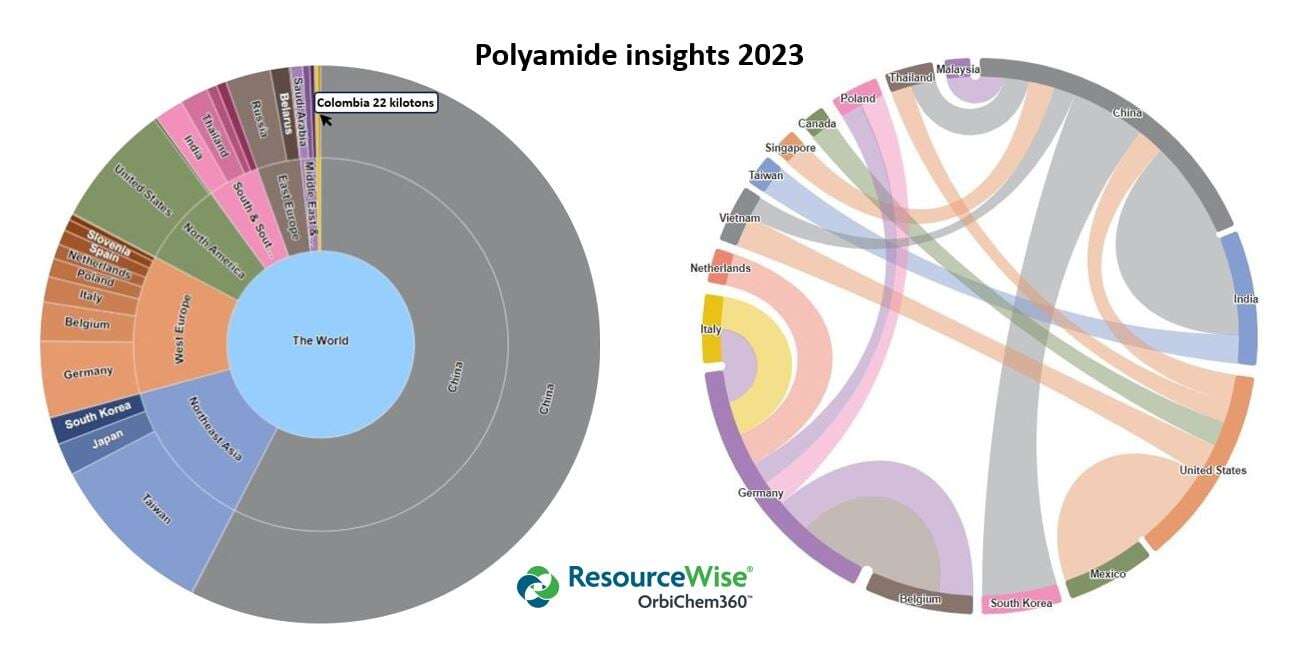

Global Polyamide Trade Flows 2023: A Snapshot

The United States is a key producer and exporter of polyamides. The country's total output capacity for PA 6 and PA 66 was almost 2000 ktpa in 2023.

The top five export destinations for US-produced PA were China, Thailand, Vietnam, Mexico and Canada. In all, these economies imported over 200 thousand metric tons of PA from the US during the first three quarters of 2023. That volume actually accounted for under half of US polyamide exports during that time frame.

Additional volumes of polyamides are exported from the US to many more destinations. To name a few, between January and September 2023, Israel imported 337 metric tons, Japan imported 9.2 kilotons and Brazil imported 8.8 kilotons.

As the graphic below shows, China imported 33 kilotons of polyamides from the US between January and September 2023. As of 2023, China's output capacity for PA 6 was self sufficient. But the Asian superpower's output capacity for PA 66 is significantly smaller. This created a market for PA 66 producers in the US.

Thailand was sent over 27 kilotons of US-produced polyamides in the first three quarters of 2023, as shown in the graphic below.

Almost 40 kilotons of US-produced polyamides were exported to Vietnam during the first three quarters of 2023.

The graphic below shows that by far the largest destination of US-produced polyamides exports during the first three quarters of 2023 was Mexico. Given that one of the country's most significant industries is automotive, its need for polyamide is unsurprising.

According to the US government's International Trade Administration, many major automakers are already established in Mexico. The country is the world’s seventh-largest passenger vehicle manufacturer, at 3.5 million annually.

Polyamides in Automotive Applications

Tesla is set to build a new plant in Nuevo Leon as part of its electric vehicle production capacity. To meet at least some of Mexico's domestic PA need, Portuguese compounder Cabopol is establishing itself in Monterrey, Mexico. The firm announced an intention to bring a new 25 ktpa thermoplastic and crosslinked compounds production unit onstream by the close of 2023.

Namely, as a layer designed to contain the occasional fires that can result from the uncontrollable, self-heating state causing electric vehicle, scooter and bicycle battery internal short-circuits. Termed thermal runaway, the phenomenon is increasingly linked to lithium-ion cell EV battery failure.

Despite their relative scarcity as transport modes, over 120 electric scooter and e-bike blazes were fought by London firefighters in the first eight months of 2023. New York City and San Francisco have co-reported 660 lithium-ion battery fires since 2019.

Heat Resistance Versus Flame Retardancy

Polymers used for engineering thermoplastic applications have traditionally exhibited high heat and chemical resistance. These properties have made them suitable compounds for encasing electrically charged mechanisms used in EV powertrains already.

Additives can improve the fire resistance in plastics. It involves the mixing in of compounds such as antimony oxide or phosphates that inhibit the start of fires.

Flame retardant polyamides—in the sense of the material itself demonstrating properties to actively prevent the spread of fire represents a relatively new concept.

Flame retardancy however—a key property in highly flammable applications including soft furnishings—requires properties that actively prevent fires from spreading. And in that sense, flame retardant polyamides represent a relatively new concept.

Innovation for Tesla, EV Batteries and More

Tesla electric vehicle (EV) battery supplier LG Chem impressed the world with a battery pack plastic material with extraordinary anti-combustive properties. The South Korean company’s composite material, when used in battery housings, delays the spread of fires caused by the uncontrollable, self-heating state that can trigger these spontaneous fires, or thermal runaway.

The materials LG Chem uses include polyphenylene oxide, polyamide (PA) and polybutylene terephthalate (PBT). Already replacements for metals such as steel and aluminium in automotive applications. The new material blocks flame propagation for over 400 seconds at 1000°Celsius, according to LG Chem’s press release, 45 times more effective than general flame-retardant plastic.

Via partnership with fellow South Korean company LX Hausys, the breakthrough reached new heights in 2023. A co-developed improvement, which is said to delay battery thermal runaway for over 20 minutes, was unveiled in October. The innovation pivots on the materials capacity to withstand the heat and pressure from a 1500°Celcius torch for significantly longer than LG Chem's 400-second achievement.

Designated a special flame-retardant material, the new material is applicable to covers of both upper and lower battery pack, says LX Hausys.

Future-proofing Polyamide and Feedstocks

In 2022, the International Energy Agency predicted worldwide electric car stock to reach nearly 350 million vehicles by 2030. That figure represents a significant increase on the 26 million the agency estimated as in use on roads globally in 2022.

There have however been high profile climbdowns on combustion engine replacement goals. The European Union tweaked its rules on combustion vehicle registration following negotiation with Germany drivers last year. A similar delay by the UK government ensued. Automakers have announced downgrades in output. Both Tesla and General Motors among them in response to dwindling demand.

Exploring the Full Range of Polyamides

Other polyamides in the family are PA 11 and PA 12. These high-grade polyamides are used to create mineral or glass filled plastic-based composites (and unfilled plastic compounds). They are particularly suited to use in automotive fuel line applications.

This is because the hose (or pipe) that transfers fuel from one point to another within a vehicle needs to be highly heat and chemical resistant. PA 46 is another polyamide grade used in hard-wearing automobile applications such as valve components. For a outline of polyamides, see our blog post 3D printing—additive manufacturing—rapid prototyping.

Explore our automotive insights Polyamide for Automotive Engineering Plastics.

Meet Our Polyamides Expert Team

William Bann – Tecnon OrbiChem Lead Business Manager

Bann coordinates our global market coverage of Polyamide Resin, Polyamide Fibres, and key intermediate chemicals including Caprolactam and Adipic Acid.

Javier Rivera – Tecnon OrbiChem Business Manager

Rivera oversees our Polyester (PET Resin, Glycols, EO, and Derivatives) and Polyamide (Caprolactam and Polyamide 6 Resin) consulting services.

Also leads Tecnon OrbiChem's global consulting activities in Fibres, PET and Intermediates (Paraxylene, Monoethylene glycols, PTA and PIA).

Joyce Chen – Tecnon OrbiChem Senior Consultant

Monitors several Polyamides & Intermediates, including Cyclohexanone, Caprolactam, Polyamide 6, Methanol and POM.

Michelle Yang – Tecnon OrbiChem Senior Consultant

& Teamleader

Covers several products, including Paraxylene, PTA, Ethylene Oxide, Ethylene Glycol, & EO Derivatives.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)