4 min read

Paper-Polymer-Plastic: A New 'Rock Paper Scissors' Game for the Packaging Sector

Jane Denny

:

Jul 14, 2022 12:00:00 AM

Jane Denny

:

Jul 14, 2022 12:00:00 AM

A report from the US Department of Agriculture’s (USDA) BioPreferred Program estimates that new sustainable products and practice within seven biobased industry sectors reduced oil consumption by 9.4 million barrels in 2017.

Those vanguard sectors are: agriculture and forestry, biorefining, biobased chemicals, enzymes, bioplastic bottles and packaging, forest products and textiles.

The report explains that this reduction was likely due to two main mechanisms: the use of biobased chemical feedstocks in place of crude oil derived chemicals, and the use of biobased materials as substitutes for traditionally petroleum-based products.

Real-world application

South Korean company Softpack launched its high barrier biodegradable coffee pouch in 2020. Designated Coffilm, its outer layering comprises Kraft paper made from softwood chips that have been pressure-cooked in a mixture of strong alkaline chemicals. At its end-of-life, Kraft paper quickly breaks down into cellulose fibres, making it a truly circular material.

The core of Coffilm packaging is made from an industrially-grown starch trade named Plantic and marketed by Japanese chemicals manufacturer Kuraray. That biobased polymer provides the gas barrier necessary to maintain the product’s freshness and keep the aroma locked inside. Although TUV-certified as home compostable, Coffilm’s barrier protection properties are marketed as matching aluminium. Traditionally the go-to material for packaging coffee globally, aluminium takes 80 to 400 years to decompose and isn’t readily recyclable so largely ends in landfill.

The packet’s eco-credentials are further boosted by its use of water-based ink for branding elements. And Coffilm was recognised by WorldStar Awards as a world first in high barrier biodegradable coffee pouch technology. More recently, Danish brewer Carlsberg launched a trial of a biobased bottle it claims is fully recyclable.

'...More localised production favours the biobased market because it typically uses local feedstock to produce chemicals and materials...'

Tecnon OrbiChem biomaterials expert Doris de Guzman

Wood-based packaging

A July 2022 survey – Sustainable food packaging in 2040 – co-conducted by paper mill UPMBiofore and US-based scientific testing and certification provider Smithers uncovered high enthusiasm for wood-based packaging solutions.

Well over half its cohort of 200 respondents – senior packaging professionals from across the packaging value chain globally – consider innovations in wood-based packaging key to industry’s capacity to evolve. It is innovation, they say, which will provide the strength and performance required for wood-based packaging to become reusable. When the UPM/Smithers report says 'fiber,' this refers to wood pulp-derived material, not synthetic fibers like Nylon.

It is also key to note that current food contact materials (FCM) regulators will need to sanction its use – and that will only happen once its consumer safety record is fully established.

The head of global packaging R&D at South Korea's CJ CheilJedang, Grace Kim, was a key contributor to the report. Operating in an increasingly mandated and regulated country regarding packaging sustainability, Kim is well-versed in innovative solutions. As covered in our blog post Plastic packaging material that is both sustainable and biodegrades, CJ CheilJedang shipped the first batches of its PHA-based material from its 5ktpa capacity facility in Pasuruan, Indonesia in April 2022. The company is, therefore, well-positioned as an innovator in biodegradable product markets.

UPMBiofore, meanwhile, is building a facility in Germany to convert woody biomass to sugars for the production of glycols. It is a different technology, but more and more new chemical processing technologies targeting biobased chemical markets are exploring woody biomass as the feedstock.

A new world

In particular, the survey’s findings reflect that micro fibrillated cellulose (MFC) and nanotechnology advancements as key to the shift away from polymers towards wood-based packaging solutions in the future.

Like the biopolymer starch compound Plantic uses in Coffilm packaging, MFC is a biomass feedstock. It is comprised of cellulose fibrils – small or slender fibres – separated from its source, such as wood pulp.

By bonding together, MFC fibres create strength that, when added to the paper making process, improve tensile strength and barrier properties, while also providing a smooth surface.

Bio-economic times

On the supply side, says Tecnon OrbiChem’s biomaterials expert Doris de Guzman ‘the bioeconomy has emerged as a globally impactful transformative force in industries.

‘On the demand side, there is a transformative force for consumption changes and waste reduction.'

Going forward, 'there will be a greater focus on localising production instead of importing goods. More localised production favours the biobased market because it typically uses local feedstock in the production of biobased chemicals and materials,’ de Guzman adds.

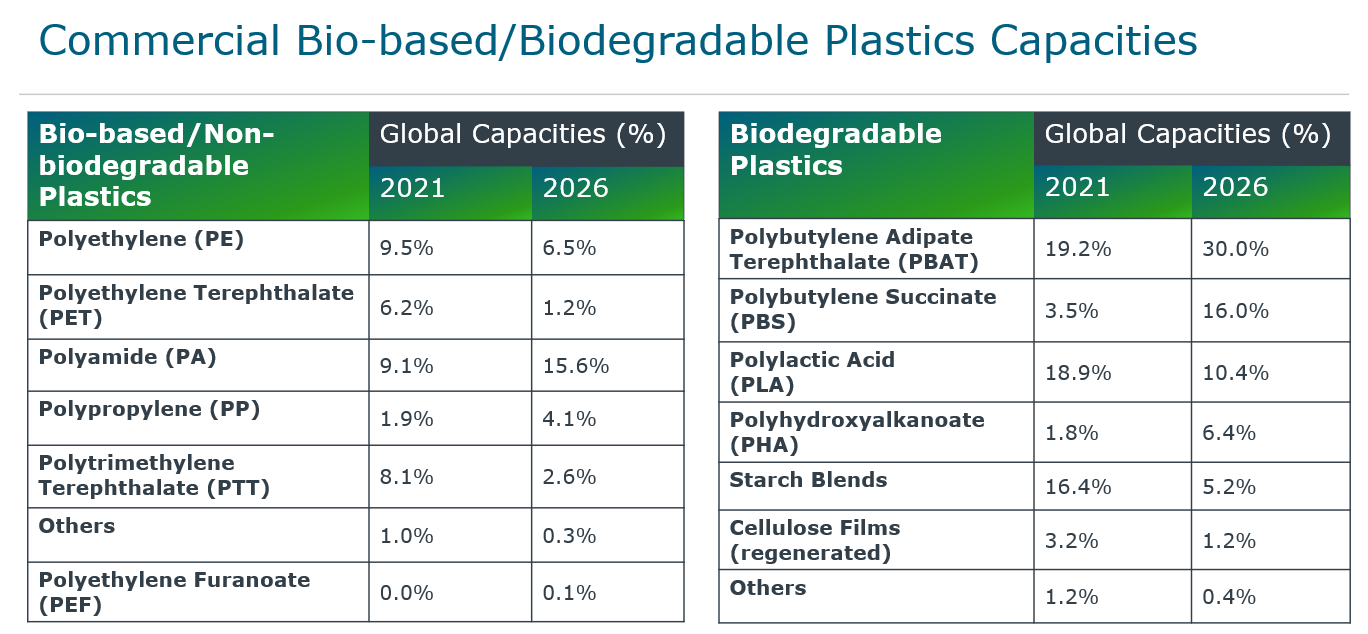

Source: nova Institute

Germany's independent research establishment the nova Institute estimates global bioplastics capacity at 2.42 million tons currently, a figure expected to increase to 7.59 million tons in five years.

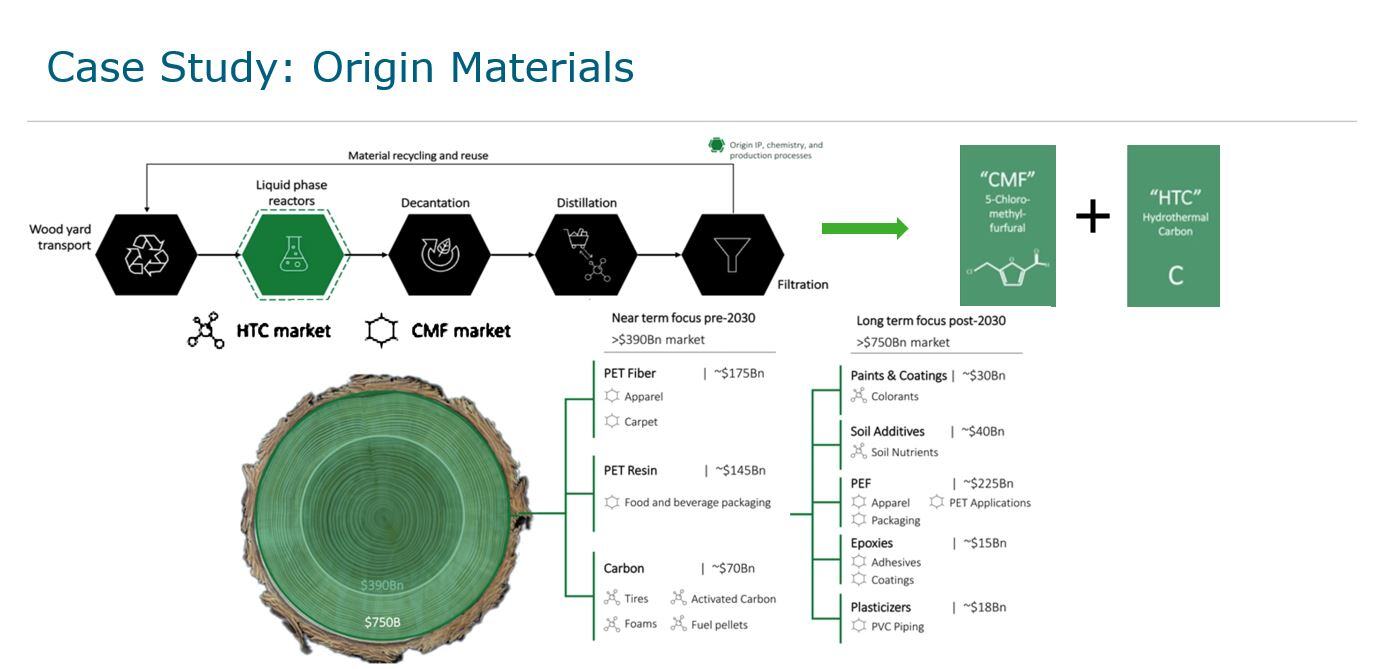

Polyethylene furanoate (PEF) is a new type of polymer made from furanic-based chemicals. Its inherent biodegradability – and barrier properties beyond those of PET – make it a promising drop-in technology for packaging markets. Some developers in this field will be using woody biomass feedstock. North America-based Origin Materials for example – a PEF vanguard we explored in a 2021 blog post Renewable materials and the future of plastics – sees huge potential for wood-based feedstock.

Source: Origin Materials

Headquartered in California, Origin is building its first commercial plant to produce chloromethylfurfural and co-product hydrothermal carbon. The plant – which is called Origin 1 – is located in Sarnia, Ontario, Canada.

In May 2022, Origin announced a partnership with Louis Vuitton parent company LVMH to produce PEF-based packaging and materials. And the company is already collaborating with several food & beverage brands to develop and commercialise PEF bottles as an alternative to PET bottles.

The hydrothermal carbon co-product can be used as alternative to activated carbon, or as raw material in the production of tyres, foams and fuel pellets.

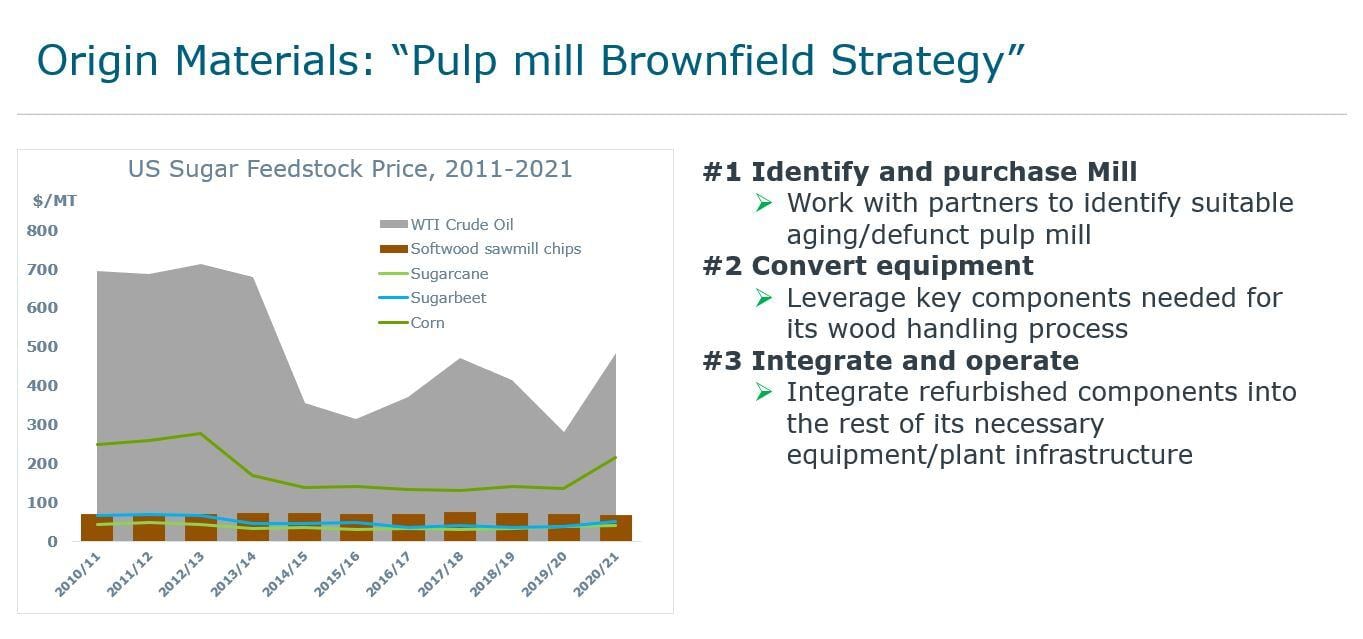

Cleverly, Origin optimizes its capital expenditure by using a Pulp Mill brownfield strategy. Sawmill chips are currently cheaper than corn and competitive compared to sugarcane and sugar beet. Wood also has the advantage that it isn’t a food source. And its cost as a feedstock is significantly lower compared to crude oil.

Source: Origin Materials

It will be interesting to see how – if it is successful – this type of technology will change the pulp mill landscape. 'ResourceWise will closely monitor the capacities, collaborations and trade flows in the coming months and years.’

Supporting Re-use Tactics

Use of recycled fibre in food contact applications has been hindered due to food safety/migration concerns and lack of clear legal standards. By 2040 however, food safe recycled fibres will likely – says the study – be US Food & Drug Administration and EU EFSA-approved. There will also have been by then improvements in recycling technology and better supply chain traceability to enable its safe use in the heavily-legislated area of FCMs.

While it is clear these products are just at their inception, the potential looks strong. if your company is looking to improve its sustainability profile, Tecnon OrbiChem – a ResourceWise company – can help develop a strategy.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)