4 min read

Orthoxylene—Phthalic Anhydride Markets: What's Happening in 2024?

Jane Denny

:

Feb 19, 2024 12:00:00 AM

Jane Denny

:

Feb 19, 2024 12:00:00 AM

Phthalic anhydride is used to produce phthalate-based PVC plasticizers, resins and coatings.

Orthoxylene is the key feedstock for manufacturing phthalic anhydride, which can also be produced from naphthalene. Whatever the process route, the alkyd resins used in coatings and unsaturated polyester resins rely on a stable, economical supply of phthalic anhydride. And in this way, markets for orthoxylene and phthalic anhydride are inextricably linked.

And as economic pressures—including inflation and interest rate rises—continue to disrupt chemicals sector supply chains, both are becoming increasingly volatile markets.

Orthoxylene and Phthalic Anhydride Markets:

A Snapshot

Operators in these markets have seen demand dwindle as consumers feel the pinch. Meanwhile, large infrastructure and construction projects are being shelved or canned completely.

And while automotive sales are predicted to grow in 2024, its market share for orthoxylene—phthalic anhydride output is fairly small.

Globally, production is down all round, and shutdowns abound in both the orthoxylene (OX) and phthalic anhydride (PA) subsectors.

What are the chances that this year will bring relief? That is the question troubling every OX and PA producer still operating today.

Find out what our consultants learned from extensive interviews with market participants, data analysis and economic indicators

Global Orthoxylene Markets: A Snapshot

Total capacity to produce orthoxylene today is 5.7 million tons per annum, according to our chemicals business intelligence platform OrbiChem360. Almost two thirds are produced in China and Asia. Smaller volumes are produced in West Europe, East Europe and North America.

Exact volume capacities per region, country and producer are available to OrbiChem360 subscribers. Our global team of analysts and consultants monitor actual outputs, showing capacity utilization as a percentage. Orthoxylene output is currently running at 57% capacity. This means output this year is likely to be around 3250 kilotons.

Orthoxylene Supply: South and Southeast Asia

Singapore is a major producer within the South and South East Asian region. Together, its two producers—oil and gas company Exxon Mobil and Jurong Aromatics Plant (which Exxon acquired in 2017)—have a production capacity of more than 400 ktpa.

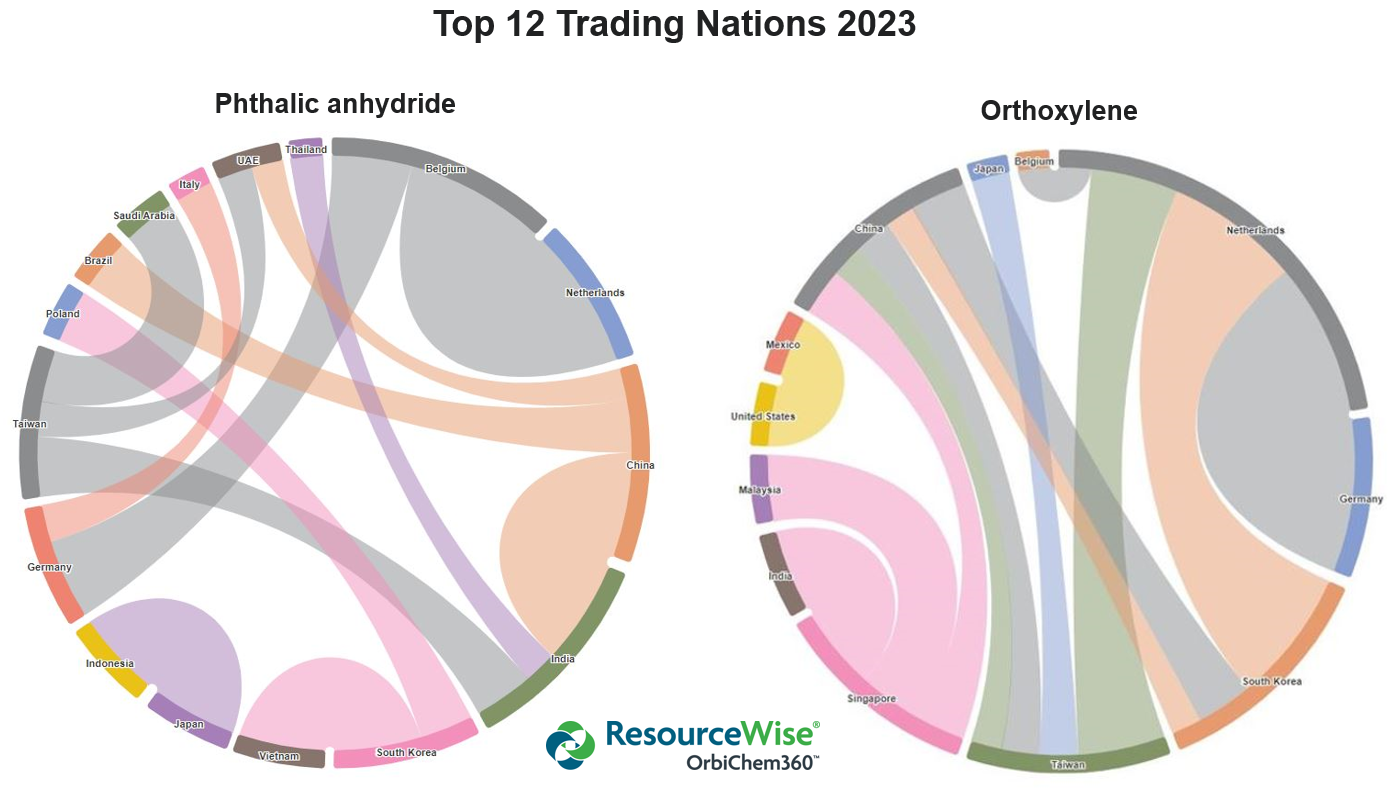

As shown in the infographic below, Singapore exports OX to India, China and Malaysia. Exports to these three countries from the relatively small Republican island totaled 112 kilotons in 2023. While not the only countries to import OX from Singapore, the volumes are indeed significant.

The infographic below shows that China imported OX from Singapore. South Korea and Taiwan were also among exporters of OX to China. And, as the infographic shows, both neighboring states also imported OX from China in 2023.

Chinese OX Price Fluctuations in 2023

It's true that the price of OX fluctuated in China during 2023, a factor fully explored by our Shanghai-based consultant Jane Zhu in the free to download eBook Orthoxylene – Phthalic Anhydride Markets: Outlook 2024 And Review 2023. In it, Zhu also highlights the relative increase in China's export volumes for OX in 2023 compared to prior years.

Global phthalic anhydride markets: A Snapshot

A key chemical intermediate for producing phthalate plasticizers and polyesters, global capacity to produce PA now exceeds 7 million metric tons per year. Various polyesters are produced by reacting PA with glycols. They include alkyd resins and unsaturated polyester resins (UPR) and polyols for polyurethanes (PU).

Current capacity to produce is already 10% up on 2022. However, while that volume is achievable, predicted output this year is much lower. In fact, rationalization tactics could leave actual yield at less than two thirds of total capacity, which translates to just an output of 4,500 ktpa in 2024.

The infographic above shows that India was a key export destination for Chinese-produced PA in 2023. Actually, that volume represents only around 10% of the 3.3 million metric tons China is now—in 2024—able to produce. In 2023, China exported a total of 131 kilotons of PA all over the world. Brazil, the United Arab Emirates and Egypt were its biggest customers after India.

New Phthalic Anhydride capacities for 2024

PA capacities will come onstream in 2024. in fact, China has grown its phthalic anhydride output by hundreds of kilotons over the last decade, as the graph below shows. Almost half of the world's total output capacity is concentrated in China.

With new capacities for phthalic anhydride coming onstream in China in 2024, naphthalene supply will tighten, keeping prices at high levels.

Orthoxylene supply may remain tight in 2024 too.

Jane Zhu, consultant, Chemical Sector, ResourceWise

According to Zhu, those in China will be tilted towards more new naphthalene-based PA than OX-based. Markets for the raw material naphthalene supply will tighten and keep prices at high levels. "With new capacities for phthalic anhydride coming onstream in China in 2024, naphthalene supply will tighten, keeping prices at high levels."

OX supply may remain tight in 2024 too. PA markets will have little space for optimism, says Zhu.

| Company | Location | Capacity | Start up date |

| Available in eBook | Gujarat, India | 90 | 2024 |

| as above | Fuxin, China | 100 | 2024 |

| as above | Gujarat, India | 80 | 2024 |

| as above | Gujarat, India | 50 | 2023 |

| as above | Zhejiang, China | 100 | 2023 |

European Phthalic Anhydride: A Snapshot

Germany is a key consumer of Belgian-made PA. However, Belgian producers also sold around 10 kilotons of PA product to the wider European market in 2023. And Germany is also a keen exporter to Italy, as the graphic below shows. West Europe is the world's third largest PA producing region, with an output not far below South and Southeast Asia's. Specialty chemicals company Lanxess, Polynt—organic anhydrides and derivatives producer—and chemicals company Proviron Fine Chemicals are among Europe's main producers, within a group of a dozen others.

Trade flow graphics remain an important tool in assessing the strengths and weaknesses of particular regions and countries. The graphs and infographics in OrbiChem360 rely on official import and export datasets submitted by the world's trading Nations. As volumes are made available in official information streams so too are they added to our platform for visual presentation.

New Orthoxylene and Phthalic Anhydride ChemForesight launched

With such volatility in chemical markets, taking the medium-long view on the cost of feedstock is essential. The price forecasting service, ChemForesight, is a valuable tool for chemical industry planning.

Value chain professionals, and colleagues that rely on supplies, can confidently set running cost budgets and effectively forward plan projects. Maximize return and minimize risk in times of uncertainty with a forecast model that considers crude oil fundamentals and market tightness at an 18-month future range.

We explored the ChemForesight methodology in our blog post Supply Chain Visibility: How Price Forecasts Aid Procurement Planning. Example graphs from our ChemForesight range are available in a free-to-download whitepaper Chemicals Industry Crystal Ball: Pricing up over 40 products.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)