7 min read

Oleochemicals, Renewable Resources from Nature: An Introduction

Jane Denny

:

Jun 26, 2024 12:00:00 AM

Jane Denny

:

Jun 26, 2024 12:00:00 AM

Oleochemical is a term derived from the Latin oleum, meaning olive oil. But, like much inherited Latin, it is a misleading collective noun for the products it describes. The cold-pressing technique used to extract olive oil from the fruit of the olive tree underpins some oleochemicals output, but its sources include both flora and fauna.

Essentially, oleochemicals are a group of compounds derived from the fats and oils of plants and animals.

Both are used in detergents, soaps, skincare, personal care, and cosmetics. The pharmaceutical sector also uses oleochemical products, as do producers of paints, coatings, varnishes, and lubricants.

However, one of the largest end markets for oleochemicals is the food sector. Food producers are major consumers of fats and oils… Think butter, margarine and oils – none would taste as good without the input of these natural feedstocks.

As natural, renewable resources, fats and oils from plants and animals provide an alternative to petroleum-based oils. Detergent, adhesives, lubricants, paints, and coatings markets can leverage oleochemicals as drop-in replacements for petroleum-based raw materials. What's more, as oleochemicals are readily biodegradable, they are regarded more environmentally compatible than petrochemical feedstocks.

Palm Oil and Palm Kernel Oil

The palm tree’s fruit and flesh yield palm oil via extraction processes, while palm kernel oil is refined from its inner seed.

Besides personal care goods, palm oil is also used to produce alkyd resins for coatings applications. It is also used as an additive in foodstuff. There's evidence that some producers are trying to limit palm oil use in foodstuffs due to consumer backlash against deforestation.

UK chocolatier Cadbury markets its Dairy Milk product as palm oil-free. The company however, retains palm-based oils as additives in many of its other products’ ingredients. Parent company Mondelēz outlines its approach to sustainable palm oil procurement.

Malaysia and Indonesia are currently the world's biggest palm oil producers. In fact, palm oil output per acre is high compared to other oils. Consequently, it is generally among the lower-priced vegetable oils.

Rapeseed Oil: Coming in as Canola

Used as a lubricant for steam engines in the 19th century, rapeseed is now a major source of animal feed raw material. Other uses include feedstocks for industrial lubricants, candles, lipsticks, and newspaper inks. It is also among the most common ingredients of vegetable oils for cooking.

Canada is a major rapeseed producer, with an output of around 19 million tons in 2022. The figure was over a third more than that produced in the prior drought-ridden year.

The Canadian government estimates that more than 210 million tons of vegetable oil are produced for human consumption annually worldwide. Soybean oil accounts for 60 million tons, and palm oil represents the largest volume at 77 million tons.

Rapeseed output—which includes canola oil—is estimated at just over 30 million tons. Canola oil, however, is made from a genetically modified version of the rapeseed plant. Its name is derived from Canadian (can) and ola (oil). Like other plant-based raw materials, rapeseed is increasingly used in biodiesel production, wherein it is reacted with methanol.

Source: Statista

Download a free copy of our eBook, An Analysis of the Market Drivers for the Fats and Oils That Underpin the 2020s Oleochemicals Markets, to explore the various market drivers for oleochemicals availability and price.

Soybean Oil: A Smooth Operator

Soybeans have traditionally provided feedstock for the food sector, pharmaceuticals, and animal feed. Neutral in taste, soybean oil underpins the smooth consistency of sauces, mayonnaise, and salad dressings. Soybean oils are obtained by distillation.

Soybean oil is also popularly used in the production of personal care products and cosmetics. It is a key ingredient in massage oils and moisturizers for skin and hair.

However, soybean use is evolving too. Crushed soybean oil becoming a major biodiesel and renewable diesel feedstock in the US. Because of the growth of renewable fuels, markets for uses besides fuels will likely see some volatility in price and availability.

These oils are first dissolved in a solvent, and the solvent is removed by distillation. Most impurities are removed during this process.

Coconut Oil

In the Philippines, the coconut tree—Cocos nucifera — is dubbed ‘The Tree of Life’ mainly due to its versatility. Indeed, it is used in sectors as diverse as textiles and construction on the island.

Beyond its use in food production, detergents, soaps, and personal care, it is used to manufacture methyl esters, fatty acids, and fatty alcohols. Those raw materials are used to make detergents, surfactants, emulsifiers, and pesticides.

It is estimated that the oil yield from 1000 coconuts weighs in at around 110 kg.

The Philippines, Indonesia and Malaysia are major coconut oil producers. As with other oils from natural resources, coconut oil is being used as a feedstock to produce biodiesel. That process involves the transesterification—or alcoholysis—the reaction of a fat or oil with an alcohol to yield coco methyl ester.

Crude Tall Oil

Crude tall oil (also called pine oil) is a wood pulp manufacturing byproduct. A viscous yellow-black odorous liquid, it is obtained via the Kraft process when pulping mainly coniferous trees.

Refiners purchase crude tall oil (CTO) and further refine it into fractions, including distilled tall oil and tall oil fatty acids (also referred to as TOFA). TOFA consists mostly of oleic acid, a mono-unsaturated omega-9 fatty acid of formula CH3(CH2)7CH=CH(CH).

Dimer or dimerized fatty acids are dicarboxylic acids prepared by dimerizing unsaturated fatty acids obtained from tall oil, usually on clay catalysts.

Dimerization of TOFA leads to a mixture of C36 diacids produced by linking the C18 units by C-C bonds in various ways.

The structure of one example of the dimers produced in this way is shown in the image left.

However, many different molecular structures are present, meaning the dimer acid mixtures remain liquid at room temperature.

The mixture of dimer acids is typically reacted with trimethylene tetramine (TETA) to give a polyamide curing agent for epoxy resins.

Source: American Chemistry Council (modified)

Interest in CTO is increasingly focused on its use as a raw material to produce biofuels such as hydrotreated vegetable oil (HVO)/renewable diesel and sustainable aviation fuel (SAF). It qualifies as a readily available feedstock under Europe’s RED II mandate and the CORSIA scheme for carbon offsetting.

The US is both a major producer and exporter of CTO. According to OrbiChem360’s Trade Flow datasets (collated from official import/export documents), the country exported 223 ktpa in 2023. The graphic below shows some of the countries that export CTO and where their supplies go.

Interestingly, Finland and Sweden imported and exported largely similar amounts of CTO between them in 2023. The orange flow towards Sweden represents an export volume from Finland of around 14 ktpa. Conversely, the purple flow from Sweden to Finland represents a volume of around 17 ktpa.

Source: OrbiChem360, ResourceWise

Overall, Finland and Sweden—an avid HVO consuming nation—were the biggest importers, along with Japan.

Until it invaded Ukraine in 2022, Russia was a significant global CTO market participant. Since then, many markets have been closed to the Soviet nation’s producers. As far as can be traced from recipient countries’ import statistics, Russia’s export volumes for CTO were around 75% lower in 2023 than they were in 2018.

The graphic above shows that Poland is a key European exporter. In fact, according to OrbiChem360 Trade Flow datasets, Poland's CTO exports increased in the 2020s. In 2020, the country exported around 13 ktpa, compared to over 27 ktpa in 2023.

According to datasets in the ResourceWise platform FisherSolve, around 200 plants currently produce high oil output volumes. According to this scientific paper, 30–50 kg of CTO by-product is yielded per ton of pulp.

The oil’s mix of fatty acids and resin acids is useful in food applications, biodiesel production, and soap making. In the latter application, fatty acids encourage lather generation, creating soap’s bubbly foam.

The distinct mix of fatty and rosin acids in distilled tall oils render them suitable raw materials in metal working fluids, oil field chemicals, cleaners and alkyd resins.

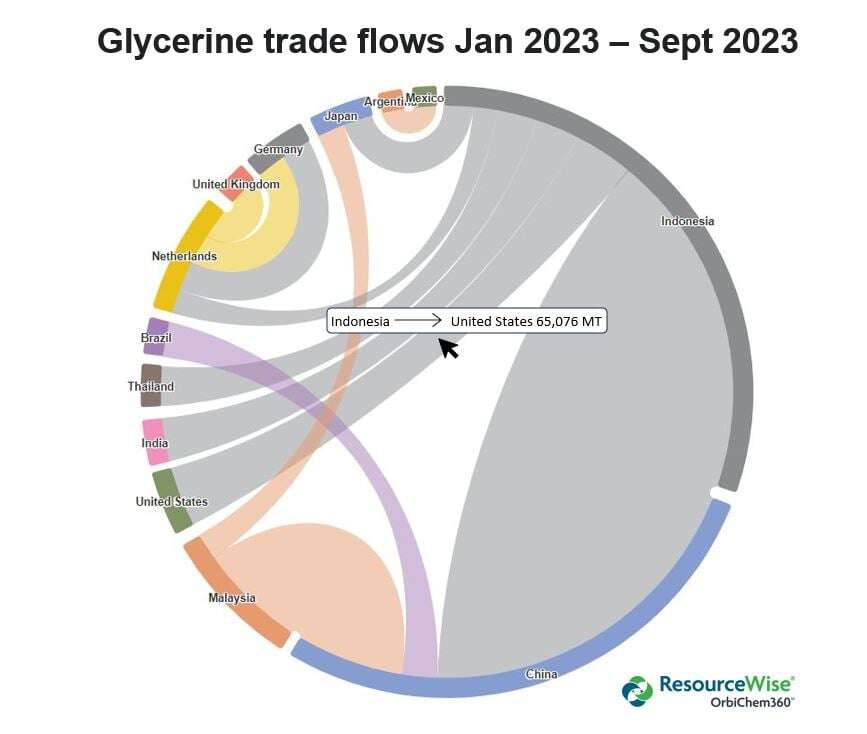

Glycerine: A 21st Century Disruptor

Glycerine was once produced synthetically. Today, it comes from the natural resources of animal or vegetable oils or fats. It is derived via hydrolysis (saponification) and by reaction with acid and alcohol (transesterification).

Several hundreds of applications rely on crude or refined glycerine feedstocks. They range from food, medicine and personal care to detergents, solvents and plastics. The relatively new market that grew around the vaping industry uses glycerine. And, seasonal demand for antifreeze underpins a cyclical market driver for this biodiesel industry waste stream.

Glycerine is available at grades of differing purity. They include crude, technical grade, technical, used cooking oil-based (UCO), feed, and pharmaceutical grades. Partly, the grade is dependent on the source—ie. whether a byproduct of biodiesel production, soap-making or UCO-based.

However, the removal of methanol and free fatty acids yields a grade refined enough for use in the food, beverage, and pharmaceutical sectors. Though costly, the refining process is necessary in these applications. Crude grades, however, can be used in industrial applications (e.g., coatings, and lubricants), as well as wastewater sanitation.

Fatty Acids and Fatty Alcohols

Crude fatty acids—like glycerine—are produced through the high-temperature and high-pressure fat-splitting method of hydrolysis. The table below indicates the fatty acids we monitor prices for in OrbiChem360.

| Fatty acid | Sources | Uses | Carbon atoms |

| Palmitic | Fruit of palm trees | Soaps, water control, medicinal and diagnostics | C 16 |

| Capric | Animal milks (also present in small amounts in coconut and palm oils) | Artificial fruit flavors and perfumes. Lubricants, greases, rubber, dyes, plastics, food additives and pharmaceuticals | C 10 |

| Caprylic | as above | Medical uses inc. controlling epilepsy/nerve disorders, as well as fungicide and herbicide applications | C 8 |

| Oleic | Meat inc. beef, chicken, and pork. Also cheese, pecan, sunflower seeds, eggs, pasta, milk, olives and avocados | A soap emulsifying agent and pharmaceuticals excipient. Aerosol product agent | C 16 |

| Stearic | Tallow derived from beef fat or from lard derived from pork fat | Producing detergents, soaps, and cosmetics inc., shampoos and shaving cream | C 18 |

| Myristic | Palm kernel oil and coconut oil | Food and beverages, soaps, detergents and textiles | C 14 |

| Lauric | Vegetable fats and in coconut and palm kernel oils | A cleansing, emulsifying, surfactant used in soaps and cosmetics | C 12 |

| Blended | Tallow and vegetable combined | Soap-making. Also a chemical intermediate used in grease, lubricants and industrial fluids |

Source: ResourceWise

All fatty acids except oleic are saturated. Oleic acid has one unsaturated link in the chain, but other long-chain fatty acids can have one, two, or three unsaturated links in the chain.

Fatty acids are versatile intermediates and chemicals. The table below shows how they are used in industries as diverse as lubricants, cosmetics, food, pharmaceuticals, and plastics.

The Federation of Oils, Seeds, and Fats Associations (known as FOSFA International) estimates that around 1.5 million tons of fatty alcohols were produced globally in 2022.

Shampoos, shaving creams, laundry detergents, and cosmetics are among their major end uses.

Future-Proofing Supply

The rising importance of green chemistry and sustainability brings oleochemicals to the fore. Vegetable oils, for example, can often be suitable drop-in replacements for petrochemicals in value chains.

Already, more environmentally friendly plastics and surfactants made using oleochemicals are emerging. However, oleochemicals can become scarce under certain conditions and in some environments. Plus, their attraction to biodiesel producers is a factor impacting supplies. And of course, the EU’s Deforestation Regulation has potential to disrupt the palm industry, a key driver of oleochemicals markets.

We explore the various market drivers for oleochemicals availability and price in our eBook, An Analysis of the Market Drivers for the Fats and Oils That Underpin

2020s Oleochemicals Markets.

Download your free copy of the eBook at the link below.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)