7 min read

Chemicals Output in a Conflict-locked Post-Covid World

Tecnon OrbiChem

:

Jul 17, 2023 12:00:00 AM

Earlier this year, BASF Chairman Martin Brudermüller warned that Europe was increasingly losing its chemicals sector competitive edge. His comments followed the announcement of permanent plant closures at the company's home base of Ludwigshafen in Germany.

Already, big chemicals sector names – Mitsubishi, Lubrizol, Trinseo, and Dow – had announced plans to close facilities, as our comprehensive list shows. The double crunch of rising energy costs and dwindling markets were largely to blame for closures in Europe.

The volumes of chemicals intermediates and compounds closures total thousands of ktpa less going forward. Buyers will have to find new supplies when the economy begins to pick up from its current lull.

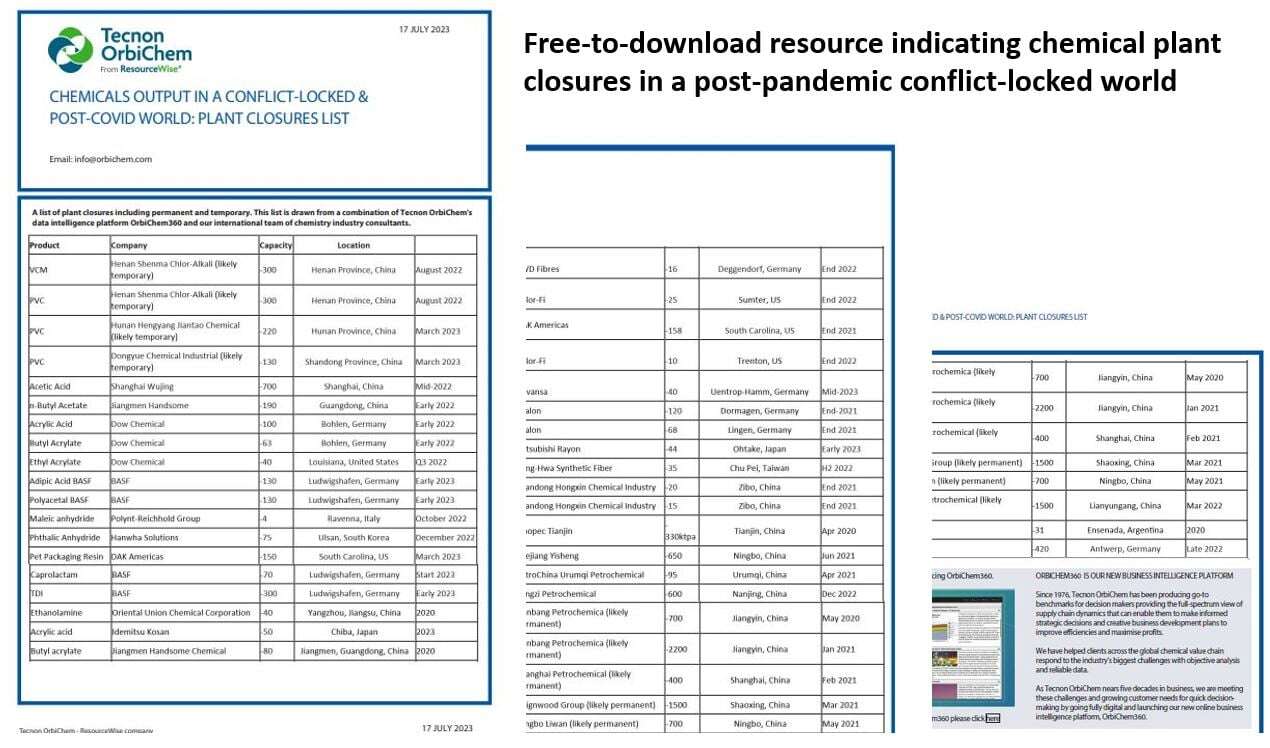

Our free-to-download list details dozens of production shutdowns globally this decade so far. The specific products affected, capacities in kilotons, site location, timing of closure and ownership are all included in the list. In addition to permanent closures, many chemicals producers reduced output – with operating rates around 50% in some cases. Since chemical producers do not operate in siloes, the closure of just one plant along a value chain can have a major impact on all industry players.

On the one hand, it can increase business risk. With plant closures, however, new opportunities open up – especially to those willing to invest in volatile times.

Assessing the variables

It is useful to consider why a particular company is closing its facilities or facilities. Does the main reason apply to others in the local value chain? Is it due to structurally low demand trends? Are exports at local or inter-regional levels viable?

Tecnon OrbiChem's consultant team – armed with datasets that leverage insights spanning six decades – is well-positioned to advise and provide case studies for new capacities across the petrochemicals value chain.

We can pinpoint the production costs in regions earmarked for plant expansion or startup. For example, the high energy costs referenced by BASF within Europe can be compared using cost-curve analysis techniques. Our experts can advise on the likelihood of the trends underpinning closure decisions being sustained, or short-term, factors.

...Our chemicals intelligence platform's datasets offer a solid framework in which decision-makers can gauge the likelihood of success for their strategies....

Tecnon OrbiChem global sales manager Matteo Baldi

'Questions that are key to chemical value chain participants navigating change are addressable and accountable. But only with reference to reliable data,' says Tecnon OrbiChem's global sales manager Matteo Baldi.

'It is true that the dynamics differ in every case point. Datasets, including current, historical price points – even price predictions leveraging future crude oil scenarios – trade flows and production capacities globally are solid frameworks. Those contexts allow decision-makers to gauge the likelihood of success.

'Whether you are a producer seeking new outlets for your products, buyers keen to secure supply, or considering investing to plug a gap in the market, our data will inform your strategy.'

A decade of warning

It is exactly a decade since the chairman of one of the world's largest chemical companies Jim Ratcliffe of Ineos began urging European politicians to wake up to the 'competitive onslaught' from America, the Middle East, and China. 'Strategically, and economically, no large economy should abandon its chemical industry,' he told EU Commission President José Manual Barroso in an open letter.

But despite Ratcliffe's bid to protect Europe's chemicals industry, the firm was forced to close its phenol and acetone facility in Antwerp, Belgium as 2022 ended. The decision removed 420 ktpa capacity from European markets.

Around the same time as the INEOS plant shut, the European Chemical Industry Council (Cefic) pointed to a periodic shift in the continent's status from a net exporter to net importer.

The transition, according to the organisation's position paper Energy Crisis: the EU chemicals industry is reaching breaking point resulted in a trade deficit of € 5.6 bn during H1 2022.

...Competitive imports of PMMA polymer – priced not much higher than the starting materials for MMA – killed margins from MMA yielded in Europe...

Tecnon OrbiChem consultant Jaroslaw Cienkosz

UK methyl methacrylate loss

Mitsubishi Chemical UK's plan to cease methacrylates production at the Billingham, Teesside site ICI started up almost a century ago may be a blow to the UK manufacturing infrastructure, but to the methyl methacrylate (MMA) sector today, the closure has not meant much.

Our Europe-based consultant Jaroslaw Cienkosz highlights what was a 'great MMA oversupply scenario on a global level'.

'The collapse in extraordinary Covid-related demand for PMMA sheets after we removed protective screens from our lives, plus the recession affecting seasonality in coatings specifically this year' triggered an oversupply.

'Europe has been flooded with competitive imports of both MMA monomer and PMMA polymer. The latter – priced not much higher than the starting MMA – killed margins from MMA yielded in Europe. When Mitsubishi's Cassel site first closed in January 2022, it did so without significant impact.

'And Europe's MMA producers reduced operating rates in mid-2022,' Cienkosz adds.

A structured basis loss

On a structured basis, the missing 200 ktpa MMA from the Cassel site is a significant loss for the region, explains Cienkosz. 'It's roughly a third of domestic capacity – 610 ktpa it was before the closure.

On a structured basis, the missing 200 ktpa MMA from the Cassel site is a significant loss for the region, explains Cienkosz. 'It's roughly a third of domestic capacity – 610 ktpa it was before the closure.

'Pre-pandemic imports of MMA were 440 ktpa (in 2019) and 2023 imports of 124 kt until May inclusive. With those figures, it is easy to understand the weight of that asset in a normal and abnormal market environment.

'Certainly, it all means increased dependence on foreign supply, being subject to those international lead times. This is and should be, something European governments are rethinking after the supply chain crisis and tensions with Russia,' Cienkosz (pictured right) adds.

Plants in shutdown/start-up loop

Handsome Chemical Group shut down its 250 ktpa ethyl acetate plant in Jiangmen, Guangdong in Q1 2022. The firm's new 300 ktpa Zhuhai, Guangdong-based ethyl acetate plant came onstream simultaneously.

While China's Bosai Group shut down its first alumina plant – the Chongqing-based Nanchuan Xianfeng Alumina – after 20 years of operation in March 2022, the firm replaced it with a new 3600 ktpa plant in Chongqing Wanzhou. Annual capacity is due for expansion to 5600 ktpa within two years.

Tecnon OrbiChem's China-based consultant Lulu Zhao (pictured left) says Chongqing Wanzhou is repositioning its offering in terms of the environmental protection measures its advanced production technology provides. The company now claims to have the lowest comprehensive energy consumption and emissions among its industry counterparts in China, says Zhu.

Tecnon OrbiChem's China-based consultant Lulu Zhao (pictured left) says Chongqing Wanzhou is repositioning its offering in terms of the environmental protection measures its advanced production technology provides. The company now claims to have the lowest comprehensive energy consumption and emissions among its industry counterparts in China, says Zhu.

Energy costs

In Europe, high energy costs – as opposed to emerging technologies to make smelting more sustainable – have triggered plant closures. Among them, are Slovakia's Norsk Hydro and Speira in Rheinwerk, Germany. Both companies shut down aluminium plants in 2022.

At the close of 2022, speciality material solutions provider Trinseo announced the shutdown of its styrene production facility in Boehlen, Germany. The firm indicated that its uncompetitive positioning within the global styrene market was down to the plant's size. However, industry capacity additions and elevated natural gas prices in Europe were also cited as reasons for the closure. At the same time, the firm announced it would close a polycarbonate (PC) production line in Stade, Germany.

Within months the company started up a PC dissolution pilot facility in Terneuzen, the Netherlands. Its press release outlines Trinseo's plan to make new recycled polymers by extracting old polymers from post- or pre-consumer products – such as automotive and consumer electronics - containing PC.

Read our blog post Synthetic fibre market outlook for 2023 & 2022 review.

A sliding scale of closures

There have been temporary and/or partial plant shutdowns in the European orthoxylene and phthalic anhydride market. These stoppages have arisen due to the recent production cost issues versus the struggling economy and sustained weak consumer demand situation over the past year or two.

China's phthalic anhydride (PA) market had already undergone a certain degree of restructuring when, in 2021 Shandong Hongxin Chemical Industry closed a 150 ktpa capacity phthalic anhydride facility it started up in 2000. The company's OX-PA and naphthalene-based phthalic anhydride (NA-PA) output capacity is now 110 ktpa. The production split from Shandong Hongxin Chemical Industry's new plant is 60 ktpa for orthoxylene-based PA and 50 ktpa for NA-PA.

In South Korea's phthalic anhydride market, Hanwha Solutions shut down its 75 ktpa PA capacity at the close of 2022. The firm blamed poor market conditions for the decision to cease PA production at Ulsan permanently.

Maleic anhydride

Maleic anhydride

Producers of maleic anhydride (MA) globally are unlikely to be running full production schedules during 2023. In China, some benzene-based MA plants have been idle since 2022 due to high feedstock costs. Our China-based consultant Shirley Zhao (pictured left) says they are awaiting a restart opportunity.

In addition to this, Tecnon OrbiChem contacts along Asia's PBT and BDO value chains have talked of MA plants running intermittently due to high costs and low demand. Our eBook

In Europe, Oxxynova announced the shutdown of its dimethyl terephthalate (DMT) production site in Germany. The company's entire industrial site remains on a stand-by mode effectively as of February 2023, according to its website. DMT is used to manufacture polyethylene terephthalate (PET) for fibre, film, container plastics, and speciality plastics applications.

A polyester fibre staple sector facility, Advansa's 40 ktpa plant in Uentrop-Hamm, Germany – had been earmarked for closure in mid-2023. The plant got an eleventh-hour reprieve from the process when Germany's STW Kautzmann stepped in and took over its essential assets.

In Ukraine, Karpatnaftochim shut down production in February 2022 as Russia declared war on the sovereign state. The company produced EDC, PVC, HDPE & VCM.

Meanwhile, a speciality chemicals plant owned by US-headquartered Lubrizol announced its closure back in 2022, Warwick Chemicals - which is in Wales, UK – will be hoping for the resolution offered to Germany's Advansa Manufacturing following its filing for insolvency.

Poor profit

Poor profits from the production of carbide-based PVC have been blamed for what will potentially be the temporary closure of Henan Shenma Chlor-Alkali and Hunan Hengyang Jiantao Chemical. However, it is believed these plants may not restart in the short term if PVC market prices will remain at low levels.

South Korea's Capro Corp began turnarounds for its caprolactam output in Ulsan in early April 2023. Initially, restart was expected for the end of June 2023. Driven by the continued demand slowdown in the nylon industry, the firm has rescheduled the restart for the end of September.

Soft epoxy demand compelled Olin to cease all operations at its solid epoxy facilities in Gumi, South Korea, and Guaruja, Brazil, according to its March 2023 press release.

Our 20-strong team of global consultants canvass a large pool of industry participants to set benchmarks for the prices of over 70 chemicals.

Our team collects and collates data and viewpoints on chemicals markets, ranging from observations on current conditions to decades-long visions for the future.

Tecnon OrbiChem's chemicals data intelligence platform, OrbiChem360, is continually updated with key information related to events, decisions, and incidents that impact the supply chains that underpin the petrochemicals, fibres, plastics, and biomaterials industries.

As and when our consultant team is made aware, they update the OrbiChem360 platform with for production capacities and outputs for key chemicals across the chemicals and intermediates spectrum.

OrbiChem360 leverages the knowledge and insight accrued from its monitoring of the chemicals sector across six decades.

The platform also draws on data from our partner GlobalTradeTracker. We convert thousands of international trade flow data points into highly visual graphics and tables in real-time every week.

The one-minute video above outlines the benefits of an OrbiChem360 subscription. For a demonstration of how Tecnon OrbiChem's insights into global chemicals markets can inform your business, hit the button below.

To access the free-to-download eBook, click this link here, fill in the form and we will send it direct to your inbox.

![[Video] Molecules to Markets Episode 2: Electrification, Interest Rates, and Emerging Chemical Market Upside](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-2-CHEMICAL%20PRODUCTS%20SOCIAL%20SPEAKER%20HIGHLIGHT.png)