2 min read

Unlocking Opportunity in Corrugated Packaging: What Market Participants Must Know

Trip Jobe

:

Jun 13, 2025 9:50:32 AM

Trip Jobe

:

Jun 13, 2025 9:50:32 AM

The corrugated packaging industry continues to grow, driven by steady demand from e-commerce, increasing sustainability requirements, and ongoing shifts in global supply chains. Those evaluating opportunities in this market must focus on more than containerboard production—they need to understand the full value chain.

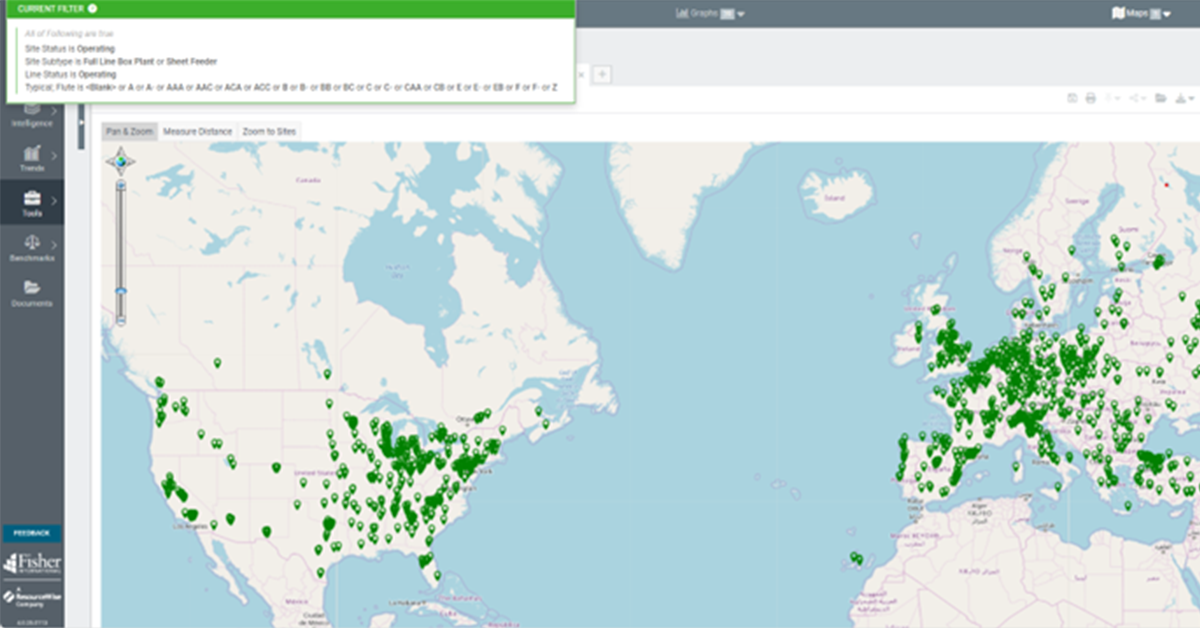

FisherSolve’s Corrugated Module, developed by ResourceWise, provides detailed insights into the box plants’ downstream of containerboard mills, offering a comprehensive view of how containerboard capacity, corrugator infrastructure, and cost structure interact. This data is essential for evaluating asset performance, identifying market opportunities, and supporting investment strategies.

Corrugators’ Role in the Containerboard Market

While global containerboard production has expanded in response to packaging demand, most of the press and box contracts focus on linerboard mills and pricing. Downstream, both integrated and independent box plants shape this large market. Every year more suppliers try to break into this growing market and buyers of corrugated boxes look for more custom solutions and lower costs.

Corrugators are critical assets in the value chain. Which begs the question: how can anyone in the value chain better assess the opportunities to enter, or enhance their position in the corrugated box market?

- For investors, it is important to assess whether existing or target assets are positioned to handle board conversion efficiently. This includes understanding geographic proximity between mills and box plants, integration levels, and throughput capabilities.

- For suppliers, it is important to understand where all the box plants are located, their asset structure, and capacity. We often find that new suppliers know where the integrated plants are located but miss the nearly 500 independent converters in North America and Europe.

- For corrugated box customers, understanding cost structure can be important in negotiating contracts that aren’t based solely on linerboard pricing.

FisherSolve: The Strategic Advantage for Market Participants

Investors, suppliers, and customers navigating this complex terrain need more than macro forecasts—they need granular, plant-level intelligence.

FisherSolve's Corrugator Module delivers precisely that. It allows users to:

- Assess Corrugator Infrastructure: Know how many corrugators exist globally, where they are, what equipment they possess and when it was installed.

- Link Mill and Converting Capacity: Analyze the physical and commercial flows between containerboard mills and corrugating plants.

- Map Conversion Bottlenecks: Identify geographies where excess containerboard capacity lacks adequate downstream conversion.

- Benchmark Operational Efficiency: Compare energy use, chemical and paper costs, and technology deployment across regions or companies.

Strategic Success Begins with Better Data

The corrugated packaging market in 2025 presents a clear growth opportunity—but also requires a detailed understanding of the supply chain from board production to box delivery.

FisherSolve enables investors and operators to make informed decisions based on accurate, comprehensive market intelligence. As corrugated continues to evolve, data-driven strategies will be essential for success.

For further information about our Corrugated Module, download our comprehensive brochure.