Download a free sample today

A-Z Guide:

ESG Reporting and Compliance Simplified

Our expert guide helps navigate ESG reporting and confidently meet mandates.

ESG REPORTING KNOWLEDGE FROM INDUSTRY VETERANS.

The commitment to achieve net-zero carbon emissions comes with major challenges and presents uncertainty. From reporting and compliance to minimizing operational costs, partnering with an expert is pivotal.

The A-to-Z Guide: ESG Reporting Landscape will strengthen your knowledge and understanding of ESG reporting frameworks, providing actionable intelligence for informed, confident business decisions. With a clear view of the ESG reporting landscape, you can establish a cost-effective decarbonization strategy that meets ESG regulations and mandates.

What’s Inside the Guide

- What is ESG Reporting?

An overview of the core elements comprising Environmental, Social, and Governance topics. - What is Materiality (Financial and Impact)?

Understanding the concepts that may affect a company’s overall performance in light of ESG considerations - ESG Reporting and Performance

A look at how proper ESG reporting contributes to a business’s competitive position - Standards, Frameworks, and Principles

Key ratings and assessment agencies driving standardization and their interplay within business materiality - Investment, Performance, and Risk

How investor and customer demand impact ESG disclosures and performance - ESG Reporting Trends

The scope of ESG disclosures and their application to businesses - Proposed Expansion to ESG Reporting Rules

Overview of proposed SEC, ISSB, and CSRD disclosure reporting rules - Science Based Targets Initiative

Summary of SBTi’s decarbonization best practices for targeting and achieving evidence-based emissions reductions - Futureproofing Your Business

How quality data drives business success in an emerging low-carbon economy

Download a preview of the A-Z guide.

Bundle Offer: ESG A-to-Z Guide and Carbon Mitigator Subscription

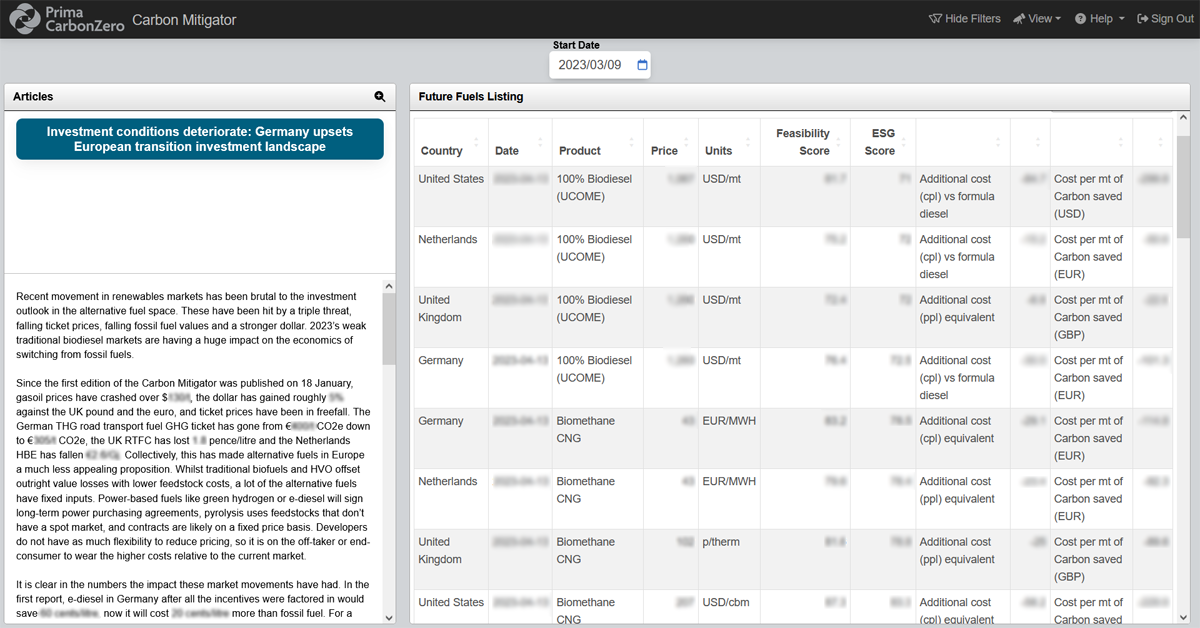

The ESG A-to-Z Guide is also available at a discounted rate when bundled with a subscription to the Carbon Mitigator in Prima CarbonZero, our biofuels and renewable feedstock pricing and analytics platform.

The Carbon Mitigator delivers a comprehensive solution for critical pricing data, expert analyst insights, and trending news across the biofuels industry.

The report offers prices, ESG feasibility scores, and other data on future fuels including sustainable aviation fuels (SAF), bio-bunkering price indexes, and more.

Market Insights

Track pricing, capacity, and trade on low-carbon fuels and monitor policies and market dynamics.

Planning for Future Fuels

Futureproof your operations with economics analyses, feasibility, and ESG scores of future fuels.

Established in 2014, Prima Markets is the leading research price benchmarking agency (PRA) in the expanding international market for low-carbon feedstocks and fuels.

An award-winning leader in low-carbon fuels and energy value chain research, they joined forces with ResourceWise in 2022. Prima excels in providing commodity price data, analytics, and strategic consulting services. Learn more about Prima Markets.

3 min read

Bio-Bunkering Market Implications After BlackRock's Panama Canal Deal

Mar 7, 2025 by ResourceWise

Frequently Asked Questions

-

What is ESG?

ESG stands for "environmental, social, and governance." In short, it identifies a broad set of various elements within business operations to measure its overall sustainability contributions and the impact of its operations on the world. ESG serves as a set of criteria to reflect responsible business operations in relation to global sustainability and the environment (E), company staff and the social community that surrounds a business (S), and corporate leadership's oversight and pursuit of positive growth and change in the world (G).

-

What is ESG reporting?

ESG reporting is a company’s disclosure of the data relating to each element of environmental, social, and governance. These disclosures reflect how a business is contributing to each area to produce a positive impact in the world. Reporting also improves operational transparency for shareholders, governmental entities, and the public alike.

-

What are ESG reporting mandates/requirements?

Current and upcoming regulatory requirements and enforcement will mean that companies must provide specific ESG data to remain in compliance. These requirements vary based on factors such as country of operation, industry sector, and markets where goods and services are provided.

-

When does my business have to begin reporting ESG and emissions data?

Mandated reporting requirements vary based on a business’s country of operation. Many countries already require specific ESG reporting, with further regulative enforcement rolling out through 2024 and 2025. Because these requirements change and shift so frequently, it is critical for businesses to keep up-to-date on their reporting.

To learn more about the current ESG reporting landscape, you can download a free preview of our ESG A-to-Z Guide.

-

What kind of ESG reporting does my business need to have?

The answer to this question varies based on multiple factors such as country of operation, markets served, and types of goods or services provided. Partnering with a market intelligence firm like ResourceWise can simplify the process of understanding and reporting to stay in compliance.

-

What is the SBTi?

The Science Based Targets initiative, or SBTi, is a joint collaboration between multiple institutes to help better define, promote, and pursue best practices for evidence-based emissions reduction and net-zero carbon targets. These targets align with the most current research and understanding of climate science.

The SBTi partners with businesses to help them understand and pursue attainable climate goals within their business operations. The organization has become globally recognized as a leader in decarbonization efforts for businesses.

-

What is happening with the SBTi?

Recent developments within the SBTi have caused confusion due to the ambiguity of the organization’s messaging on carbon credits. A disparity between official company announcements on potentially allowing carbon credits into corporate decarbonization plans and internal objections to them have directly contributed to this confusion. The ambiguity has created significant uncertainty and frustration for many businesses seeking a clear and grounded decarbonization plan.

-

What are Scope 1, Scope 2, and Scope 3 emissions?

Scope 1 emissions are direct carbon emissions coming from an organization directly, such as from burning fuel to power a factory or gas used in company vehicles.

Scope 2 emissions are indirect emissions from energy that a company uses in its daily operations. The emissions caused from the generation of electricity that a company uses to power its building is an example of Scope 2.

Scope 3 emissions are also indirect emissions that a company causes either up or down its value chain. Examples include capital goods and waste up the value chain or the use of sold products and the transport and distribution of goods down the value chain. Scope 3 emissions are much more challenging to account for than Scope 1 or 2 as a company neither directly owns nor controls how they are produced.

-

What are carbon credits?

Carbon credits are a trading mechanism to help offset carbon emissions without necessarily reducing or eliminating carbon output. Businesses can purchase carbon credits to offset their emissions, and those credits are then invested in other areas working actively to reduce or eliminate emissions somewhere else.

Carbon credits can be used for businesses that may not be able to directly or immediately decarbonize their operations but still need to find ways to lower their net carbon emissions at an organizational level.

-

Do carbon credits work to lower emissions?

Many corporations rely on carbon credits as one method to reduce emissions across their value chain—particularly for Scope 3 emissions. However, the validity and effectiveness of carbon credits remains controversial as many critics claim they do nothing to actually reduce or eliminate carbon emissions.

Part of the SBTi controversy speaks directly to this, with internal staff claiming that carbon credits are ineffective despite official company announcements potentially allowing them for Scope 3 emissions accounting. You can read the full story on the ResourceWise Sustainability blog.

-

What does my business need to begin decarbonizing?

ResourceWise has a wealth of materials to help your business through its transition to net-zero emissions. You can download our free eBook, Mapping a Path to Decarbonization, to get you started.