Prima Carbon Mitigator delivers critical market data, analysis, price points, and updates.

Support your organization's pathway to net-zero carbon emissions with Prima Carbon Mitigator, part of the Prima CarbonZero platform. With timely and accurate information, you can confidently plan, invest, and adopt your own carbon strategy.

![]()

Identify emerging biofuel trends to inform your decisions

Gain a complete understanding of current and future biofuel opportunities with a full-scale report of the renewables market—the first of its kind.

![]()

Achieve corporate decarbonization goals with targeted data

Monitor and assess your organization's progress toward achieving corporate decarbonization objectives.

![]()

Track ESG policies, regulatory news, and assessments

Ensure you're meeting all current and upcoming compliance enforcement using one platform.

![]()

Develop economic feasibility and ESG scores for smarter strategies

Understand future fuels' economic feasibility and ESG scores to make better decisions on your fuel adoption and investment strategy.

![]()

Receive news and updates to never miss out on what's important

Access trusted news, updates, and insights from our experienced analysts on the latest decarbonized fuel alternatives, trends, and data in this rapidly moving industry.

![]()

Simplify switching to renewables with fuel switch calculator

Track prices and identify savings opportunities when switching from traditional formula diesel to generation 1, 2, and future fuels such as UCOME, HVO, SAF, and biomethanol—with adoptability ratings, overall carbon intensity, and total carbon saved.

Renewable Fuels

- Green Ammonia

- Green Hydrogen

- E-Methanol

- Biomethanol

- Biomethane Compressed Natural Gas (CNG)

- Synthetic Natural Gas (SNG)

Green Diesel

- Wood Waste Pyrolysis Diesel

- UCOME 100% Biodiesel

- Plastic Pyrolysis Diesel

- Hydrogenated Vegetable Oil (HVO) Diesel

- E-Diesel

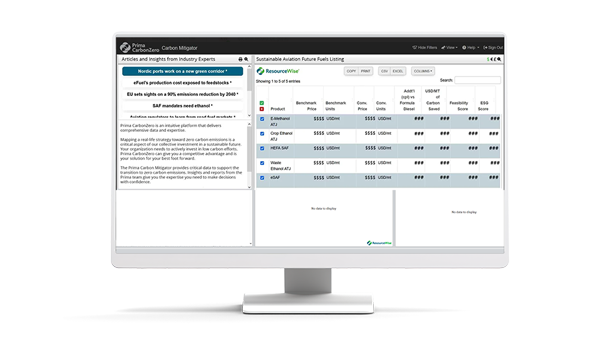

Sustainable Aviation Fuels (SAF)

- HEFA SAF

- Crop Ethanol Alcohol to Jet (ATJ) SAF

- E-Methanol ATJ SAF

- Waste Ethanol ATJ SAF

- E-SAF

High-Quality Pricing Data

Gain access to timely and accurate proprietary pricing data that reflect actual market conditions.

Actionable Expert Market Insights

Inform your decision-making with unparalleled market analysis from experienced industry experts.

Streamlined Analysis

Save time with customizable filters that allow you to quickly get to the information you need.

Ongoing Support

As your partner along your business’ decarbonization journey, our dedicated team is available to support you in achieving your net-zero goals.

Track by Industry

Monitor biofuels and renewable fuels across various industries, including:

- Agriculture

- Automotive

- Aviation

- Chemicals

- Manufacturing

- Energy

Access Quick Views

Filter low-carbon fuel data based on three fundamental fuel sectors, including:

- Aviation

- Marine

- Road based

Filter by Location and Geography

Get the data you need based on geography from countries like:

- United States

- United Kingdom

- Germany

- Netherlands

Customize and Save Views

Configure by industry, fuel type, and geography.

- Choose the view that works best

- Save your views for quick access

Consistently Expanding Covered Fuels and Feedstocks

We recognize the fast-paced, ever-changing nature of the low-carbon fuels market. Our team closely monitors the market, identifying new and emerging fuel technologies and enhancing our platform with data and analysis on the latest innovations.

Full Commitment to Unbiased and Accurate Reporting

We deliver unparalleled expertise in the information critical to your business’s current and future decarbonization success. We guarantee unbiased and accurate data, consistently evaluating the quality and fine-tuning the precision in our reporting. And we welcome input from our subscribers to enhance and broaden our market coverage.

Our team knows and understands how the biofuel and feedstock markets move. Our expertise means you can rest assured that you’re only getting the most accurate data and the most important news and insights for your business.

Frequently Asked Questions

-

What is ESG?

ESG stands for "environmental, social, and governance." In short, it identifies a broad set of various elements within business operations to measure its overall sustainability contributions and the impact of its operations on the world. ESG serves as a set of criteria to reflect responsible business operations in relation to global sustainability and the environment (E), company staff and the social community that surrounds a business (S), and corporate leadership's oversight and pursuit of positive growth and change in the world (G).

-

What is ESG reporting?

ESG reporting is a company’s disclosure of the data relating to each element of environmental, social, and governance. These disclosures reflect how a business is contributing to each area to produce a positive impact in the world. Reporting also improves operational transparency for shareholders, governmental entities, and the public alike.

-

What are ESG reporting mandates/requirements?

Current and upcoming regulatory requirements and enforcement will mean that companies must provide specific ESG data to remain in compliance. These requirements vary based on factors such as country of operation, industry sector, and markets where goods and services are provided.

-

When does my business have to begin reporting ESG and emissions data?

Mandated reporting requirements vary based on a business’s country of operation. Many countries already require specific ESG reporting, with further regulative enforcement rolling out through 2024 and 2025. Because these requirements change and shift so frequently, it is critical for businesses to keep up-to-date on their reporting.

To learn more about the current ESG reporting landscape, you can download a free preview of our ESG A-to-Z Guide.

-

What kind of ESG reporting does my business need to have?

The answer to this question varies based on multiple factors such as country of operation, markets served, and types of goods or services provided. Partnering with a market intelligence firm like ResourceWise can simplify the process of understanding and reporting to stay in compliance.

-

What is the SBTi?

The Science Based Targets initiative, or SBTi, is a joint collaboration between multiple institutes to help better define, promote, and pursue best practices for evidence-based emissions reduction and net-zero carbon targets. These targets align with the most current research and understanding of climate science.

The SBTi partners with businesses to help them understand and pursue attainable climate goals within their business operations. The organization has become globally recognized as a leader in decarbonization efforts for businesses.

-

What is happening with the SBTi?

Recent developments within the SBTi have caused confusion due to the ambiguity of the organization’s messaging on carbon credits. A disparity between official company announcements on potentially allowing carbon credits into corporate decarbonization plans and internal objections to them have directly contributed to this confusion. The ambiguity has created significant uncertainty and frustration for many businesses seeking a clear and grounded decarbonization plan.

-

What are Scope 1, Scope 2, and Scope 3 emissions?

Scope 1 emissions are direct carbon emissions coming from an organization directly, such as from burning fuel to power a factory or gas used in company vehicles.

Scope 2 emissions are indirect emissions from energy that a company uses in its daily operations. The emissions caused from the generation of electricity that a company uses to power its building is an example of Scope 2.

Scope 3 emissions are also indirect emissions that a company causes either up or down its value chain. Examples include capital goods and waste up the value chain or the use of sold products and the transport and distribution of goods down the value chain. Scope 3 emissions are much more challenging to account for than Scope 1 or 2 as a company neither directly owns nor controls how they are produced.

-

What are carbon credits?

Carbon credits are a trading mechanism to help offset carbon emissions without necessarily reducing or eliminating carbon output. Businesses can purchase carbon credits to offset their emissions, and those credits are then invested in other areas working actively to reduce or eliminate emissions somewhere else.

Carbon credits can be used for businesses that may not be able to directly or immediately decarbonize their operations but still need to find ways to lower their net carbon emissions at an organizational level.

-

Do carbon credits work to lower emissions?

Many corporations rely on carbon credits as one method to reduce emissions across their value chain—particularly for Scope 3 emissions. However, the validity and effectiveness of carbon credits remains controversial as many critics claim they do nothing to actually reduce or eliminate carbon emissions.

Part of the SBTi controversy speaks directly to this, with internal staff claiming that carbon credits are ineffective despite official company announcements potentially allowing them for Scope 3 emissions accounting. You can read the full story on the ResourceWise Sustainability blog.

-

What does my business need to begin decarbonizing?

ResourceWise has a wealth of materials to help your business through its transition to net-zero emissions. You can download our free eBook, Mapping a Path to Decarbonization, to get you started.