![]()

Get everything you need to know in one place

The A-to-Z Guide is a vital resource for ESG reporting with all the essentials your business needs.

![]()

Understand how ESG reporting will impact your business

Get critical information on the mechanisms of ESG regulations and how to accommodate them in your business planning.

![]()

Stay on top of the latest ESG trends

Learn how trending ESG requirements will likely affect your industry in the future.

![]()

Futureproof your business for sustainability

Develop an integrated sustainability and business strategy to ensure success in the future.

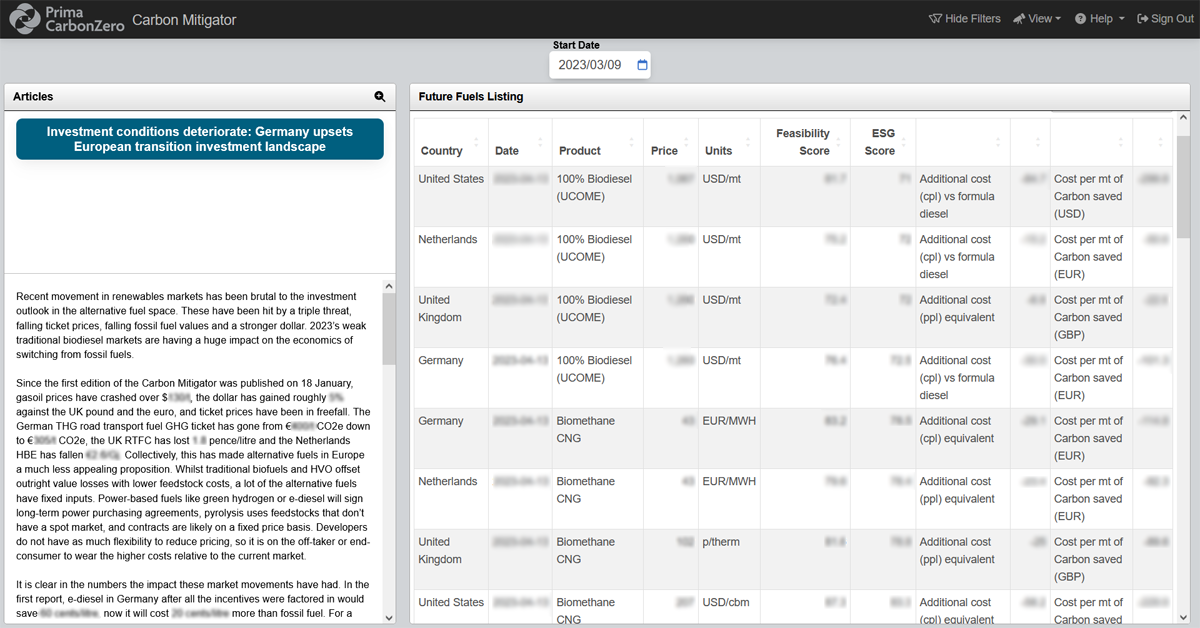

Also Available with our Carbon Mitigator Report

The A-to-Z Guide is also available with a subscription to the Carbon Mitigator report in Prima CarbonZero, ResourceWise’s biofuels and sustainable feedstock pricing and analytics platform.

The Carbon Mitigator delivers an all-in-one solution for critical pricing data, expert analyst insights, and trending news across the biofuels industry. The platform gives you the knowledge you need to plan and execute a successful decarbonization strategy for your business. Our key insights will ensure your business can confidently transition into a sustainable future.

Market Insights

Track pricing, capacity, and trade on low-carbon fuels and monitor policies and market dynamics.

Planning for Future Fuels

Analyze the economics, feasibility, and ESG scores of future fuels.

ESG Intelligence: Decarbonization Pricing and Insights You Can Trust

No matter where your business is on the decarbonization journey, the A-to-Z Guide provides you with a powerful starting point and continual reference as you move toward a net-zero carbon future. It’s the perfect complement to the data and insights available in the Carbon Mitigator.

Download a sample of the A-to-Z Guide: ESG Reporting Landscape today for a look at how ResourceWise can take your business even further.

3 min read

Bio-Bunkering Market Implications After BlackRock's Panama Canal Deal

Mar 7, 2025 by ResourceWise

Frequently Asked Questions

-

What is ESG?

ESG stands for "environmental, social, and governance." In short, it identifies a broad set of various elements within business operations to measure its overall sustainability contributions and the impact of its operations on the world. ESG serves as a set of criteria to reflect responsible business operations in relation to global sustainability and the environment (E), company staff and the social community that surrounds a business (S), and corporate leadership's oversight and pursuit of positive growth and change in the world (G).

-

What is ESG reporting?

ESG reporting is a company’s disclosure of the data relating to each element of environmental, social, and governance. These disclosures reflect how a business is contributing to each area to produce a positive impact in the world. Reporting also improves operational transparency for shareholders, governmental entities, and the public alike.

-

What are ESG reporting mandates/requirements?

Current and upcoming regulatory requirements and enforcement will mean that companies must provide specific ESG data to remain in compliance. These requirements vary based on factors such as country of operation, industry sector, and markets where goods and services are provided.

-

When does my business have to begin reporting ESG and emissions data?

Mandated reporting requirements vary based on a business’s country of operation. Many countries already require specific ESG reporting, with further regulative enforcement rolling out through 2024 and 2025. Because these requirements change and shift so frequently, it is critical for businesses to keep up-to-date on their reporting.

To learn more about the current ESG reporting landscape, you can download a free preview of our ESG A-to-Z Guide.

-

What kind of ESG reporting does my business need to have?

The answer to this question varies based on multiple factors such as country of operation, markets served, and types of goods or services provided. Partnering with a market intelligence firm like ResourceWise can simplify the process of understanding and reporting to stay in compliance.

-

What is the SBTi?

The Science Based Targets initiative, or SBTi, is a joint collaboration between multiple institutes to help better define, promote, and pursue best practices for evidence-based emissions reduction and net-zero carbon targets. These targets align with the most current research and understanding of climate science.

The SBTi partners with businesses to help them understand and pursue attainable climate goals within their business operations. The organization has become globally recognized as a leader in decarbonization efforts for businesses.

-

What is happening with the SBTi?

Recent developments within the SBTi have caused confusion due to the ambiguity of the organization’s messaging on carbon credits. A disparity between official company announcements on potentially allowing carbon credits into corporate decarbonization plans and internal objections to them have directly contributed to this confusion. The ambiguity has created significant uncertainty and frustration for many businesses seeking a clear and grounded decarbonization plan.

-

What are Scope 1, Scope 2, and Scope 3 emissions?

Scope 1 emissions are direct carbon emissions coming from an organization directly, such as from burning fuel to power a factory or gas used in company vehicles.

Scope 2 emissions are indirect emissions from energy that a company uses in its daily operations. The emissions caused from the generation of electricity that a company uses to power its building is an example of Scope 2.

Scope 3 emissions are also indirect emissions that a company causes either up or down its value chain. Examples include capital goods and waste up the value chain or the use of sold products and the transport and distribution of goods down the value chain. Scope 3 emissions are much more challenging to account for than Scope 1 or 2 as a company neither directly owns nor controls how they are produced.

-

What are carbon credits?

Carbon credits are a trading mechanism to help offset carbon emissions without necessarily reducing or eliminating carbon output. Businesses can purchase carbon credits to offset their emissions, and those credits are then invested in other areas working actively to reduce or eliminate emissions somewhere else.

Carbon credits can be used for businesses that may not be able to directly or immediately decarbonize their operations but still need to find ways to lower their net carbon emissions at an organizational level.

-

Do carbon credits work to lower emissions?

Many corporations rely on carbon credits as one method to reduce emissions across their value chain—particularly for Scope 3 emissions. However, the validity and effectiveness of carbon credits remains controversial as many critics claim they do nothing to actually reduce or eliminate carbon emissions.

Part of the SBTi controversy speaks directly to this, with internal staff claiming that carbon credits are ineffective despite official company announcements potentially allowing them for Scope 3 emissions accounting. You can read the full story on the ResourceWise Sustainability blog.

-

What does my business need to begin decarbonizing?

ResourceWise has a wealth of materials to help your business through its transition to net-zero emissions. You can download our free eBook, Mapping a Path to Decarbonization, to get you started.