1 min read

US Wood Pellets Gain Market Share in Europe as Russian Presence Drops

Håkan Ekström

:

February 9, 2023

Håkan Ekström

:

February 9, 2023

The costs of industrial wood pellets imported to multiple key European markets increased in 2022. Russia's current crisis has positioned the US in a highly strategic spot for imports.

The increase reflects several factors at play. And the lower spike in industrial prices reflects some optimism within the market.

Import Volume and Pricing Shows US Picking Up Russia’s Slack

70% of the total European industrial wood pellets import volume shipped to just four countries:

- The United Kingdom

- The Netherlands

- Denmark

- Belgium

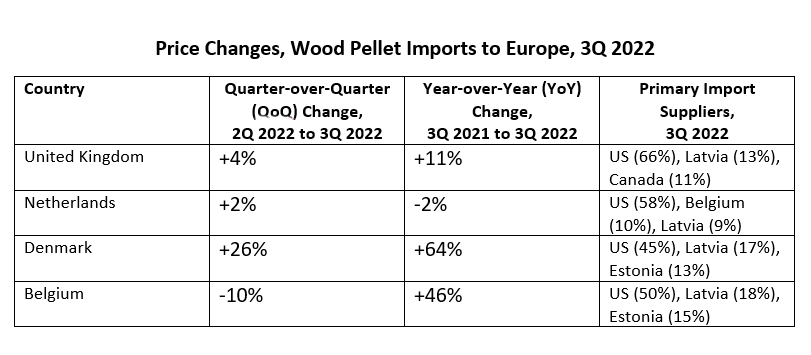

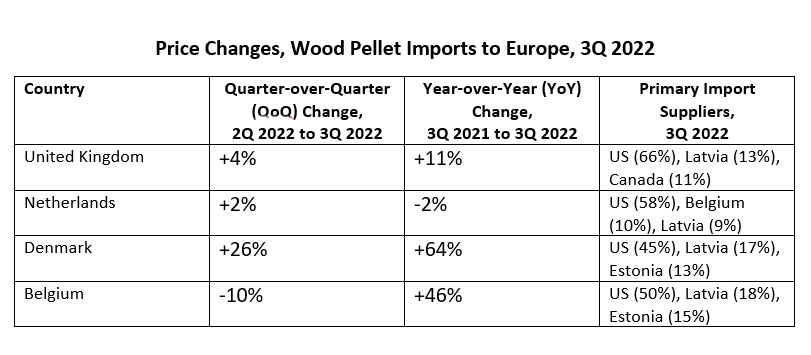

From a pricing point of view, imports saw cost jumps in most major reporting areas. The greatest price hikes occurred in Denmark and Belgium, with a 64% and 46% increase year-over-year, respectively (see table).

A few significant factors are contributing to these rises in prices:

- Boycott of Russian Imports

Russia historically has the lowest-priced pellets supplying European nations. The boycott comes on the heels of the Russia-Ukraine war. The Russian market share fell from 74% of total import supply in 3Q 2021 to 0% a year later in 3Q 2022.

Without this lower-cost source, prices inevitably rose.

- US-Based Agreements

Much of the rise comes from longer-term supply agreements with US pellet producers coming to harvest. This, combined with the removal of Russia as a source, drove the US share from 32% to 50% between 3Q 2021 and 3Q 2022.

Russian War Continues to Impact Global Wood Markets

Russia's invasion of Ukraine has resulted in a sharp decline in shipments of pellets from Belarus, Russia, and Ukraine. As a result, the total volume from the three countries is likely to fall an estimated 35% year-over-year.

Simultaneously, US pellet producers have increased their shipments to Europe. 2022 volumes are estimated at a record 8.6 million tons, up from 7.4 million tons in 2021.

WoodMarket Prices: Global Pricing Data You Can Trust

This Market Insights report is an excerpt from Wood Resources International, a ResourceWise company.

Our data and insights are now available as an interactive online business intelligence platform, WoodMarket Prices (WMP). The pricing data service, established in 1988, has subscribers in over 30 countries.

WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide.

WoodMarket Prices provides users with a highly valuable tool for all businesses seeking insights across the global forest industry. Schedule a demo today to see how WMP can work for you.