2 min read

US Forest Industry & Manufacturing Sector Continue to Expand

Joe Clark

:

October 28, 2021

Joe Clark

:

October 28, 2021

US forest industry performance in August and September was recently reported by both the US government and the Institute for Supply Management.

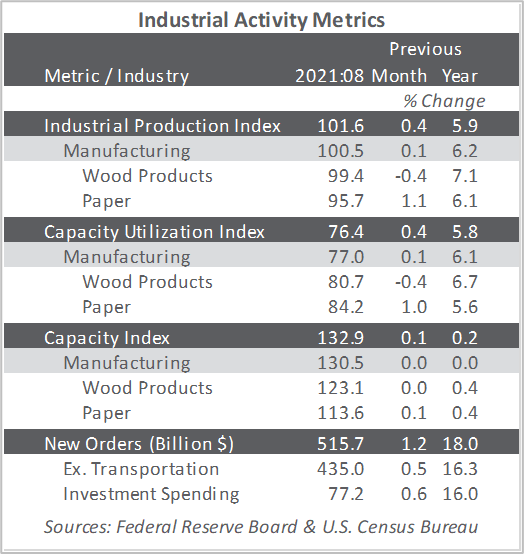

Total industrial production (IP) increased 0.4 percent in August (+5.9 percent YoY, and 0.3 percent above its pre-pandemic level). Although a deceleration from July’s 0.8 percent MoM jump, it marked the sixth consecutive monthly advance. Late-month shutdowns related to Hurricane Ida held down the gain in IP by an estimated 0.3PP. While the hurricane forced plant closures for petrochemicals, plastic resins, and petroleum refining, overall manufacturing output rose 0.2 percent. The output of utilities increased 3.3 percent, as unseasonably warm temperatures boosted demand for air conditioning.

Lumber’s precipitous price drop appears to have prompted solid wood manufacturers to reduce production and capacity utilization; both declined by 0.4 percent in August.

The Institute for Supply Management’s (ISM) monthly sentiment survey showed an increase in the proportion of U.S. manufacturers reporting expansion in September. The PMI registered 61.1 percent, a rise of 1.2PP from the August reading. (50 percent is the breakpoint between contraction and expansion.) The sub-indexes for slow deliveries (+3.9PP), order backlogs (-3.4PP), and exports (-3.2PP) exhibited the largest changes. Of the industries we track, Wood Products and Ag & Forestry contracted. Respondent comments included the following:

- Paper Products: “We are still amazed by the labor market. We used to have 100 applicants for an opening; we are now seeing about 10—and often, the applicant does not show for the interview.”

- Construction: “Constraints on logistics from a cost and availability standpoint continue to be an issue.”

- Real Estate: “Business volumes remain remarkably high, although material shortages persist.”

The consumer price index (CPI) increased 0.3 percent in August (+5.3 percent YoY) after rising 0.5 percent in July. The indexes for gasoline, household furnishings and operations, food, and shelter all contributed to the MoM increase. The energy index increased 2.0 percent, mainly due to a 2.8 percent increase in the gasoline index. The index for food rose 0.4 percent, with the indexes for food at home and food away from home both increasing 0.4 percent.

Meanwhile, the producer price index (PPI) increased 0.7 percent (+8.3 percent YoY), led by prices for final demand services (+0.7 percent)—in particular, a 7.8 percent rise in margins for health, beauty, and optical goods retailing. The index for final demand goods moved up 1.0 percent thanks to an 8.5 percent rise in the index for meats—although prices for residential natural gas, industrial chemicals, processed young chickens, motor vehicles, and steel mill products also contributed to a lesser extent.

In the forest products sector, price index performance included:

- Pulp, paper & allied products: 0.5 percent (+13.7 percent YoY)

- Lumber & wood products: -7.9 percent (+15.4 percent YoY)

- Softwood lumber: -27.3 percent (-9.8 percent YoY)

- Wood fiber: +1.1 percent (+12.7 percent YoY)