US forest industry performance in August and September was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) rose 0.4 percent in August (+4.9 percent YoY), its third consecutive monthly increase. Manufacturing output moved up 0.3 percent on the strength of a 4.0 percent rise for motor vehicles and parts; excluding the gain in motor vehicles and parts, factory output was unchanged. The output of utilities advanced 1.2 percent, and mining production increased 0.7 percent; the index for mining last decreased in January

New orders jumped by 2.3 percent, the largest increase in 11 months, mainly on a 69.1 percent surge in non-defense aircraft and parts. Excluding transports, new orders rose by a meager 0.1 percent (+7.7 percent YoY). Business investment spending tumbled by -0.9 percent (+7.5 percent YoY). The sharp drop in business investment was “disturbing,” Joel Naroff said, although he added “That component had been surging, so maybe a soft month here or there should be expected.”

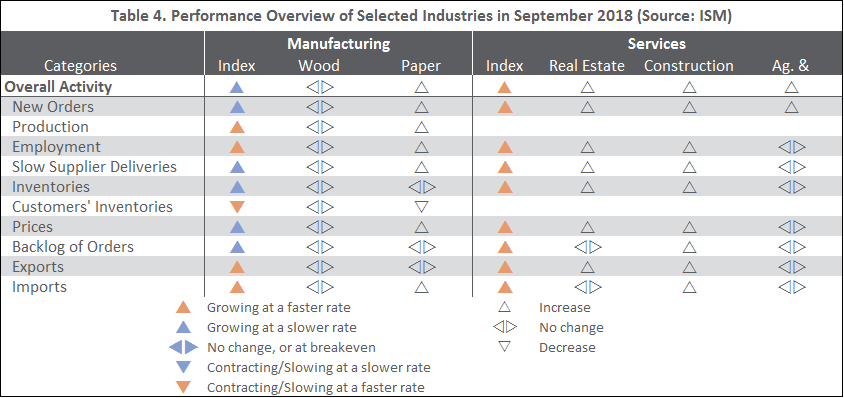

The Institute for Supply Management’s (ISM) monthly sentiment survey showed that the expansion in US manufacturing decelerated (-1.5PP) in September, to 59.8 percent. By contrast, the pace of growth in the non-manufacturing sector accelerated (+3.1PP) to a record-high 61.6 percent. Of the industries we track, only Wood Products (which went unmentioned in the report) did not expand. Respondent comments included the following:

- “New residential construction market is still strong, with a good backlog of orders. Labor shortages and tariffs on materials continue to negatively weigh on earnings.”

- Paper Products. “Sourcing hourly workers for remote locations continues to be a challenge for both full-time and part-time opportunities. Have implemented a wide variety of recruiting techniques and suppliers to aid us in sourcing this hard-to-find talent.”

The consumer price index (CPI) increased 0.2 percent in August (+2.7 percent YoY). Increases in the indexes for shelter (0.3 percent) and energy (1.9 percent) were the main contributors to the seasonally adjusted monthly increase in the all-items index. The index for all items less food and energy rose 0.1 percent (+2.2 percent YoY), the smallest monthly increase since April.

The producer price index (PPI) declined 0.1 percent (+2.8 percent YoY), thanks to a 0.1 percent decrease in prices for final-demand services (especially from a 0.6 percent drop in transportation and warehousing prices). The index for final-demand goods was unchanged.

Forest products sector performance included:

- Pulp, Paper & Allied Products: +0.2 percent (+2.4 percent YoY)

- Lumber & Wood Products: -1.9 percent (+6.5 percent YoY)

- Softwood Lumber: -9.6 percent (+5.0 percent YoY)

- Wood Fiber: +2.3 percent (+6.7 percent YoY)

Joe Clark

Joe Clark