2 min read

UPDATE: Wood Chip Prices Continue to Soar in the Pacific Northwest

John Greene

:

Nov 21, 2022 12:00:00 AM

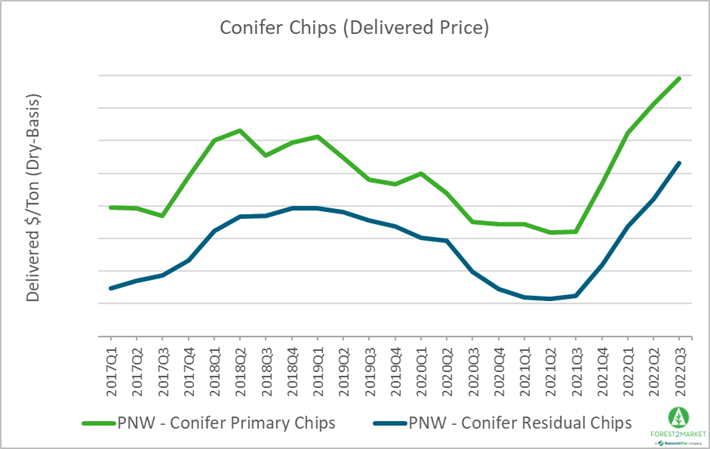

Conifer wood chip consumers in the Pacific Northwest (PNW) continue to find themselves in a tough situation, as a convergence of events has pinched supplies and driven prices to some of the highest levels since Forest2Market began collecting transaction-based data in the region more than 12 years ago.

Circumstances have resulted in a decrease in chip and log availability; strong demand and soaring chip prices have also impacted the regional pulpwood market, where prices are at a 10-year high.

However, there could be a light at the end of the tunnel.

What is driving the rapid change in the western chip market?

- The Weyerhaeuser labor union strike that began roughly 6 weeks ago has not only reduced sawmill chip availability on the market, but the company’s woodlands also haven’t been producing pulpwood that is traditionally sold to whole log chippers. However, Weyerhaeuser and representatives for the International Association of Machinists and Aerospace Woodworkers District Lodge W24 recently reached an agreement. Once these mills come back online, chip availability should increase in the coming weeks.

- Softwood lumber production in the west is down roughly 5% YTD, which has resulted in a decrease in residual chip supply and a decrease in log availability; when fewer sawlogs are harvested, pulpwood deliveries also decline correspondingly. Based on softening demand in the homebuilding sector, there have been recent announcements of sawmill curtailments in British Columbia (BC).

- Canfor said it is making moves to reduce about 200 million board feet (MMBF) of production capacity at its solid wood facilities in BC.

- West Fraser Timber recently announced it is permanently curtailing approximately 170 MMBF of combined production at its Fraser Lake and Williams Lake sawmills, and approximately 85 million square feet of plywood production at its Quesnel Plywood mill.

If curtailments also begin to develop on the US side of the border, the chip market will be under even more pressure as BC pulp mills inevitably try to dip into the PNW for chip imports.

- Log trucks are in short supply, loggers are struggling to keep their production moving once a logging site is finished, and transportation costs are sky high. With strained harvesting/trucking links, small logs may get left behind as crews seek to maximize harvest values via sawtimber.

Potential Solutions

For now, viable alternative solutions are few, and mostly rely on higher pricing to create incremental sources. Private forests unfortunately offer little volumes of unutilized pulpwood, as logs are smaller and there is less defect in today's second growth. But there are a couple of options worthy of consideration:

- Whole log chipping and/or buying sawmill residual chips from distant areas are potential options, though transportation costs may limit chip production in many areas. Depending on a consuming mill’s location, this could provide a temporary solution.

- There are millions of tons of dead and dying timber in the dry-side National Forests, and a concerted whole-log chipping effort could produce significant volumes of chips from these wood resources. However, trucking costs remain exorbitant, and operators are generally suspicious of the USFS and unwilling to risk a large investment when the government is such an unpredictable partner.

Both of these options may only be temporary solutions for those who are geographically advantaged in the region — and longshots for those who are not. However, the PNW forest industry is going to have to develop some creative methods to address regional fiber stressors since political obstacles continue to burden the entire supply chain.