2 min read

The Importance of Historical Data When Making Investments

Marcello Collares

:

Feb 1, 2024 12:00:00 AM

Marcello Collares

:

Feb 1, 2024 12:00:00 AM

Having the ability to strategically determine when and where to invest is crucial for business growth and maintaining a competitive edge. Leveraging historical data can serve as a guiding force in addressing these pivotal questions.

Historical data offers valuable insights into past trends, market behavior, and customer preferences. Such information enables businesses to identify patterns and make well-informed decisions based on concrete evidence rather than relying solely on intuition.

Developing Investment Strategies in the Pulp and Paper Industry with Historical Data

Analyzing data over an extensive timeframe allows companies to uncover patterns and anticipate upcoming market conditions. This knowledge proves particularly beneficial in the pulp and paper industry, where market dynamics are frequently shaped by various factors including environmental regulations, technological advancements, economic conditions, and global demand.

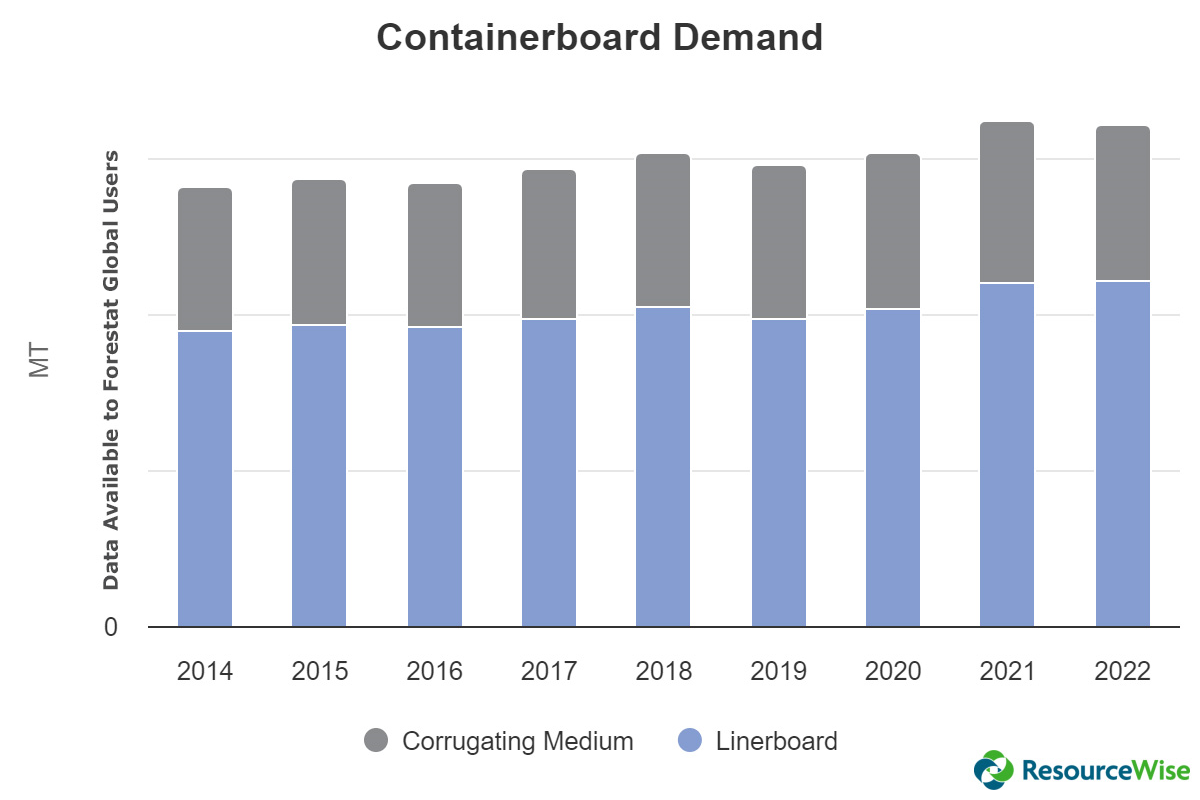

For example, let’s say company ABC wants to open up a containerboard mill in the United States. The first question they would likely ask themselves is what does demand in the containerboard sector look like in the United States?

When we take a look at the data found in ResourceWise’s Forestat Global platform, we can see that US demand is fairly steady, with slight dips now and then.

At face value, one could take this to mean that investing in a containerboard mill in the United States is pretty much a safe bet at any time. However, when we also look at the US GDP growth percentage, we can see that for the most part, when economic growth isn’t as strong as the previous year, demand dips.

US GDP Growth Percentage

Source: The World Bank

This information alerts decision-makers that investing in containerboard during strong economic times is likely to be the most beneficial move. However, it doesn’t just end there.

In addition, company ABC should also consider the performance of existing containerboard mills. It is important to note that even though there may be a gradual increase in demand, established mills may already be expanding their production capacity to meet the growing needs of the market.

Taking a closer look at the containerboard production history in the United States reveals just that. Each year, companies are not only meeting demand expectations but also producing roughly 12% more tons of containerboard than demand levels call for.

This information should provide company ABC with valuable insights, guiding them to either:

- Look at trading opportunities

- Look into other countries where production is not meeting demand levels

Diving Deeper with Market Intelligence

By harnessing the power of historical data, company ABC can unlock valuable insights that drive their decision-making process, leading to maximum return on investment. This invaluable information obtained from market intelligence tools is often accompanied by additional data sets that reveal further valuable insights.

By using ResourceWise’s Forestat Global platform, company ABC can also easily identify countries experiencing a shortage of containerboard production. This information opens up a world of possibilities for alternative investment locations, potentially leading to a more favorable outcome based on the market conditions.

Alternatively, if company ABC is determined to invest in the United States, they can explore the containerboard trade data of the country to gain comprehensive insights into the available choices and potential prospects.

Harnessing the Power of Forestat Global for a Competitive Edge

For businesses to thrive and stay ahead in the pulp and paper industry, having access to historical data and market intelligence is crucial. It provides them with a deeper understanding of the potential risks, market trends, and competitive dynamics. These insights allow them to develop a comprehensive and data-driven investment strategy.

By leveraging this valuable information, companies can expand their competitive footprint and make informed decisions that will drive their success in the industry.

ResourceWise's Forestat Global platform is our cutting-edge business intelligence tool that provides comprehensive market data and analytics for the forest products industry. Gain an enriched understanding of the dynamic market landscape and unlock valuable insights to drive your business forward. Learn more today and stay ahead of the competition.