2 min read

SYP Lumber Prices Hold Much Steadier Through Q1 2023

Forest2Market

:

Mar 23, 2023 12:00:00 AM

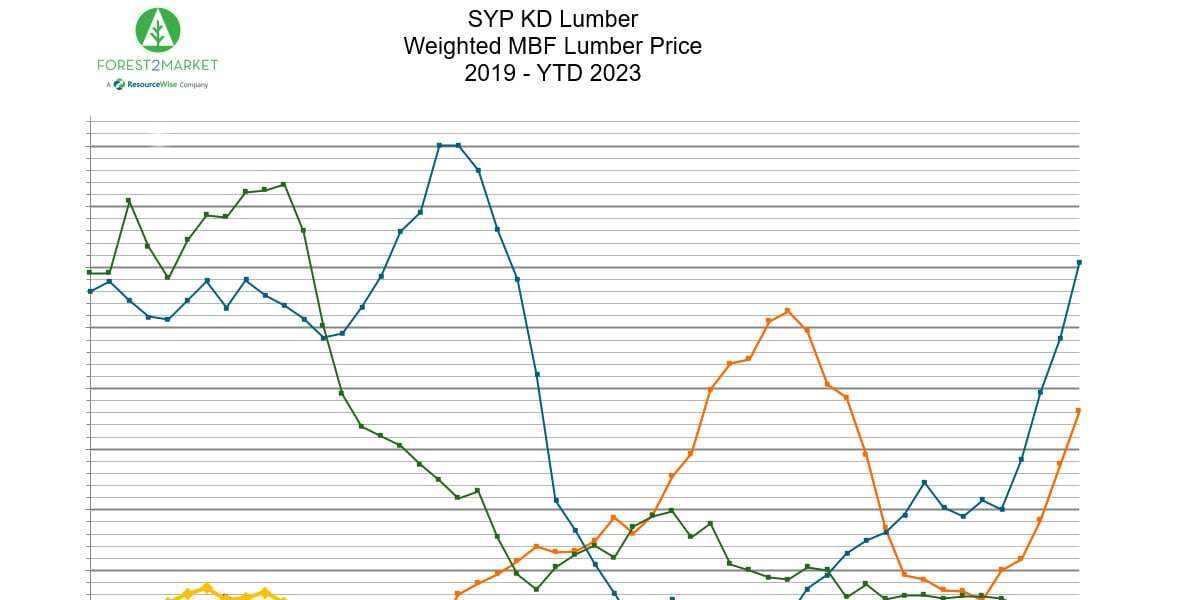

Weighted MBF southern yellow pine lumber has remained fairly steady thus far in Q1 2023. With the high variance in prices over the past several years, the steadying suggests some financial stabilizing within the recently volatile market.

According to data from Forest2Market, a ResourceWise company, prices have fluctuated within a $100 range since the start of 2023. The amounts are about 11% higher than both 2019 and 2020 prices.

Current prices also fall in stark contrast to the much less stable ones seen in 2022 and 2021. Both years started with prices far above current ones – about 42% higher, in fact. 2022 saw an immense decline after the current week of data (week 11), plunging 45% in the following 8 weeks.

As the above chart shows, volatility was the name of the game for SYP lumber prices in the previous 2 years. However, the current numbers are holding steady after hitting a Dec. 2022 low not seen since the pandemic first hit in 2020.

These drastic rises and falls in recent years seem to be calming thanks to several interventions to help curve the continuing rise in inflation. Other markets impacting southern softwoods have seen similar steadying across Q1 2023.

Housing Market Update: Finally Slowing Down?

Speaking of housing, check out the latest updates on the housing market courtesy of Forest2Market’s monthly Economic Outlook report.

After four straight months of declining housing starts (three months for permits), January results were expected to be more mixed—with permits rebounding by 1.5% but starts falling by 1.2%.

Forecasters were directionally correct but wrong in magnitude as starts tumbled 4.5% month-over-month (MoM) from December’s downward revision. Permits rose just 0.1% MoM after December’s 1.0% MoM (originally -1.5%).

Given the drop in starts, residential construction spending retreated by an unsurprising 0.6% MoM (-6.2% year-over-year). At the same time, the gain in home-improvement spending decelerated to +0.5% MoM (+15.3% YoY).

Analysts weren’t quite on-par with their predictions on January sales.

New-home sales were expected to nudge up by just 0.2% rather than the reported +7.2%. Resales were expected to break off their 11-month slide with a +2.0% rise. Instead, they posted a surprising ‑0.7% that compounded December’s downward revision from -1.5% to -2.2%.

The jump in new-home sales appears to be a function of builders using mortgage-rate buydowns to move inventory. However, home prices themselves appear to finally be slowing down somewhat since their meteoric rise post-pandemic.

Despite resilience in the new-home segment of sales, higher mortgage rates are among factors that have poured cold water on purchase sentiment and applications. And with the Fed eyeing yet another increase, an easing of the gas in the market is likely.

Banking Uncertainty and Financial Anxiety After SVB Collapse

While the market seems to suggest a stability trend, other economic factors may indicate otherwise. The failure of Silicon Valley Bank triggered some degree of a cascading effect in markets. It should surprise no one that a failure like this would cause some unease and anxiety both inside and out of banking.

Some analysts expect the news to serve as confirmation that a recession is likely happening. With banks and financial institutions on high alert, this could also mean more expensive loans, fewer approvals for mortgages, and other stressors on industries like forestry.

It is important to acknowledge that none of this is written in stone quite yet. The banking crisis is a very recent development to the time of this blog’s publication. Therefore, it remains to be seen how and where it will impact the market.

Forest2Market: Real-World Data and Forecasting Tools You Can Trust

Forest2Market will continue to monitor these economic factors and provide you with curated data relative to forest products and other markets.

Our commodity pricing and forecasting tools offer a wide range of global data significant to your business strategy. From pricing levels to benchmarks, we have you covered across all the critical areas of timber, lumber, pulp and paper.

Forest2Market’s products and tools can prepare your business to face whatever lies ahead in forestry. Contact our team to learn more about what we offer.