As 2022 presses onward, timber markets have experienced mixed growth in early 2022 with factors such as Russian instability affecting the global supply.

Global Timber Markets

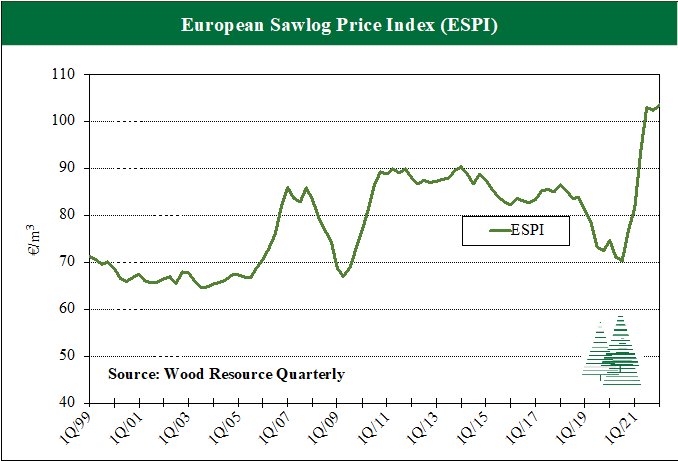

Global sawlog price changes were mixed in the 1Q/22 with q-o-q increases in North America and Eastern Europe, while prices declined in Central and Northern Europe.

The European Sawlog Price Index (ESPI) increased slightly in the 1Q/22 and reached a new all-time high, 27% higher than just a year ago.

Global trade of softwood logs slowed substantially in early 2022 because of reduced house construction and remodeling activities in Europe, North America, and Asia.

Global Wood Fiber Markets

Wood fiber costs for pulp manufacturing were up worldwide in the 1Q/22. The global wood fiber price indices (SFPI and HFPI) increased about 10% from the 1Q/21.

Global trade of hardwood chips rose in early 2022, driven by increased fiber demand by Chinese pulpmills.

Global Pulp Markets

Imbalances between supply and demand for market pulp have pushed pulp prices to record highs this spring.

China’s long period of increased market pulp imports came to a halt in 2021 and importation has continued downward in early 2022.

Global Lumber Markets

Global trade of softwood lumber slowed in early 2022, in particular to China, the US, and Germany. Import volumes were down in the range of 6-20% from the same period in 2021.

Lumber prices declined in the first few months of 2022 as demand fell in most major markets worldwide. Despite the reduced prices, current levels are still among the highest they have been in over 15 years.

The reduction in exports and limited opportunities to increase lumber sales domestically will likely result in reduced sawmill production in Russia for the remainder of the year.

Lumber prices in the US have fluctuated during the first half of 2022, from a high of $700/m3 (Southern pine) in March to a low of $325/m3 in early June. However, it is essential to note that even the low end of the price range is higher than prices were at any time before 2020.

Lumber exports from Sweden were 12.6 million m3 in 2021, down 10% from the previous year. Export sales shifted from China and the MENA region to Europe, while shipments to the US were unchanged year-over-year.

Global Biomass Markets

Global trade of wood pellets rose for the tenth consecutive year in 2021, reaching a record-high of 29 million tons.

Vietnam has rapidly become the premier source of wood pellets in Asia and was the world's second-largest exporter in 2021 with a 13% share of global trade.

This is a preview post of our Market Insights report from Wood Resources International (WRI). For the past 13 years, Wood Resources International has distributed Market Insights on a regular basis to over 8,000 forest industry executives, analysts, investors, consultants and journalists worldwide. These Market Insights have covered the most recent developments in regard to global wood supply, forest industry production, forest products trade, and pricing of sawlogs, pulpwood, wood chips, lumber and biomass.

Håkan Ekström

Håkan Ekström

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)