3 min read

Southern Timber Prices Continued to Climb in 1Q2022

Neila Cole

:

May 23, 2022 12:00:00 AM

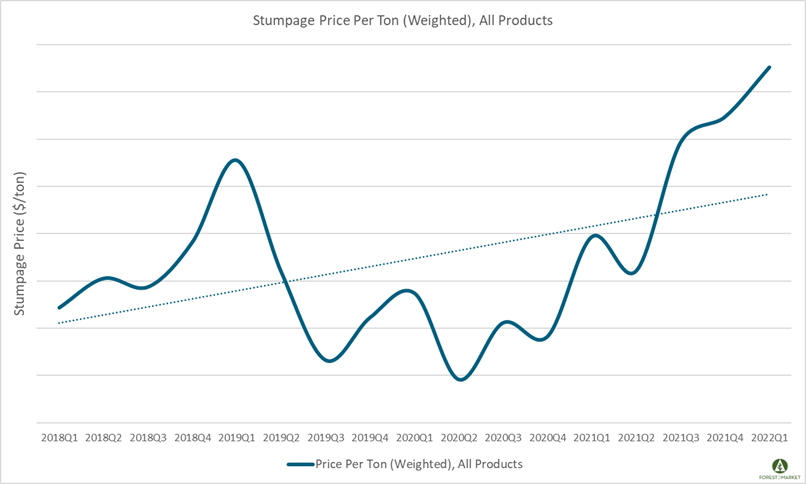

Continuing the strong demand trend that we witnessed during most of 2021, the weighted average price for southern timber surged to a new 15-year high in 1Q2022. Stumpage prices were up +5% quarter-over-quarter (QoQ) and +19% year-over-year (YoY). The last time Forest2Market’s Southwide weighted average stumpage price was this high was in 2Q2007, just before the onset of the Great Recession.

Pulpwood

A notable surprise in 1Q2022 was the collapse in pulpwood pricing—particularly the acute decrease in pine pulpwood (PPW) prices. Southwide prices for PPW plummeted -29% QoQ, as decreases occurred in all three regions for this product. Prices in the East-South were down -28%, prices in the Mid-South dropped -30%, and prices in the West-South declined -28%.

Though not as extreme, hardwood pulpwood (HPW) prices generally followed PPW performance in 1Q as prices for this product also dropped in all three regions. Southwide prices were down -5% QoQ. Prices in the East-South were down the most -25% percent, prices in the Mid-South dropped -16%, and prices in the West-South inched down by -1% QoQ.

Sawtimber & Chip-n-Saw

Conversely, prices for pine logs in 1Q2022 soared on a Southwide basis. Pine chip-n-saw (CNS) prices were up +26% percent QoQ as prices for this product were up significantly in two of the three regions. Prices in the East-South soared +36%, prices in the Mid-South jumped +21%, and prices in the West-South climbed +9% QoQ.

Southwide pine sawtimber (PST) prices also demonstrated a double-digit increase by jumping +11% QoQ as prices for this product increased in two of the three regions. Prices in the East-South were down -3%, but prices in the Mid-South were up +8% along with prices in the West-South, which jumped +7% QoQ.

After experiencing a significant uptick in 2Q and 3Q2021, Southwide hardwood sawtimber (HST) prices in 1Q were largely flat as they ticked up just 2.5% QoQ. Prices in the East-South jumped +20% and prices in the West-South inched up by +1%. However, prices in the Mid-South plummeted -14% QoQ.

Outlook

Total precipitation across the South was well below the 5-year average in 1Q, which provided some relief for harvesting operations that were washed out by constant rainfall in 3Q2021. However, precipitation levels have increased in a few areas over the last couple of months—especially in the Mid-South.

Finished lumber prices surged above the $1,000/MBF mark where they remained for most of 1Q2022 primarily due to strong demand, trucking and transportation bottlenecks, and pinched trade flows from Canada. Nevertheless, prices reversed course sharply in mid-March and have now dropped for eight consecutive weeks. Per Forest2Market’s southern yellow pine (SYP) lumber price composite, prices are now down 43% over the last two months and inflationary pressures, rising interest rates and economic concerns are causing trepidation in the new-construction market.

However, an interesting dynamic is taking shape in the Southern timber market. As we have predicted for some time, strong demand for pine logs—both PST and CNS—is impacting stumpage prices in many wood basins throughout the region. Håkan Ekström recently wrote that the forest industry expansion across the South will lead to tighter log markets in certain pockets and longer-term, the demand could overtake growth in some procurement areas unless the productive forest area expands, harvest yields improve, or access to small woodlots and underutilized forest increases.

Timber Owner Market Guide

While the southern timber market has been oversupplied for a decade, stumpage markets are growing increasingly volatile on a QoQ basis. Your timberland may be one of the most valuable investments you own and if your goal is to protect this important asset, Forest2Market’s Timber Owner Market Guide can help you:

- Track the value of your timber over the long term

- Read about best practices in managing timberland for incremental income, long-term investment purposes, forest health and recreation

- Stay up to date with the latest news affecting demand for timber in your local area

- Determine the value of your timber for tax and/or insurance purposes

The Timber Owner Market Guide is published bi-monthly (6 issues per year) and provides local pricing and trend information for pine sawtimber, chip-and-saw and pulpwood, as well as hardwood sawtimber and pulpwood in 39 unique micromarkets. Our easy-to-read guide provides detailed price charts, helpful tips and industry updates—all of the information you need to manage and sell your timber, preserve your legacy and protect your investment.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)