2 min read

Softwood Lumber Prices Tumble 40%; Is Another Rally on the Horizon?

John Greene

:

Jun 1, 2022 12:00:00 AM

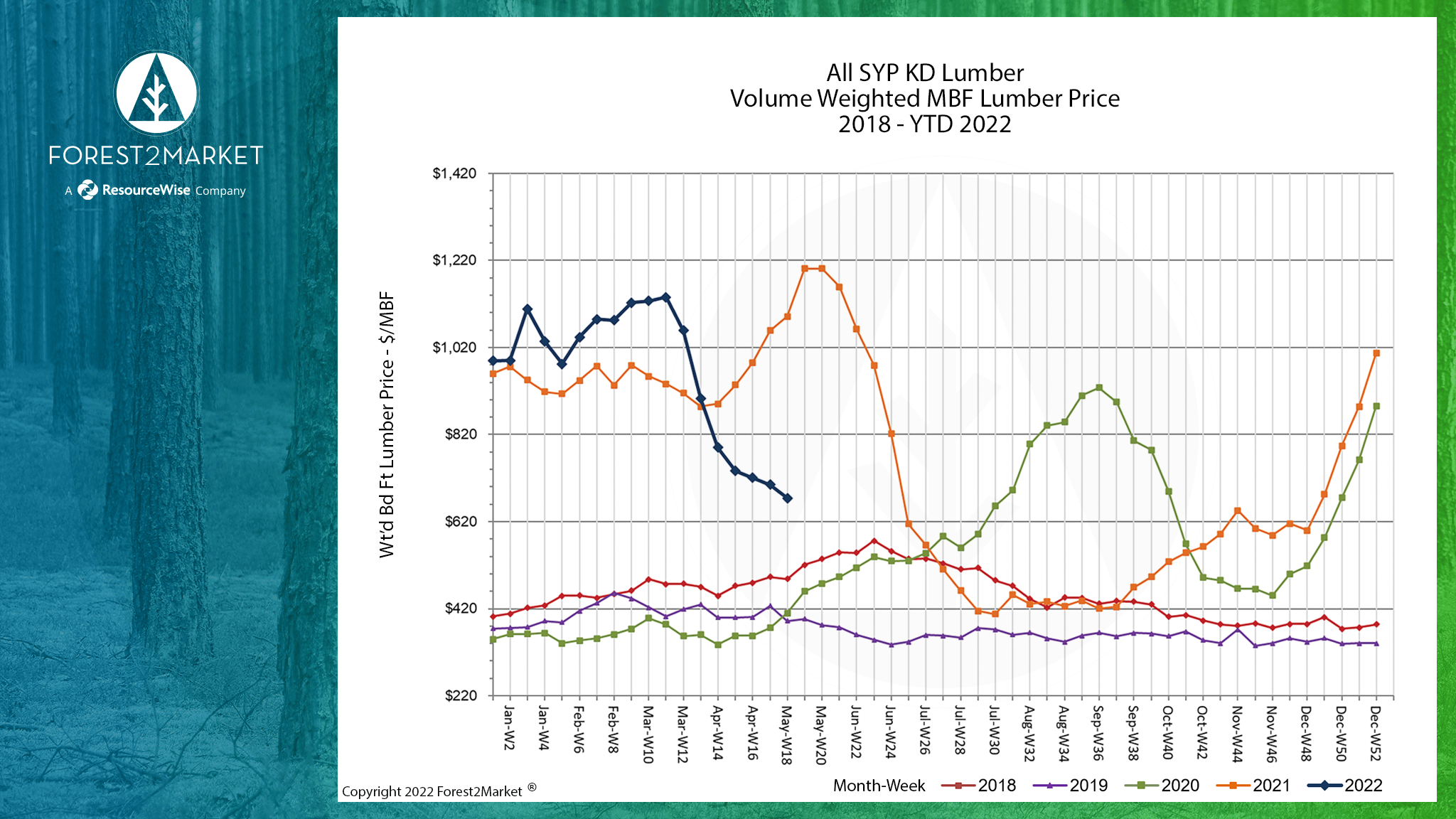

The volatile North American softwood lumber market continues to keep us all guessing as we enter mid-2Q2022. After spending most of 1Q above the $1,000/MBF mark, week-over-week southern yellow pine (SYP) lumber prices dropped dramatically throughout the month of April and into early May.

Forest2Market’s composite SYP lumber price for the week ending May 6 was $674/MBF, which represents a 41% decrease compared to prices just seven weeks ago ($1,136/MBF). A closer look at some of the price trends thus far in 2022 illustrates the volatility in the market.

- 1Q2022 Average Price: $1,036/MBF

- 2Q2022TD Average Price: $709/MBF

Economic & Housing Market Headwinds

At this point, the North American softwood lumber market has been stuck in a cycle of extreme peaks and valleys for nearly two years. While production was up in 2021, strong demand kept steady pressure on supply and prices have reflected a high degree of uncertainty into 2022. Recent challenges across the entire economy reflect this instability; skyrocketing interest rates and consumer prices, as well as an increasingly tight housing market suggest this trend is far from over.

With mortgage rates likely to continue an upswing, home values will eventually tip over and begin declining. To show the impact of rising rates on mortgage payments, consider March’s median new home price of $407,000. At the April average 30-year mortgage rate of 5%, the monthly payment to purchase the home is near $2,000 (assuming a 10% down payment and ignoring property taxes and other costs).

In addition to soaring interest rates, inflation is poised to take a more direct bite out of housing affordability. At recent inflation rates, the average US household will have to spend an extra $5,200 this year compared to last year for the same consumption basket according to analysts at Bloomberg Economics. Furthermore, “Accelerated depletion of savings will increase the urgency for those staying on the sidelines to join the labor force, and the resulting increase in labor supply will likely dampen wage growth,” they wrote.

That $5,200/year in higher household costs is equivalent to $433 per month. Extending the mortgage example above, if $433 is deducted from the $2,000 monthly payment at the 5% mortgage rate, it translates into a significant erosion of purchasing power—for both household items and home loans. Consumer sentiment reflects these concerns; respondents to the February 2022 University of Michigan Consumer Survey indicated the most negative expectation to their year-ahead financial situation since the late-1970s.

Of course, a cycle of perpetually rising costs is unsustainable for any economy. Pantheon Macroeconomics’ Ian Shepherdson is predicting a 25% retreat in the pace of home resales this year due to affordability issues, and such a drop would also spill over into the new-home sector. However, there are some potential positive offsets to watch in the near-term as well:

- Rising rates could pull demand forward, which could underpin near-term building activity.

- The pandemic has driven a shift towards remote work, which could facilitate migration from high-cost areas to low-cost areas where homeownership is more affordable.

- Lumber prices have plunged 40% from their recent peaks, which could help temper home-price increases if prices hold.

- Millennials—now in their prime home-buying years—will provide tailwinds to demand.

After seven straight weeks of price decreases (amid lower mill inventories), the NA softwood lumber market seems to have softened about as much as it can for now. While intensifying economic headwinds are making it increasingly difficult for prices to mount another abrupt rebound, data over the last two years suggests the lull may not last long.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)