6 min read

Reviewing ResourceWise's Predictions for the 2023 Pulp and Paper Industry

ResourceWise

:

Jan 25, 2024 12:00:00 AM

As 2023 has come to a close, it's time to reflect on the insightful predictions made by ResourceWise's VP of Global Sales, Matt Elhardt, for the pulp and paper industry in 2023. Let's take a moment to revisit these predictions and examine how they unfolded throughout the previous year.

Energy Volatility in Europe Will Create Winners and Losers

Energy prices have a significant impact on the production costs of pulp and paper as it's an energy-intensive industry. For many companies, the volatile energy prices we saw last year crept into production costs. And for many, this resulted in the closure of some mills.

Source: FisherSolve

At the beginning of last year, companies were facing a few key challenges, including:

1. How to optimize energy usage in a highly volatile market.

2. How to create long-term and short-term strategies to optimize profits in the future.

Those who are able to pivot to address these challenges will benefit from the situation and be the winners. Whereas those who can't may find themselves in high-risk territory.

While energy prices have come down from their 2022 highs, they are still substantially higher than before the Ukraine–Russia conflict. Average wholesale electricity prices are 300% higher in Italy for example than in the same period in 2020, per Statista.

The impact of soaring energy costs led to the closure of several European mills in 2023. Notable examples include the shutdown of Sappi’s Lanaken and Stockstad mill; Kübler & Niethammer Papierfabrik’s (K&N Paper) mill in Kriebstein; and Glatfelter’s Ober-Schmitten mill. These closures underscore the significant challenges faced by mills in the face of escalating energy expenses.

There Will Be an Increase in Capital Flows Into Wood-Based Biofuels

Wood-based biofuels have emerged as a promising and environmentally friendly alternative to traditional fossil fuels, capturing the attention of investors and companies worldwide. A groundbreaking moment in the adoption of sustainable aviation fuels (SAF) was recently witnessed when Virgin Atlantic successfully flew a Boeing 787 from Heathrow in London to JFK in New York, powered solely by SAF. This momentous achievement signifies a significant milestone in the widespread acceptance and utilization of renewable fuels.

Read more about it in our blog: First 100% SAF Flight, Airport Subsidies Show Strong Push to Renewables

This is a crucial opportunity for the pulp and paper industry as their manufacturing processes generate substantial amounts of wood residues and by-products that can be transformed into biofuels. This not only allows them to diversify their revenue streams but also presents valuable investment prospects for those seeking bio-based alternatives.

For instance, the extraction of crude tall oil from black liquor and the production of fossil-based products through the fiber-cooking process offer a multitude of applications. These bio-based alternatives hold immense value for companies looking to invest in sustainable solutions.

Another example is the extraction and refinery of biodiesel, methanol, and ethanol from the kraft pulp process to tap into a new revenue stream. Down the road, there may be other opportunities to capture biogenic carbon from pulp mill smokestacks to produce e-fuel.

Wood-based biofuels provide a dual opportunity for the pulp and paper industry as they offer a cost-effective alternative to the expensive kraft pulp process. However, it is important to note that these innovative processes are still in the early stages of testing and development, relying on emerging technologies for their implementation.

Throughout the year 2023, there was a notable surge in mandates and investments focused on biofuels. Among these initiatives were:

- Japan's 10% SAF Mandate: Japan announced its new regulation that aims to achieve a 10% SAF mandate for international flights out of Japanese airports by 2030. The target aligns with global companies' commitment to the Clean Skies for Tomorrow Initiative, which seeks to address the energy, infrastructure, and financing needs of the aviation industry's transition to net zero carbon emissions by 2050.

- Biden-Harris Administration's $11 Billion Funding for Rural Utility and Energy Providers: The US government administration unveiled a substantial allocation of nearly $11 billion in funding to support rural utility and energy providers. This financial support will be disbursed through grants and loans, facilitating investments in reliable and affordable clean energy deployment across rural regions.

- The EU's New Rules: In June of last year, the European Commission adopted new rules establishing the share of biofuels and biogas in mixed fuels. They are pushing now for a minimum 14% increase in transportation fuels by the goal year of 2030. This number includes at least a 3.5% share of second-generation biofuels.

Central Banks' Efforts to Rein in Inflation Will Slow Demand Worldwide

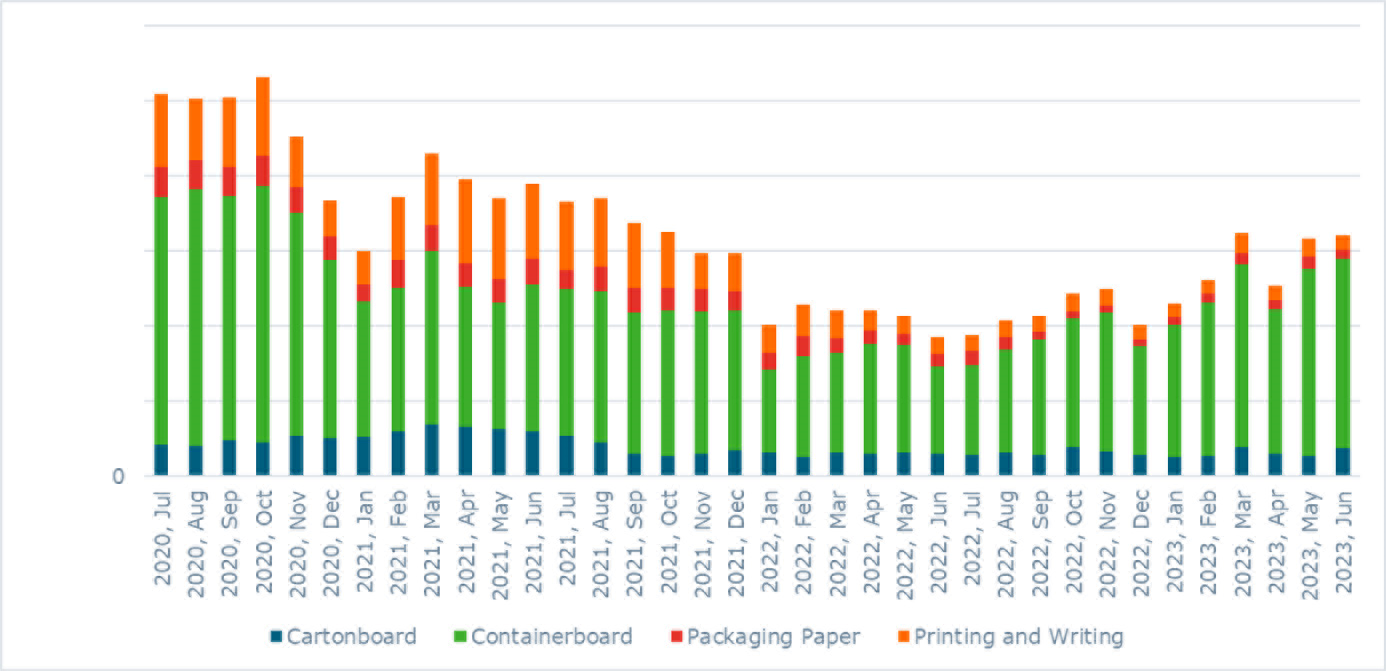

The global economy in the past year was less than impressive, with inflation, high interest rates, and geopolitical tensions significantly affecting consumer spending patterns and creating a challenging environment for businesses. For example, within the first quarter of 2023, the packaging market, containerboard demand, and consumer board all showed signs of decline.

The quarterly report released by the Brussels-based Bureau of International Recycling (BIR) in July highlighted the significant global challenges faced by the recovered paper industry. Francisco Donoso, President of the BIR Paper Division, attributed the current market state to a notable lack of demand, particularly in packaging materials due to reduced consumption of finished products.

Factors such as the financial crisis, high inflation rates, and the impact of the war in Ukraine have all contributed to this decline in demand. As a result, the economic conditions of different regions will play a crucial role in determining the state of the recovered paper market in those areas.

Chinese paper mills have been significantly impacted, currently operating at only about 70% of their capacity due to weak domestic demand and relying heavily on external markets. The struggling Chinese and European economies have encountered difficulties in recovering from the consequences of the pandemic. However, there is a glimmer of optimism as declining freight rates to Asia offer some respite in an otherwise weakened market.

The challenging economic conditions and reduced demand were key factors in the closure of several mills last year. There were several notable instances of mill closures, including:

- Pactiv Evergreen's Canton mill: The company's President and Chief Executive Officer Michael King commented, "As we continue to confront a challenging market environment for our Beverage Merchandising business, we are faced with these difficult decisions that directly impact our employees."

- Sonoco's Hutchinson mill: The closure of the 114-year-old OCC mill occurred due to softer economic conditions that reduced sales for Sonoco and other paper packaging producers.

- India's 20 mill closures in 1H2023: According to the Gujarat Paper Mills Association (GPMA), export challenges and excess capacity resulted in many paper mills in India temporarily halting production to resolve the imbalance between supply and demand.

In India, like many other Asian countries, the combination of a global recession and increasing inflation led to a significant decrease in demand, particularly for kraft and recycled board. As a result, prices took a sharp decline as exports for these grades plummeted. This unexpected shift in demand left countless Indian mills grappling with an overwhelming surplus of production capacity.

In a span of just two years, the exports from paper mills in Gujarat and Maharashtra took a significant hit, dropping from approximately 150,000 tons per year to a mere 30,000 tonnes. As a result, paper mills were compelled to operate at a reduced capacity of 50-60%, facing the challenge of managing their production with limited resources.

One or Two Pulp Mills in British Columbia Will Permanently Close

This forecast suggested that the permanent closure of one or two pulp mills in British Columbia was imminent due to a combination of long-term wood resource pressures, such as sawmill capacity shifting to the US South, and short-term factors like housing starts, along with a decrease in demand.

And we saw just that.

In 2023, Canadian company Canfor Pulp Products made the difficult decision to permanently close its Taylor Pulp mill in British Columbia. Despite exploring alternative options for the site, the company concluded that there was no viable path to resume production. The company stated this decision was in response to the long-term decline in fiber availability in British Columbia.

Recent Geo-Political Events Will Cause Executives to Rethink the Risk-Reward of Offshore Manufacturing

The recent surge of geo-political events has created rippling effects throughout the global economy, leaving many businesses questioning whether they should limit their interactions and trade exclusively with trusted allies.

Last year, we witnessed a trade decline. For example, China's imports were down last year by roughly 5 million tons. Is this indicative of deglobalization as some predict?

China's Imports of Paper and Board

Source: FisherSolve

According to numerous industry experts, the United States is currently experiencing the initial phases of a manufacturing investment 'supercycle.' In April 2023, US manufacturing construction spending soared to a 20-year peak, reaching an annual rate of $194 billion. Per the Federal Reserve, this was nearly double the $107 billion annual rate recorded just one year prior.

The surge in spending within the US has been fueled by legislative support for manufacturing and related projects. These include initiatives like the CHIPS Act, Inflation Reduction Act, and Infrastructure Law. However, another significant driver of this trend is the growing number of companies reassessing and restructuring their global supply chains in the wake of the pandemic and recent geopolitical disruptions.

A recent Business Journal article revealed that the US has attracted 23% of total foreign direct investment, a significant increase from the 15% reported just a year ago.

As global companies set their sights on the US, many are planning to establish large-scale facilities in the country. This growing trend is projected to continue over the next few years, bringing with it heightened demand for raw materials and a flourishing foundation of activity across diverse industries.

To check out our predictions for 2024, click the link below.

ResourceWise's 2024 Forest Products Industry Predictions

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)