2 min read

Record Share of Lumber Production Now in US South

ResourceWise

:

Apr 20, 2023 12:00:00 AM

For years, the US South has continued gaining market share of North American lumber production. That production has now hit record highs across a sea of decreased year-over-year numbers in the other North American regions.

New Highs Reflect Major Shift to US South

Lumber production was down year-over-year in three of the four major North American regions in 2022. Today, almost 38% of North America's lumber is currently produced in the US South.

This percentage represents a record-high share following 13 consecutive years with increased output from the region's sawmills. The US South has attracted producers from areas such as the US Pacific Northwest and Canada. Restrictions, increased costs and higher risks from wildfires prompted many companies to move operations to the southeast.

Lumber output has remained mostly stable in both the western US and Eastern Canada over the past decade. But sawmill closures in British Columbia have led to the total production in the province falling about 36% between 2013 and 2022.

The numbers show a significant push toward adopting the US South as the new “home base” for US lumber.

SYP Prices Unsteady Due to Economic Uncertainty

While lumber production and mill operation increased in the South, pricing has not followed such a linear path.

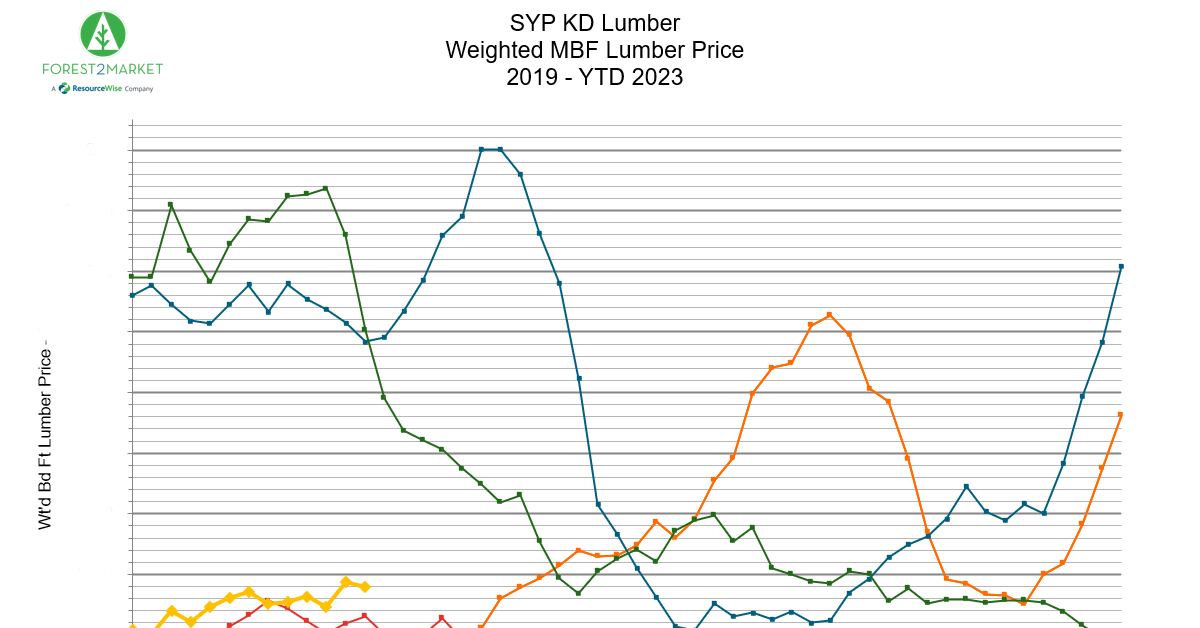

Southern yellow pine (SYP) prices ticked up slightly as 2023 started. However, economic volatility remained a concern for everyone throughout the value chain.

Continued interest hikes by the Federal Reserve were one of the major factors leading to hesitation. Additionally, ongoing murmurings of a recession may keep 2023 lumber prices muted through the quarter, according to Forest2Market.

Last year's highs and lows reflected an unstable pine market. After a 59% price plunge in June from a 2022 high, prices somewhat stabilized throughout September.

However, notable decreases in home starts and recession concerns caused lumber prices to fall again. By the end of 2022, SYP prices have continued their downward plunge. As the chart shows, however, there has been some movement upward through the first quarter of 2023 in SYP weighted MBF lumber price.

2023’s current pricing data hangs similar to 2019 and 2020—at least in comparison to the much more unpredictable 2021 and 2022. While much lower than the 2022 highs, current prices remained above cash costs for most sawmills in the region.

Lumber Production Down in Higher Cost North American Regions

In the other areas of North America where sawlog costs are higher than in the US South, many sawmills have curtailed production during the fall of 2022.

As mentioned, this was particularly true for the sawmill sectors in British Columbia and the US west coast. Many companies ran despite periods of sustained losses. Accordingly, we can probably expect a continued movement to the US South in North American lumber production.

Accurate Lumber Cost Tracking from WoodMarket Prices

Wood Resources International, a ResourceWise company, offers key insights, pricing data, and market intelligence for subscribers with its interactive online platform, WoodMarket Prices (WMP).

The pricing data service, established in 1988, has subscribers in over 30 countries. WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide.

The WMP platform provides a unique and valuable tool for every company and organization that requires updates on the latest developments of global forest products markets.

Learn more about WoodMarket Prices by following the link below.