6 min read

Predictions for the Global Forest Industry in 2022

Pete Stewart

:

Apr 1, 2022 12:00:00 AM

Pete Stewart

:

Apr 1, 2022 12:00:00 AM

Much like the previous year, the global forest products industry underwent significant changes in 2021 – some expected, and some unexpected. However, the industry as a whole remains solidly profitable and structurally sound despite changing demand patterns and supply chain strains that continue to be a source of frustration across the entire economy.

Most importantly, the forest value chain is well-positioned to play a critical role in a global future that is eager to embrace natural, sustainable, and renewable solutions that help mitigate the effects of climate change.

This is what forests and the forest industry do best, and this is the story we must continue to tell in 2022.

Predictions for 2022

-

Southern log market will pick up steam.

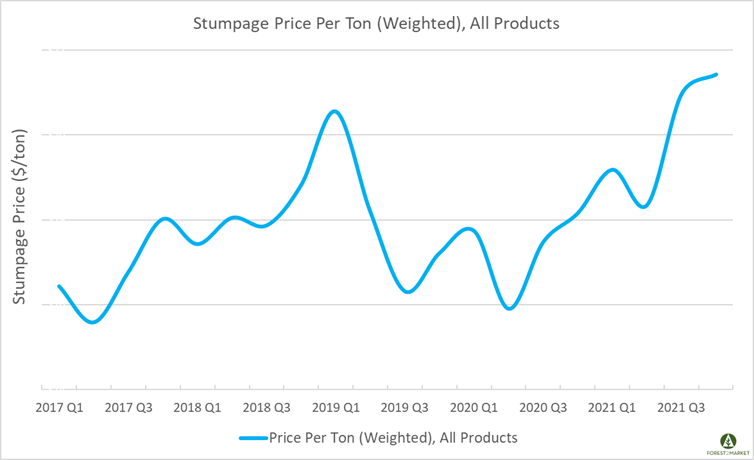

Led by near insatiable demand for small pine and hardwood logs, the weighted average price for southern timber surged to a 14-year high in 3Q2021. Stumpage prices were up +16 percent quarter-over-quarter (QoQ) and +22 percent year-over-year (YoY). The last time Forest2Market’s Southwide weighted average stumpage price was this high was in 4Q2007, just before the onset of the Great Recession. And the price run isn’t showing signs of subsiding anytime soon.

Southwide sawtimber prices jumped even higher in 4Q and that trend is poised to maintain pace through 1Q2022 as demand remains strong and new capacity comes online throughout the region. However, small pine logs continue to be the hottest products on the southern market. For instance, pine pulpwood prices in the South Georgia/North Florida market are now up 113% YoY, and CNS prices are up 57%. As we head into the winter months, we look for pockets of increased competition that will continue to impact regional log prices, as the wet period traditionally limits harvesting activity throughout the South.

-

The North American softwood lumber market will remain volatile.

Prices for North American softwood lumber surged to new highs in 2021 as a continuation of some of the mismatched supply/demand dynamics we saw develop in 2020. During 1H2021, the market struggled to find equilibrium as demand for lumber and panels intensified, wholesalers tried to play catch-up, and producers ran at max capacity in an effort to keep pace. This culminated in late 2Q, when prices for finished southern yellow pine (SYP) lumber peaked at a new record of $1,200/MBF.

Volatility crept back into the market in 4Q. British Columbia was pounded by relentless precipitation in November, which prompted a temporary halt in softwood lumber exports. Vancouver, for instance, broke records for the rainiest fall season (September to November) with 24” of precipitation (normal seasonal average is 14”). The Canadian National Railway—which transports forest products—was able to restart operations in early December but by that time, the flooding had already caused severe delays in shipments to the US.

The U.S. Department of Commerce also made an announcement in late 4Q that it will proceed with plans to impose (average) duties of nearly 18% on softwood lumber imports from Canada—nearly twice the previous rate of 9%. For those seeking reassurance and some kind of balance in the market, this announcement couldn’t come at a more inopportune time. It’s too early to tell how the DOC’s decision will impact US/CAN trade flows in 2022, but we expect continued volatility as the market tries to find its footing amid considerable pressures from nearly every angle.

-

US housing starts will be flat.

The prevailing wisdom for the last several years is that the housing market is undersupplied. The National Association of Realtors, for example, estimates an underbuilding gap of 5.5 to 6.8 million housing units since 2001. Soaring home values and the Millennial cohort reaching home-buying age are typical underpinnings for this argument. However, rising prices are beginning to throttle back demand; the median new home sale price in October was up +18.7% YoY to a new record of $408,800.

Some analysts believe the widespread supply chain disruptions have actually kept the market from severely overheating. “The supply chain bottleneck is at least acting like a regulator from the industry blowing itself up,” wrote Ivy Zelman. We take a more cautious approach to the housing market going forward. While there has indeed been a modest cumulative shortfall in construction over the last 20 years, the housing market is not currently at risk of a major contraction or expansion. Demand is strong but continued high prices will restrict expansion. We expect total starts in 2022 to average 1.579 MU (+1.0% from 2021).

-

Forest industry in the Pacific Northwest will continue to tighten.

The housing/remodel markets that have driven record prices for finished softwood lumber over the last year have kept regional lumber production strong and increased residual chip availability. However, prices for both primary and residual chips are at 10-year lows, suggesting that chip markets will remain soft. Domestic and export log prices have also dropped off over the last couple of months. This is a surprising trend, but it highlights a foundational challenge for the PNW’s forest industry: There is simply no opportunity for expansion. The regional market for public timber is hobbled, and the supply of private timber is largely maxed out. Unless more public timber becomes available to the market in the near term – which seems unlikely based on the current political climate - the forest industry in the PNW simply has no room to grow other than through acquisition.

-

Global supply chain and inflationary pressures will level off, but we’re not out of the woods yet.

The US inflation rate rose 6.8% in 2021, the highest increase since 1982. In a year-end analysis on the phenomenon, Morgan Stanley wrote, “In a typical economic cycle, this would be a clear signal for central banks to raise rates and pump the brakes on growth. Then again, this cycle has been anything but typical.” “Things are normalizing,” said Morgan Stanley's Chief Global Economist Seth Carpenter, “but they are not normal.” Indeed, global markets, economies, legislation, etc. have been so erratic for so long that we’re all beginning to forget what “normal” feels like.

One of 2021’s defining struggles has been stubborn global supply chain disruptions, which are a major driver of the inflation we have experienced over the last several months. While FED Chair Jerome Powell recently admitted that he jumped the gun in calling it a “transitory” challenge, he is in a bit of a pickle: He knows a material rise in rates would upend the stock market and broader economy, as well as dramatically impact debt payments in both the public and private sectors. Higher rates would increase debt servicing requirements and variable rate interest payments, which would reduce future productive investment, negatively impact housing, and trigger a rising deficit/GDP ratio as borrowing costs spike.

Ultimately, we believe the FED will allow inflation to run hot as a “least-worst” option for the time being. We look for a few (token) 0.25% rate hikes during 2022 under an assumption the FED’s hand will be forced by the pressure of rising prices. In 2022, we also expect broad QoQ fluctuations in CPI and PPI driven by volatility of the underlying macroeconomic trends and ongoing uncertainty. When all is said and done, however, CPI will average +4%, and PPI will average +5% overall.

-

The US dollar (USD) will maintain strength as a “safe” currency.

On the broad trade-weighted index basis, the USD strengthened by 0.9% against a basket of 26 currencies in November. The USD’s strength was attributed to a “flight to safety” as ongoing fear over the COVID-19 pandemic continues to rattle markets and—particularly for the CAD—impact oil prices. Looking forward, the CAD is poised to gain against the USD. The Canadian labor force participation rate recently hit a record high, and 3Q GDP figures indicated the economy grew at a SAAR of 5.5%.

Unless overtaken by geopolitical events, or fresh lockdown restrictions on economic activity are again imposed, the European Central Bank’s monetary policy stance will likely drive the EUR’s rate against the USD. Almost regardless of the scenario, we continue to see the EUR weakening against the USD. On balance, we expect the CAD to appreciate on trend within a range of C$1.177 to C$1.242; the EUR will depreciate in a range between €0.871 and €0.949.

-

ESG initiatives and impact investing will continue to shape global markets and policy.

As I wrote last February, paradigms and priorities continue to shift at an escalating pace as we enter into a renewed global century that demands increased alignment between civic, corporate, and environmental goals and responsibilities that transcend borders. For example, 71% of global fund managers representing $12.9 trillion in assets stated last year that the pandemic would lead to an increase in actions designed to tackle climate change and bio-diversity losses. Some of the world’s largest brands have committed to ambitious zero carbon targets including Apple, Amazon, Unilever, Starbucks, Nike, among others.

As the momentum behind this movement continues to gain traction, the question is no longer a matter of “if” carbon will hit manufacturers’ bottom lines, but “when” it will hit. Carbon costs are coming, and it is evident that optimized sourcing in the future will require consideration of both traditional and environmental costs.

The good news is that the entire forest value chain is poised to play an important role in developing both market and policy solutions in this new century. Obviously, keeping forestlands forested is integral to maintaining the cyclical nature and inherent value of forests, which act as the world’s most effective carbon sinks. But the wood that is harvested from working forests and subsequently used in a manufacturing process also imparts significant environmental benefits well after it is converted to other uses. Hundreds of products made from trees – lumber, OSB, plywood, cross-laminated timber (CLT), paper and furniture, to name a few – can sequester carbon for many years. Corporate leaders across the forest spectrum are in an excellent position to help frame the debate—and the policy—that will drive global climate change solutions going forward.

-

Capital will continue to flow into forest industry manufacturing in the US South.

Even before the US DOC announced a doubling of duties on Canadian softwood lumber imports last month, capital was actively flowing into southern forest products manufacturing. But things weren’t always so rosy. From 2007-2017, the region saw the permanent closure of three pulp and paper mills, three particleboard plants, 36 pine sawmills and 66 hardwood sawmills, which represented a loss of roughly 1.7 – 2.0 billion board feet (BBF) of annual lumber capacity.

As US homebuilding slowly picked up momentum, the southern sawmilling industry reacted accordingly. It was a long, slow slog but in 2017, SYP lumber production totaled 18 billion board feet (BBF), or roughly one-third of total North American production. An additional 3 BBF of new SYP lumber capacity was installed by the end of 2020 via several new mill facilities—both greenfield operations and older mills that were significantly overhauled. Announcements for 2022 (new, re-starts and expansions) include nearly 2.7 BBF of additional capacity throughout the region, which will go a long way to help meet demand.

Record prices and mill profitability continue to attract new capital to the Southern lumber industry. Due to the region’s low log costs and deeply embedded forest supply chain, we expect this trend to accelerate in the coming years.

![[Video] Molecules to Markets Episode 2: Electrification, Interest Rates, and Emerging Chemical Market Upside](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-2-CHEMICAL%20PRODUCTS%20SOCIAL%20SPEAKER%20HIGHLIGHT.png)