The global forestry industry has seen its share of turbulence and uncertainty over the last year. While some areas have experienced extraordinary price drops compared to recent years, others have spiked thanks to disruptions in traditional supply chains.

Let’s take a few moments to analyze the most significant trends that affected the global forestry industry in 2023. This will help to better understand what factors may also play a role in the industry’s performance across 2024 as well.

Russian Invasion of Ukraine Continues to Impact Hardwood Pulplog Supply

Russia’s war against Ukraine is now approaching its two-year anniversary. The horrendous effects of this conflict have been felt in industries across the world—wood markets included.

Once a leading source of wood products such as softwood lumber and hardwood pulplogs, Russian exports have dropped substantially. This comes thanks to sweeping bans for many Russian commodity exports from the EU and other countries.

Related: 2024 Outlook on Russian Exports in the Lumber Market

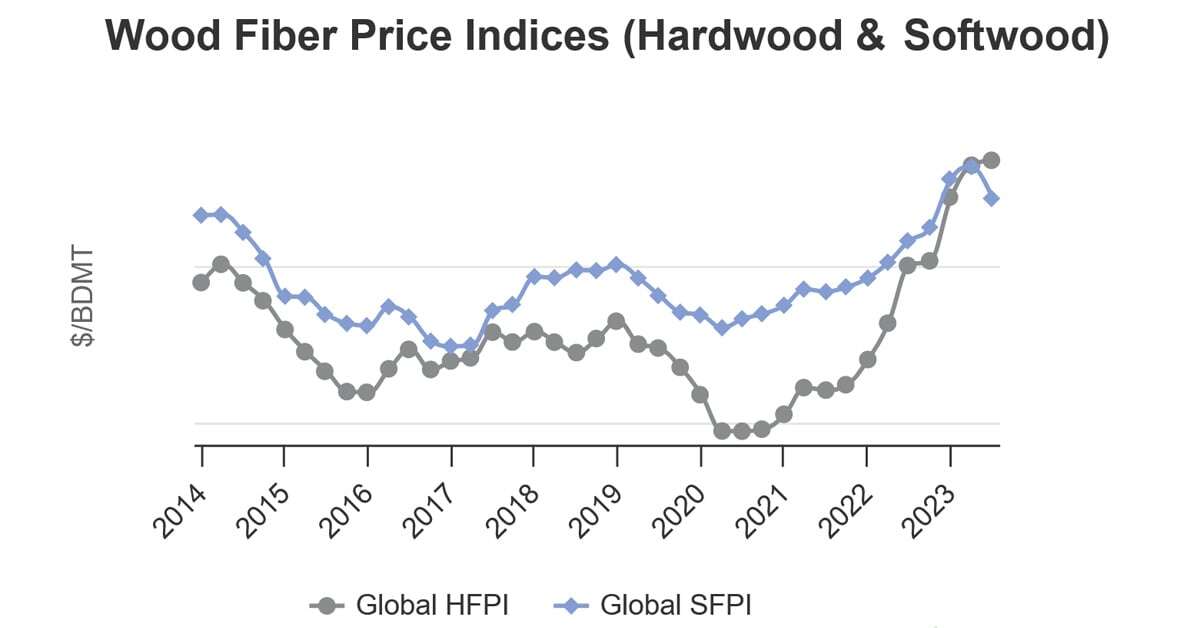

These bans have led to other European countries, like Finland, covering the gap. However, supply interruptions caused spikes in the Global Hardwood Fiber Price Index (HFPI) to its highest levels in over a decade. In fact, HFPI surpassed the Global Softwood Fiber Price Index (SFPI) in Q2 2023 for the first time since ResourceWise began tracking these indices in 2014 (see graph).

(Source: ResourceWise via our online pricing and analytics platform, WoodMarket Prices)

China’s Shifting Economic Climate Slows Hardwood Chip Demand

For several years, China remained a sizable source of overall global demand in hardwood chips and other wood products. This was because the country’s economy was in a growth/investment phase with new buildings, developments and other constructions which required these resources.

Demand for wood products was actually forecast to grow in China in 2023. However, instead, the country’s economic climate floundered throughout the year, plunging a once robust hardwood chip trade by 26% between 2022 and 2023.

This economic decline also seriously affected Russian exports as China was one of the few countries that continued to trade with them. The dip in expected trade will likely continue causing unstable prices for many wood products into the first quarter of 2024.

Full Effects of Canadian Wildfires Yet to Be Seen

As ResourceWise has already reported, 2023 set the record for the most devastating wildfire season Canada has seen in modern history. According to Natural Resources Canada, the country endured over 18 million hectares of burned forests across the lengthy wildfire season.

To paint a picture of the level of damage, Quebec's Forest Industry Council (QFIC) issued a warning on November 30 about damages. They noted that the current wildfire response strategy will cost about C$13.5 billion of financial impact on Quebec's sawmilling industry alone.

Those numbers will continue to grow as additional operations and categories are also included. Such a high dollar value to only one aspect of Quebec's local forestry operations shows just how broad the scope of damage will be from the wildfires.

Unsurprisingly, damage to this degree will produce a ripple effect that will make its way out of Canada’s local economies and into the global wood markets. When, where and to what degree those effects will be felt remains to be seen.

Canada has already felt the pinch of decreased production in regions such as the Pacific Northwest. Many companies have shifted operations into the US South, creating a production gap in the country.

Canada remains the top source of lumber imports to cover US demand. But with their shrinking supply potential, some countries in Europe are now covering the market gap.

Ongoing risks of wildfires will undoubtedly continue to play a role in Canada’s production potential. ResourceWise will continue to monitor the situation and provide news and updates as it relates to forestry and the global wood products market.

Get Insights into All Major Global Wood Markets with ResourceWise’s 2024 Report

The global wood markets all carry their own set of unique circumstances and factors influencing their current and future prices. That’s why understanding how these markets interact is so important.

Get a full breakdown of all the critical wood markets with our Market Insights report from Hakan Ekstrom, ResourceWise’s Special Advisor, Global Forest Products.

These include the following markets:

- Global Timber Markets

- Global Wood Fiber Markets

- Global Lumber Markets

- Global Biomass Markets

Download the report here:

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)