3 min read

Key Considerations Regarding International Paper’s Georgetown Mill Closure

ResourceWise

:

Nov 4, 2024 12:00:00 AM

On October 31, International Paper announced its plan to review strategic options for its Global Cellulose Fibers (GCF) business. This decision includes the closure of its Georgetown mill, a move expected to unfold in stages with a full shutdown by the end of 2024.

The GCF business generated $2.9 billion in revenue in 2023 thanks to its production of high-quality, absorbent pulp. The material is used in numerous applications ranging from personal care products to construction materials. The Georgetown mill alone produces around 300,000 tons of fluff pulp, a crucial component for baby diapers and incontinence products.

Despite the closure, GCF plans to retain 100% of the mill's fluff pulp capacity by transferring production to other facilities. Additionally, the mill's uncoated freesheet paper production, under a strategic contract with Sylvamo, will terminate by December 31, 2024.

Considerations for Buyers

For potential buyers of the Georgetown mill, there are several critical factors that necessitate careful consideration:

- Current and projected market demand for fluff pulp, especially for personal care products and construction materials.

- Competitor analysis and market positioning of the Georgetown mill.

- Historical financial performance and viability of the mill.

- Environmental impact assessment.

- Comprehensive valuation of the mill's physical assets and infrastructure.

- Future growth opportunities.

Leveraging Insights to Understand Market Dynamics

ResourceWise offers a suite of tools and datasets that can empower buyers with valuable insights, aiding them in navigating the evolving landscape of International Paper's announcement.

Wood Fiber Insights

Fluctuations in wood fiber prices directly impact the economic viability of pulp production. ResourceWise's WoodMarket Prices platform provides users with a comprehensive view of wood raw material price trends spanning over 30 years.

By accessing data on trade information for lumber, logs, wood chips, and pellets, buyers can evaluate the global competitive dynamics of sawmills and pulp mills. This information helps potential buyers make informed decisions regarding investment in the mill by understanding the potential cost implications of raw materials.

Viability Benchmarking

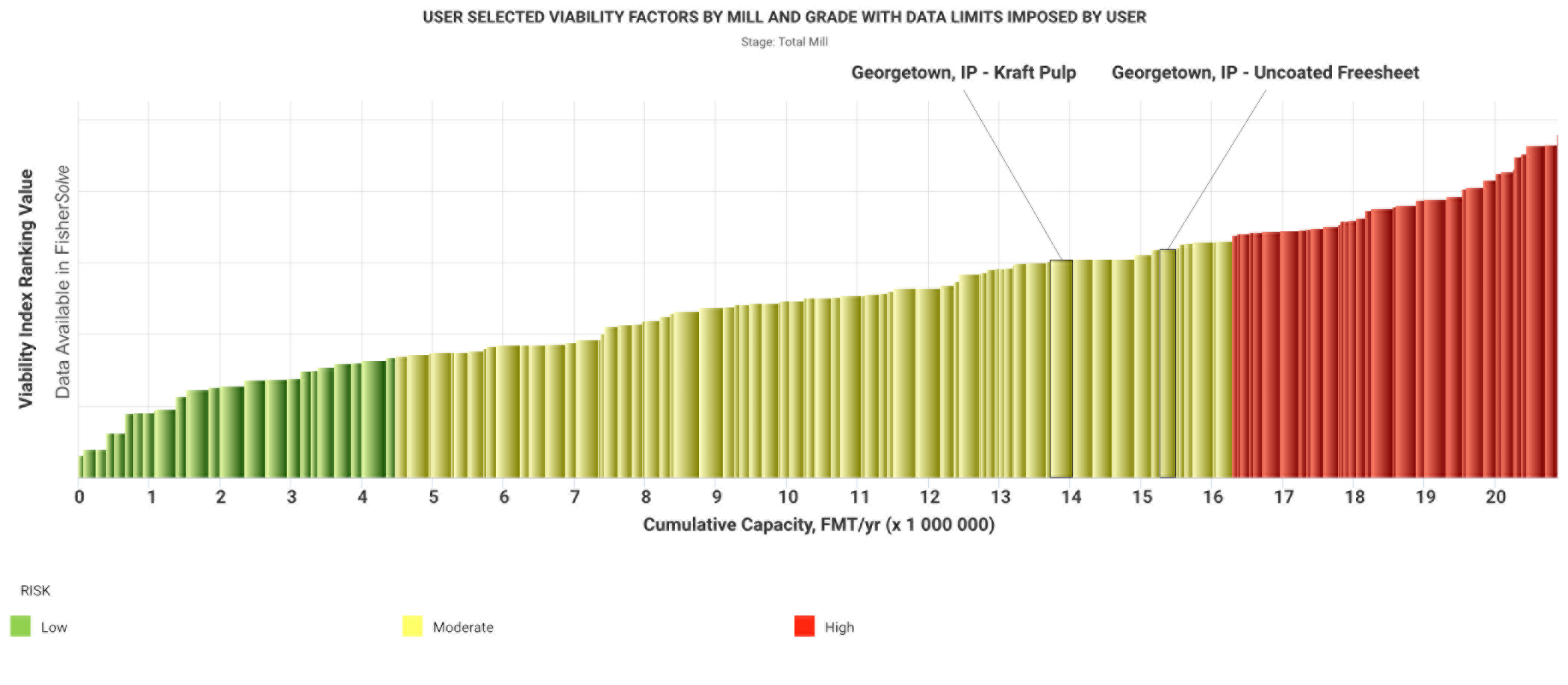

When contemplating mill acquisitions, understanding cost efficiency and carbon output is crucial. ResourceWise's FisherSolve platform empowers companies to benchmark a variety of factors, including cost performance, carbon emissions, and viability.

Using our Viability Index, we found that last quarter, International Paper's Georgetown mill ranked in the upper tier of the third quartile. This indicates a moderately high viability risk.

Source: FisherSolve

Source: FisherSolve

It’s important to note, however, that the mill falls within the upper moderate range for viability risk in the two grade categories where it competes. This suggests a likelihood that there are mid-term inherent risks. However, it doesn’t necessarily reflect that the mill is at risk of shutting down on its own.

With this knowledge, users can then analyze the specific factors contributing to this risk, from carbon emissions to cost elements. This analysis is crucial for potential buyers as it highlights the necessary investments required to make the mill competitive and reduce its risk level.

Pulp Price Forecasts

Understanding pulp market dynamics is essential for potential investors. ResourceWise-STE Forecasts offer data-driven insights, enabling buyers to simulate key market drivers such as supply, demand, price fluctuations, and more. By analyzing forecasted pulp prices, buyers can make informed decisions regarding investment strategies and anticipate future market trends.

Bioeconomy Considerations

With the growing emphasis on sustainability and bioeconomy, buyers must consider the mill's alignment with these principles. Current growth and incentives for biofuels and carbon capture indicate that many mills in the US have the potential to consider additional revenue streams. Therefore, things to consider as a potential buyer include the biogenic carbon produced at the mill, wood availability, and potential offtake partners.

ResourceWise's FisherSolve database and Prima CarbonZero platform provide valuable information about decarbonization efforts, costs, and energy consumption. This knowledge empowers buyers to assess the mill's potential to contribute to a sustainable future, attracting environmentally-conscious customers and investors.

Navigating Change with ResourceWise

ResourceWise is committed to guiding potential buyers through the complexities of potential mill investments and acquisitions. Our tailored consulting services offer real-time insights designed to meet your unique needs.

By adapting to market trends and understanding key drivers, buyers can seize new opportunities and maximize their return on investment. With ResourceWise's data-driven approach, buyers are equipped to make confident decisions, optimize their competitive positions, and develop effective asset optimization strategies.

For detailed insights on how ResourceWise can craft a customized assessment for your company looking to acquire the Georgetown mill or any other facility, please visit our consulting page.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)