2 min read

How Will China’s New Tariff Impact the Global Paper Industry?

Amy Chu

:

Feb 22, 2023 12:00:00 AM

Amy Chu

:

Feb 22, 2023 12:00:00 AM

Starting January 1, 2023, China implemented a provisional import tariff rate for 1,020 commodities, which are lower than the most favored nation (MFN) tariffs. 67 finished paper products and converting products are covered in this policy and will enjoy a lower import tariff of 0-5% compared to the standard MFN import duties of 5-6%.

Finished paper products, containerboard, cartonboard, printing and writing paper will all receive a 0% import tariff in an attempt to strengthen resource supply capacity and improve the resilience of industrial and supply chains. However, this raises a lot of concern from players in this value chain.

Widespread Effects of Tariff Reductions

From a macro perspective, reducing tariffs can increase imports and foreign exchange expenditures as well as reduce foreign exchange reserves. China's foreign exchange reserves are dominated by US dollars. Considering the current, serious inflation situation that is looming above the United States economy, stimulate imports that can avoid China's foreign exchange reserves will depreciate. The change will result in foreign exchange losses. However, this policy will also impact domestic manufacturers heavily. Due to China’s zero-Covid policy, China’s domestic demand decreased and directly impacted the paper industry. We’ve seen the lower demand of paper lead to both lower operating rates and lower market prices. In 2022, linerboard prices were down to their lowest point in the last two years. A decreased import tariff will encourage the import of oversea production into China at a lower price and most likely a higher quantity too. This will obviously place further pressure on the industry.

Short-Term and Long-Term Trends

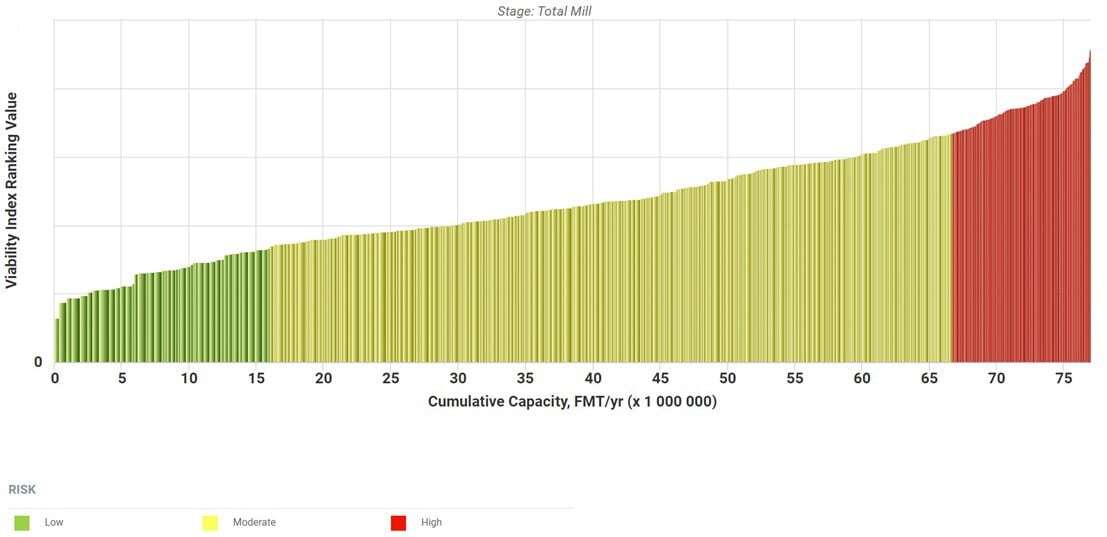

In the short-term, domestic paper prices will keep on a downward trend. In the long-term, as the net profit reaches a new low record, more manufacturers will exit this market and more consolidations will be expected to occur in the next five years. Let’s look at containerboard as an example. Though containerboard is highly consolidated compared with other paper grades in China, 13% of the machines in this segment are considered risky machines, as seen in the image below.

Benchmark Viability of Containerboard Machines in China

Source: FisherSolve

Some of these high-risk mills may exit the market on their own while some may be acquired by companies with healthier operations. For the mills that will be shut down, opportunity arises for manufacturers in emerging countries in Africa, the Middle East and Latin America. These regions are fond of secondhand machines from China. Based on Fisher’s analysis of the high-risk mills in China, there are advanced technology paper machines with sound capacity of over 200,000 MT/Y, while the majority are producing capacity greater than 100,000 MT/Y.

High-Risk Containerboard Machines in China

Source: FisherSolve

*Bubble size represents machine capacity

Allocating these second-hand machines from mills that are likely to shut down due to its high-risk status could save manufacturers tons compared to investing in new equipment. On the other hand, domestic producers may consider how to increase their competitive advantage to stay in the market. Should one stick to mass production by capacity expansion or grow roots and develop within a niche market? These are questions that need to be answered.

Containerboard Volume Since Recycled Fiber Import Ban

Furthermore, the volume of imported containerboard has increased since the ban of recycled fiber imports. As seen in the image below, it reached a record high in 2020.

China’s Imported Containerboard Trends

Source: FisherSolve

While volume decreased in 2021 and 2022, it’s expected that the travel restrictions that are to be lifted in 2023 will elate consumer confidence and trigger more import opportunities. More paper products and brands will gain new market share. This will especially impact those with stable quantity, adequate supply and competitive prices.

Preparing for the Changing Market

This new provisional import tariff in China will undoubtedly impact the global paper industry. Management in this value chain will need to prepare for this new dynamic shift and the challenges it could bring.

In such a volatile industry, it’s important to always address questions in advance to anticipate market shifts.

Fisher International offers unparalleled data services and insights that allow innovative and forward-looking companies to identify new opportunities that drive business success. Talk with one of our experts today.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)