2 min read

How to Maintain a Competitive Edge in the Evolving Pulp and Paper Industry

Marko Summanen

:

Aug 5, 2024 12:00:00 AM

Marko Summanen

:

Aug 5, 2024 12:00:00 AM

Recently, Saica Group announced it will acquire Schumacher Packaging's Polish subsidiary. This acquisition includes two state-of-the-art corrugated board plants, two paper mills, and three service centers. The acquisition will reshape the competitive dynamics in Europe with expectations to bolster Saica Group's capabilities.

But what does this mean for other containerboard producers in Europe? How can businesses stay competitive in a rapidly evolving market?

At ResourceWise, we anticipated this shift using our comprehensive data platform, FisherSolve®, and the expertise of our consulting team. In this blog, we'll explore the implications of this acquisition and how ResourceWise can help companies stay ahead of the curve.

Understanding the Acquisition

Saica Group's acquisition of Schumacher Packaging's Polish subsidiary is a strategic move to enhance its market position. The acquisition includes:

- 440,000 tonnes of paper production capacity.

- 535 million square meters of corrugated board packaging capacity.

- €327 million turnover from Polish sites in 2023.

Completion of this transaction is pending clearance by Polish anti-trust authorities and the fulfillment of certain conditions precedent. This acquisition will significantly expand Saica's footprint in Europe, making it a formidable player in the market.

ResourceWise's Prediction Becomes Reality

In a recent analysis, ResourceWise closely examined the European pulp and paper market. The data revealed a pressing need for containerboard producers to enhance their competitive positions after significant mergers across Europe. It also indicated a looming trend of potential over-investment in papermaking capacity within Europe, prompting a foreseeable shakeout of lower-end asset bases.

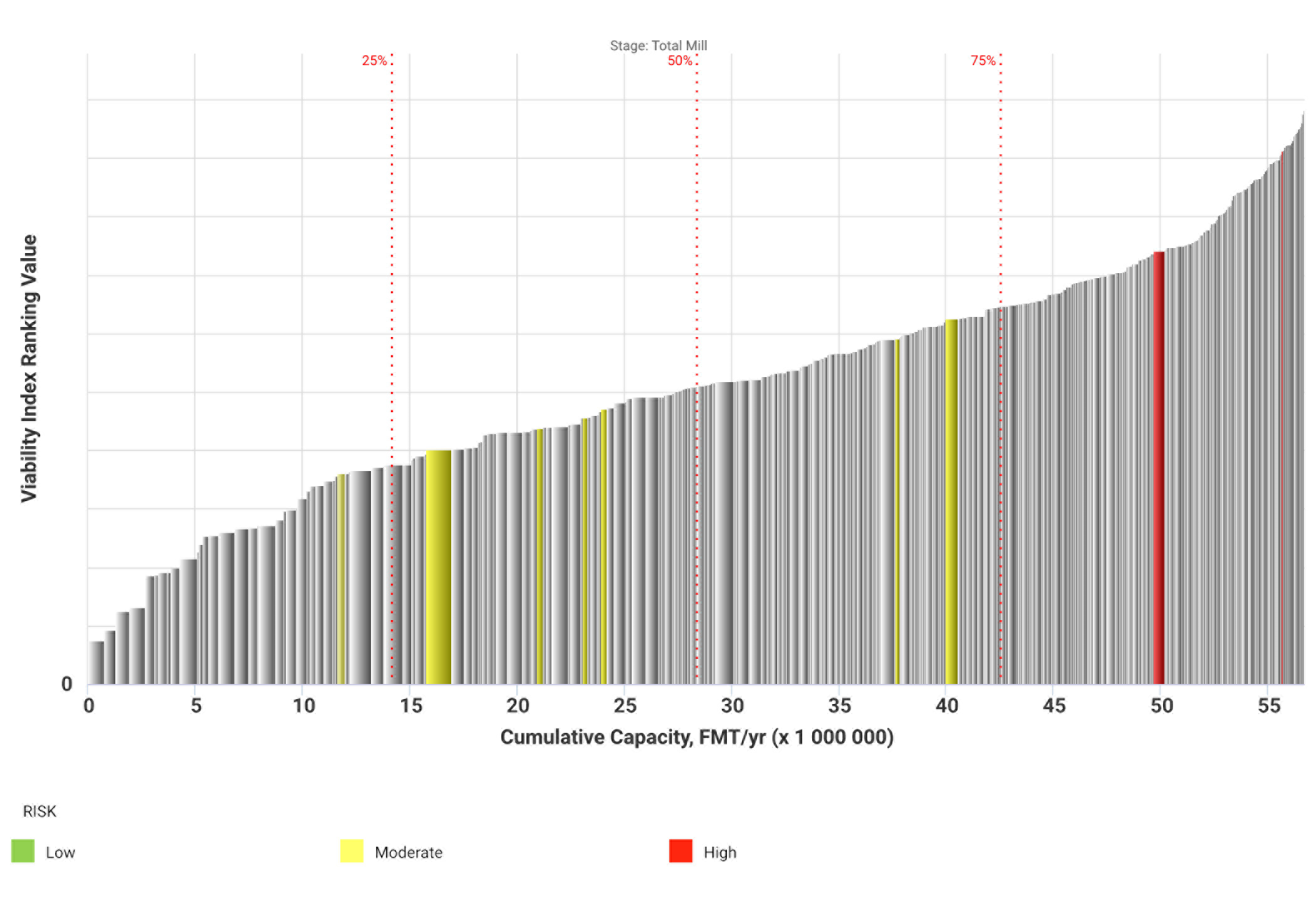

Using FisherSolve's Benchmark Viability Module, ResourceWise identified that Saica Group, a containerboard producer in Europe, was in a position to potentially feel the pressure from the mergers shaping the industry in Europe. This means that to improve its position, the company would need to acquire well-performing assets and expand its territory.

Benchmark Viability helps users to forecast the future trajectory of pulp lines and paper machines. Its model mirrors the considerations of asset owners when strategizing their next steps. By utilizing this tool, users can assess the competitiveness of specific machines, mills, or companies to gain valuable insights into each asset's strengths and weaknesses.

FisherSolve Benchmark Viability

Using data from Benchmark Viability, ResourceWise predicted that Saica Group would be among a few other companies interested in making strategic investments. Leveraging other capabilities of FisherSolve, ResourceWise also determined that Schuamacher Packaging's assets presented an attractive acquisition opportunity. This aligned perfectly with Saica's goals and indicated a market movement to watch out for. ResourceWise expects Saica to continue organizing its asset base in Europe.

Why This Matters

For pulp and paper industry participants, understanding market dynamics and anticipating changes is crucial. The Saica-Schumacher acquisition underscores the importance of staying informed and making data-driven decisions.

Companies that can adapt to market shifts will become better positioned to thrive in a competitive landscape. ResourceWise's comprehensive data platform, FisherSolve, and consulting expertise can provide valuable insights to help companies navigate market changes successfully.

Leveraging High-Quality Data

The pulp and paper industry is continuously evolving, with new technologies, shifting consumer demands, and sustainability concerns driving change. Companies must stay ahead of these changes to remain competitive.

At ResourceWise, we provide high-quality data, advanced analytics, and invaluable expertise to help companies drive transformative decision-making. Our data platform, FisherSolve, offers comprehensive information on every pulp and paper mill globally, making it an invaluable tool for pulp and paper producers globally.

Benefits of FisherSolve

- Comprehensive Data

FisherSolve provides detailed data on pulp and paper mills worldwide, including production capacity, equipment details, and manufacturing costs. This information helps businesses assess market conditions and identify opportunities.

- Advanced Analytics

Our platform includes various modules such as virtual mills, capacity trends, and benchmarking for carbon, viability, cost, and more. These tools enable companies to analyze performance, forecast trends, and make confident decisions.

- Expert Insights

Along with data insights from FisherSolve, our seasoned industry professionals provide actionable recommendations to enhance growth and viability.

The Importance of Staying Competitive

In a rapidly changing market, staying competitive is essential. The Saica-Schumacher acquisition highlights the need for businesses to be proactive and strategic.

For companies looking to stay competitive, leveraging high-quality data and making informed decisions is crucial. ResourceWise, with its FisherSolve platform, offers the tools and expertise needed to navigate these changes and drive growth.

Explore more of FisherSolve today and see how ResourceWise can help you stay ahead of the curve.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)