Wood fiber costs for pulp manufacturing have gone up worldwide in 2022 as fiber demand remained strong and supply tightened.

Prices for pulplogs and wood chips increased quarter-over-quarter in early 2022 in all 19 regions worldwide as tracked by the Wood Resource Quarterly (WRQ). This universal increase is a highly unusual occurrence that has only happened a few times since the WRQ started tracking global wood fiber prices in 1988.

Prices rose for softwood and hardwood fiber, with the most significant increases occurring in Germany, US Northwest, Chile, Australia, Western Canada, and Austria (in descending order).

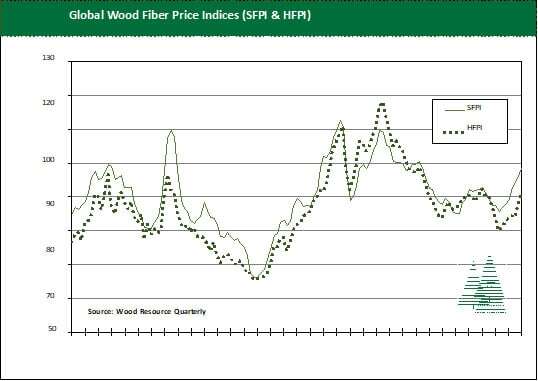

Price Indices Up for Global Wood Fiber

The global wood fiber price indices (SFPI and HFPI), denominated in US dollars, were up 2.0% and 3.3% quarter-over-quarter in 1Q/22 for softwood and hardwood, respectively. The increase from 1Q/21 was as much as 10% for both price indices (see chart).

In North America, wood raw-material costs have increased in all major regions, not only for the continent’s pulpmills but also for the sawmills (see table).

Price Changes for Wood Raw-Material in North America from 1Q/21 to 1Q/22

|

|

US South |

US Northwest |

Canada, BC |

Canada, East |

| Sawlogs, Softwood |

8% |

7% |

31% |

0% |

| Pulplogs, Softwood |

9% |

39% |

5% |

1% |

| Pulplogs, Hardwood |

15% |

10% |

N/A |

11% |

| Wood Chips, Softwood |

1% |

40% |

8% |

-5% |

| Wood Chips, Hardwood |

15% |

0% |

N/A |

N/A |

Source: Wood Resource Quarterly

Note. “N/A”- region does not produce large volumes in the open market of the product.

The most significant increases occurred in the US Northwest, where prices for softwood pulplogs and wood chips were up 40% from 1Q/21 to 1Q/22. These increases occurred because log supply became tighter, fuel costs increased, and shipments of wood chips to Asia trended upward.

The US South has long had low and stable log and wood chip prices. However, prices have moved upward over the past year, increasing 10-15% since early 2021. Softwood sawlog prices (in nominal terms) reached their highest level in almost 15 years, while pulpwood prices were close to all-time highs.

In Europe, wood fiber prices in US dollar terms were mixed in 1Q/22, slightly lower year-over-year in the Nordic countries and substantially higher in Central Europe. Prices for softwood and hardwood pulplogs were up 10-50%, while residual prices have almost doubled in Germany in the past year. The most significant factors for the surge in prices were increased demand for wood fiber and a slowing in the production of lumber.

Higher Energy Costs Bring Higher Pulp Prices Globally

Close to record-high pulp prices worldwide and higher energy costs in the 2Q/22 have resulted in continued upward price pressure for pulplogs and wood chips on all continents, including North America, Europe, Latin America, and Asia. In many countries, prices reached close to their highest prices in over ten years.

This is a preview post of our Market Insights report from Wood Resources International (WRI). For the past 13 years, Wood Resources International has distributed Market Insights on a regular basis to over 8,000 forest industry executives, analysts, investors, consultants and journalists worldwide. These Market Insights have covered the most recent developments in regard to global wood supply, forest industry production, forest products trade, and pricing of sawlogs, pulpwood, wood chips, lumber and biomass.

Håkan Ekström

Håkan Ekström

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)