3 min read

European Instability Changes Up Global Lumber Markets

Håkan Ekström

:

Apr 28, 2023 12:00:00 AM

Håkan Ekström

:

Apr 28, 2023 12:00:00 AM

Wood Resources International, a ResourceWise company, regularly tracks the trends and developments impacting global lumber markets.

Below, we’ve compiled recent news and data on some of the most critical global regions.

Nordic Markets Producing Record Amount of Softwood Lumber

The Nordic countries produced a record-high amount of softwood lumber in 2021. In the following years, production fell slightly at about 2% due to weakening European wood markets in the second half of 2021.

Production levels were close to all-time highs in Finland, Norway, and Sweden in 2022, with the Norwegian sawmill sector having grown the most in the past decade. Swedish production accounted for 56% of the total volume in the region, followed by Finland (34%), Norway (9%), and Denmark (1%). These shares have remained mostly unchanged over the past decade.

About 38% of European softwood lumber exports are from sawmills in the Nordic countries, down from a peak of 45% in 2016. In 2022, the total volume from the sub-region reached increased 5% from the previous year.

Sweden is the largest softwood lumber exporter in Europe. In 2020, a record amount of lumber was shipped from the country. However, volumes fell over 10% the following year as European demand weakened.

In 2022, the export markets were mixed, with strengthening demand for Swedish lumber in the US (+84% year-over-year), China (+83%), and the Middle East and North Africa region (+34%). This occurred even while sales to Europe were down approximately 5%.

Finland ranked third of the lumber-export countries in Europe and was the only country in northern Europe that reduced shipments in 2022. Export volumes were down 2.2% year-over-year, but the amount was higher than its 10-year average.

Softwood Lumber Demand Sinks Year-Over-Year in Germany

Demand for lumber fell in Germany in 2022, resulting in a 34% year-over-year decline in softwood lumber imports. This is the lowest level in over ten years.

All supplying countries shipped less lumber to Germany in 2022. But sawmills in the Nordic and the Baltic regions gained relative market shares. Furthermore, suppliers in Central Europe, Russia, Belarus, and Ukraine lost shares.

Germany continued as a net exporter of lumber shipping a record amount in 2022. The country has expanded and modernized its sawmill sector over the past few years and has become more competitive in global markets.

Over the past five years, lumber production has increased by 6%. Net exports have increased significantly with a 125% rise in output in 2022 compared to 2018 data.

The most significant changes in lumber sales to the top 15 markets since 2018 were in the following areas:

- China (+329%)

- Taiwan (+219)

- United States (+186%)

- Poland (+129%)

Over the same period, there have been smaller declines in shipments to neighboring countries. This includes the Czech Republic, the Netherlands, the United Kingdom, France, and Austria.

Russian Lumber Markets Lose $1 Billion

In response to Russia's invasion of Ukraine, many European and Asian markets closed their ports to Russian sawmills. This caused softwood lumber exports to fall by almost 21% year-over-year from 2021 to 2022.

The estimated lost value for the reduction in exports was about $1 billion. In the second half of 2022, there were no shipments to Europe. Volumes also declined compared to the first half of 2022 to Japan and South Korea.

As a result, Russian lumber producers had to redirect sales to the domestic market and lower-priced markets in the following areas:

- Northern Africa

- Middle East

- CIS Countries

- Turkey

Shipments were down to most countries in 2022, with the most significant declines to countries on Russia's "Unfriendly Countries List.”

Countries that increased their share of Russia’s total exports included:

- Uzbekistan

- Egypt

- Kazakhstan

- Tajikistan

- Turkey

- Singapore

- UAE

- Iran

China Sees Lowest Import Levels in 12 Years

China's softwood lumber imports in 2022 fell to their lowest level in 12 years as the country was locked down in response to the COVID epidemic. Import volumes were down from their 2019 peak – the year before the COVID-19 outbreak.

Supply sources for lumber to China have shifted over the past decade. The most significant changes have been a substantial decline in shipments from North America and increases from European suppliers. This, accordingly, increased their market shares substantially.

Russia has also increased its share to become the largest supplier to China. They account for almost two-thirds of the import volume in 2022.

In the second half of 2022, there were significant shifts in China's lumber imports. The Russian share fell from 73% of total imports in the the 3rd quarter of 2022 to 57% in the 4th quarter.

On the other hand, European lumber producers shipped more volume. Their market share grew from 14% in the 3rd quarter of 2022 to an all-time high of 27% in the last quarter of 2022. The predominant European suppliers in the included (in descending order) Finland, Sweden, Belarus, and Germany.

Lumber import prices fell about 7% during 2022. The most significant declines were for lumber shipped from Finland, Sweden, and Canada.

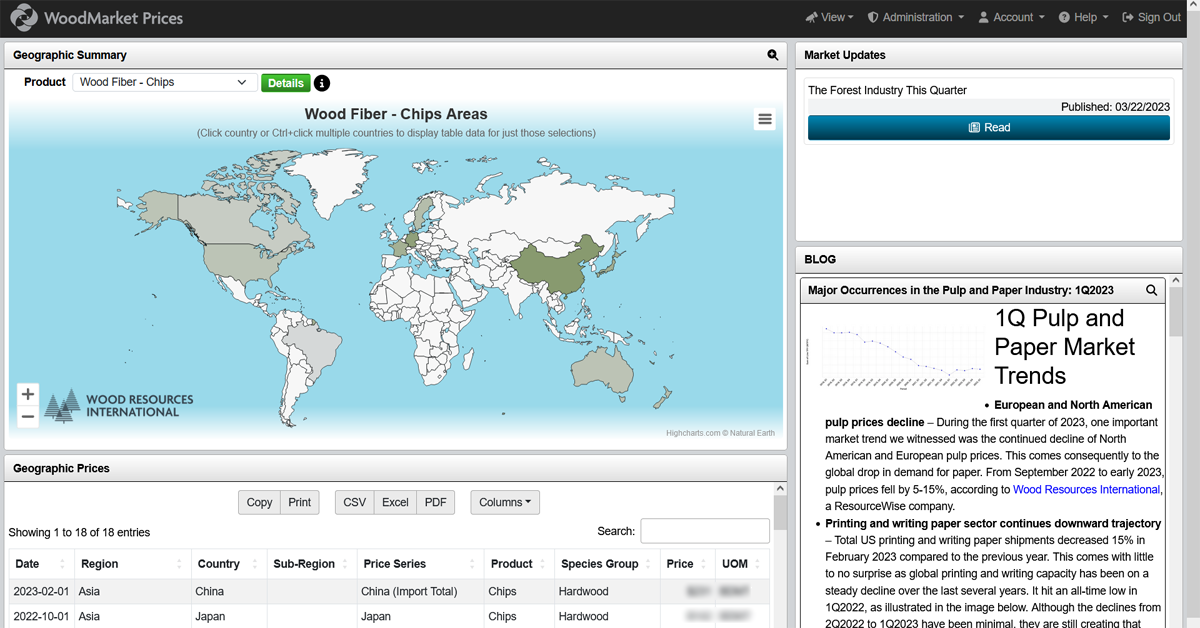

Track Global Lumber Pricing with WoodMarket Prices

Wood Resources International, a ResourceWise company, offers key insights, pricing data, and market intelligence for subscribers with its interactive online platform, WoodMarket Prices (WMP).

The pricing data service, established in 1988, has subscribers in over 30 countries. WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide.

The WMP platform provides a unique and valuable tool for every company and organization that requires updates on the latest developments of global forest products markets.

Learn more about WoodMarket Prices by following the link below.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)